Free Durable Power of Attorney Document for Hawaii State

Frequently Asked Questions

-

What is a Durable Power of Attorney in Hawaii?

A Durable Power of Attorney (DPOA) in Hawaii is a legal document that allows you to appoint someone else, known as an agent or attorney-in-fact, to make decisions on your behalf. This authority remains effective even if you become incapacitated. The DPOA can cover a variety of decisions, including financial matters, healthcare, and property management.

-

Why should I consider creating a Durable Power of Attorney?

Creating a DPOA is a proactive step that ensures your wishes are honored if you cannot communicate them yourself. It provides peace of mind, knowing that a trusted individual can manage your affairs. This document can also help prevent potential disputes among family members regarding your care and finances.

-

Who can I appoint as my agent?

You can appoint any competent adult as your agent, including a family member, friend, or professional advisor. It's important to choose someone you trust and who understands your values and preferences. In Hawaii, the person you select should be willing to take on this responsibility and be able to act in your best interests.

-

What powers can I grant my agent?

The powers granted to your agent can be broad or limited, depending on your preferences. You can allow them to handle financial transactions, manage real estate, make healthcare decisions, and more. Clearly outlining the scope of authority in the DPOA is essential to ensure your agent acts in accordance with your wishes.

-

How do I create a Durable Power of Attorney in Hawaii?

To create a DPOA in Hawaii, you must fill out the appropriate form, which can be obtained from various legal resources or online. The form must be signed in the presence of a notary public or two witnesses. After completing the document, provide copies to your agent and any relevant institutions, such as banks or healthcare providers.

-

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your DPOA at any time as long as you are mentally competent. To do so, you should create a written revocation and notify your agent and any institutions that may have a copy of the original DPOA. This ensures that your wishes are clear and prevents any confusion regarding your decision.

Other Common Hawaii Forms

Is Hawaii a 50/50 Divorce State - It can simplify the divorce process if the couple chooses to go that route later.

Quit Claim Deed Hawaii - This form does not provide legal protection against prior claims or title issues.

Understanding the importance of the New York Boat Bill of Sale is crucial for anyone involved in maritime transactions. This form serves as a critical tool for ensuring a smooth transfer of ownership and compliance with legal requirements.

Hawaii DNR Order - Online resources can help guide individuals and families through the process of creating a DNR order.

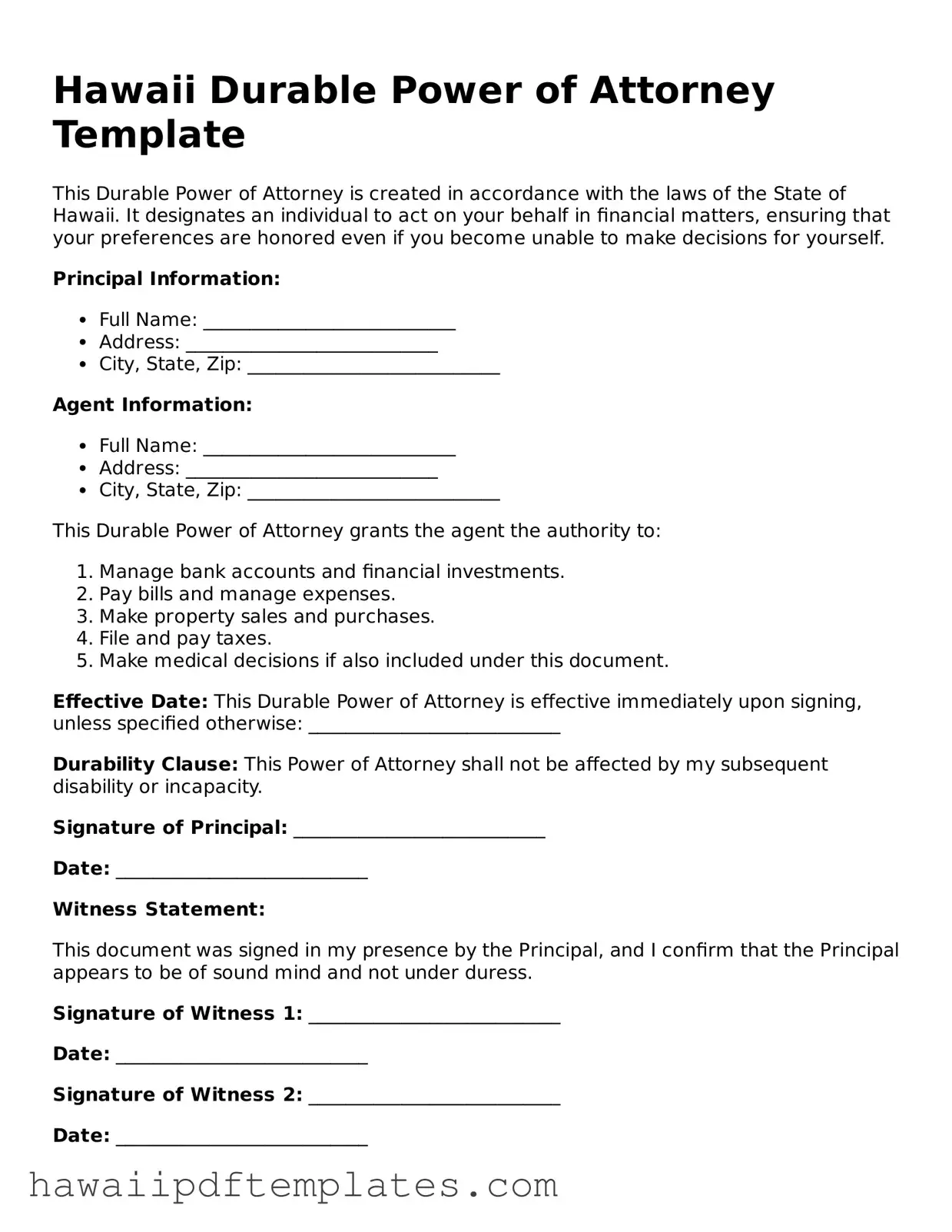

Steps to Writing Hawaii Durable Power of Attorney

Filling out the Hawaii Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are managed according to your wishes. Please follow these steps carefully to complete the form accurately.

- Obtain the Hawaii Durable Power of Attorney form. You can find this form online or at a local legal office.

- Read through the entire form to understand the sections and requirements.

- In the first section, write your full name and address. This identifies you as the principal.

- Next, identify the person you are appointing as your agent. Include their full name and address.

- Specify the powers you are granting to your agent. You can choose to give broad or limited powers.

- Include the date when the powers will begin. You can choose to make them effective immediately or at a future date.

- Sign and date the form in the designated area. Your signature must match your legal name.

- Have the form notarized. This step is important for the document to be legally valid.

- Provide copies of the completed form to your agent and any relevant financial institutions or individuals.

After completing the form, keep a copy for your records. It is advisable to review the document periodically to ensure it still reflects your wishes.

Misconceptions

Understanding the Hawaii Durable Power of Attorney (DPOA) form is essential for anyone looking to manage their financial and legal affairs effectively. However, several misconceptions can lead to confusion. Here are nine common misconceptions about the Hawaii Durable Power of Attorney form:

- It only applies to financial matters. Many believe that a DPOA is limited to financial decisions. In reality, it can also cover health care decisions if specified in the document.

- It is only for the elderly. Some think that only older individuals need a DPOA. However, anyone over 18 can benefit from having one in place, especially if they anticipate future incapacity.

- It becomes invalid if I become incapacitated. This is a common myth. A durable power of attorney remains effective even if the principal becomes incapacitated, which is the key feature of "durable."

- Once signed, it cannot be changed. Many people believe that a DPOA is permanent. In fact, you can revoke or modify it at any time as long as you are mentally competent.

- My agent can do anything they want with my DPOA. While an agent has significant authority, they must act in your best interest and follow the guidelines set forth in the document.

- A DPOA is the same as a will. Some confuse these two legal tools. A DPOA is used while you are alive, whereas a will takes effect after your death.

- I don’t need a DPOA if I have a joint account. This is misleading. Joint accounts can simplify some transactions, but a DPOA provides broader authority for decision-making.

- My spouse automatically has power of attorney. Many assume that marriage grants automatic authority. Without a DPOA, a spouse does not have the legal right to make decisions on your behalf.

- It is too complicated to set up. While legal documents can seem daunting, creating a DPOA can be straightforward. Resources and legal assistance are available to help guide you through the process.

Clearing up these misconceptions can empower individuals to make informed decisions about their legal and financial futures. Understanding the true nature and function of a Durable Power of Attorney in Hawaii is crucial for effective planning.