Free Articles of Incorporation Document for Hawaii State

Frequently Asked Questions

-

What is the purpose of the Articles of Incorporation in Hawaii?

The Articles of Incorporation serve as the foundational document for establishing a corporation in Hawaii. This document outlines essential details about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document with the state is a crucial step in legally forming a corporation, allowing it to operate and conduct business in Hawaii.

-

What information is required to complete the Articles of Incorporation?

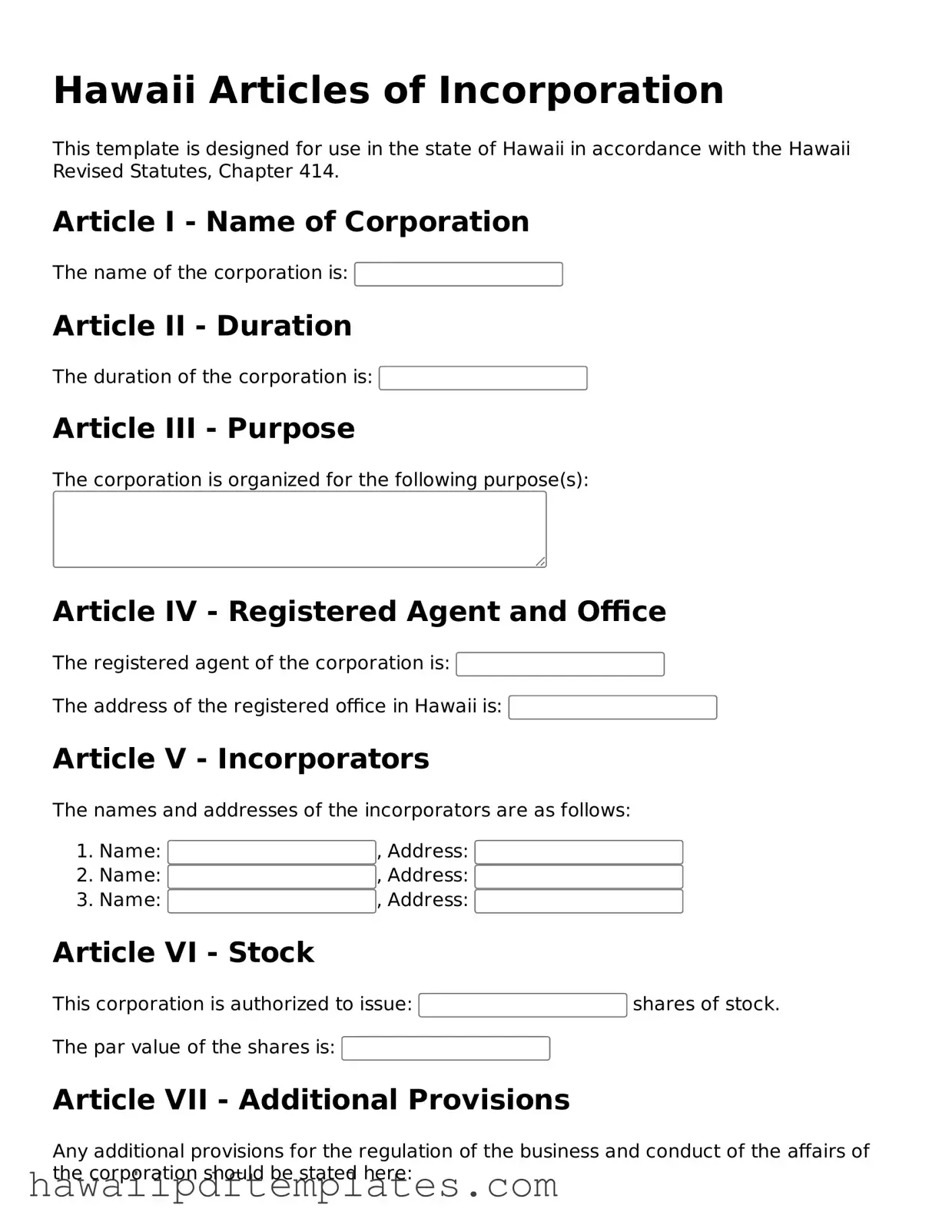

To complete the Articles of Incorporation form, several key pieces of information are necessary:

- The name of the corporation, which must be unique and not already in use by another entity in Hawaii.

- The purpose of the corporation, which can be general or specific.

- The name and address of the registered agent, who will receive legal documents on behalf of the corporation.

- The number of shares the corporation is authorized to issue, along with any classes of shares if applicable.

- The names and addresses of the incorporators, who are the individuals responsible for filing the Articles.

-

How do I file the Articles of Incorporation in Hawaii?

Filing the Articles of Incorporation in Hawaii can be done either online or by mail. To file online, you can visit the Hawaii Department of Commerce and Consumer Affairs (DCCA) website, where you can complete the form and submit it electronically. If you prefer to file by mail, print the completed form, sign it, and send it to the DCCA along with the required filing fee. Ensure that all information is accurate to avoid delays in processing.

-

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Hawaii varies depending on the type of corporation being formed. As of the latest information, the fee is typically around $50 for a profit corporation. Nonprofit corporations may have different fees. It is advisable to check the Hawaii DCCA website for the most current fee schedule, as these amounts can change.

-

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary based on several factors, including the method of filing. Online submissions are generally processed more quickly, often within a few business days. Mail submissions may take longer, typically around 2 to 4 weeks. For expedited processing, there may be additional fees available. Always check the DCCA website for the most up-to-date processing times.

Other Common Hawaii Forms

Hawaii Homeschool Laws - A simple form declaring a family’s decision to homeschool.

To ensure a smooth transaction when buying a boat, it's crucial to utilize the correct documentation, such as an essential Boat Bill of Sale form that outlines the key aspects of the sale and protects your investment. For more information, visit the reliable resource for the Boat Bill of Sale form.

Promissory Note Hawaii - Creating a promissory note can help establish trust between lenders and borrowers.

Hawaii Residential Lease Agreement - Covers maintenance responsibilities for both the landlord and tenant.

Steps to Writing Hawaii Articles of Incorporation

After completing the Hawaii Articles of Incorporation form, you will need to submit it to the appropriate state office along with the required filing fee. This process establishes your corporation officially in Hawaii.

- Obtain the Articles of Incorporation form from the Hawaii Department of Commerce and Consumer Affairs website or their office.

- Provide the name of your corporation. Ensure it complies with Hawaii naming requirements and is not already in use.

- List the principal office address. This should be a physical address in Hawaii, not a P.O. Box.

- Identify the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Specify the purpose of the corporation. Be clear and concise about the business activities you plan to engage in.

- Indicate the number of shares the corporation is authorized to issue. Include any classes of shares if applicable.

- Provide the names and addresses of the incorporators. This includes the individuals who are forming the corporation.

- Review the form for accuracy and completeness. Ensure all required sections are filled out correctly.

- Sign and date the form. The incorporators must sign to validate the document.

- Prepare the filing fee. Check the current fee schedule on the Hawaii Department of Commerce and Consumer Affairs website.

- Submit the completed form and payment to the appropriate state office, either online or by mail.

Misconceptions

When considering the Hawaii Articles of Incorporation form, several misconceptions can arise. Understanding these misunderstandings can help individuals and businesses navigate the incorporation process more effectively.

- Misconception 1: The Articles of Incorporation are the only requirement for starting a business in Hawaii.

- Misconception 2: Filing the Articles of Incorporation guarantees that the business will be successful.

- Misconception 3: The process of filing Articles of Incorporation is overly complicated and time-consuming.

- Misconception 4: Once the Articles of Incorporation are filed, there is no need for ongoing compliance.

This is not entirely accurate. While the Articles of Incorporation are essential for establishing a corporation, other steps are necessary. These may include obtaining business licenses, permits, and adhering to local regulations. Each business type may have unique requirements that must be fulfilled.

Filing the Articles of Incorporation is just one step in the business journey. Success depends on various factors, including market research, effective management, and strategic planning. Incorporation provides legal protection and structure but does not ensure profitability.

While the process may seem daunting, it can be straightforward with proper guidance. Many resources are available to assist individuals in completing the form accurately. Additionally, online filing options can expedite the process, making it more accessible.

This is a common misunderstanding. After filing, corporations must adhere to ongoing compliance requirements, such as annual reports and tax filings. Failure to meet these obligations can result in penalties or even the dissolution of the corporation.