G 45 Hawaii PDF Form

Frequently Asked Questions

-

What is the purpose of the G-45 form in Hawaii?

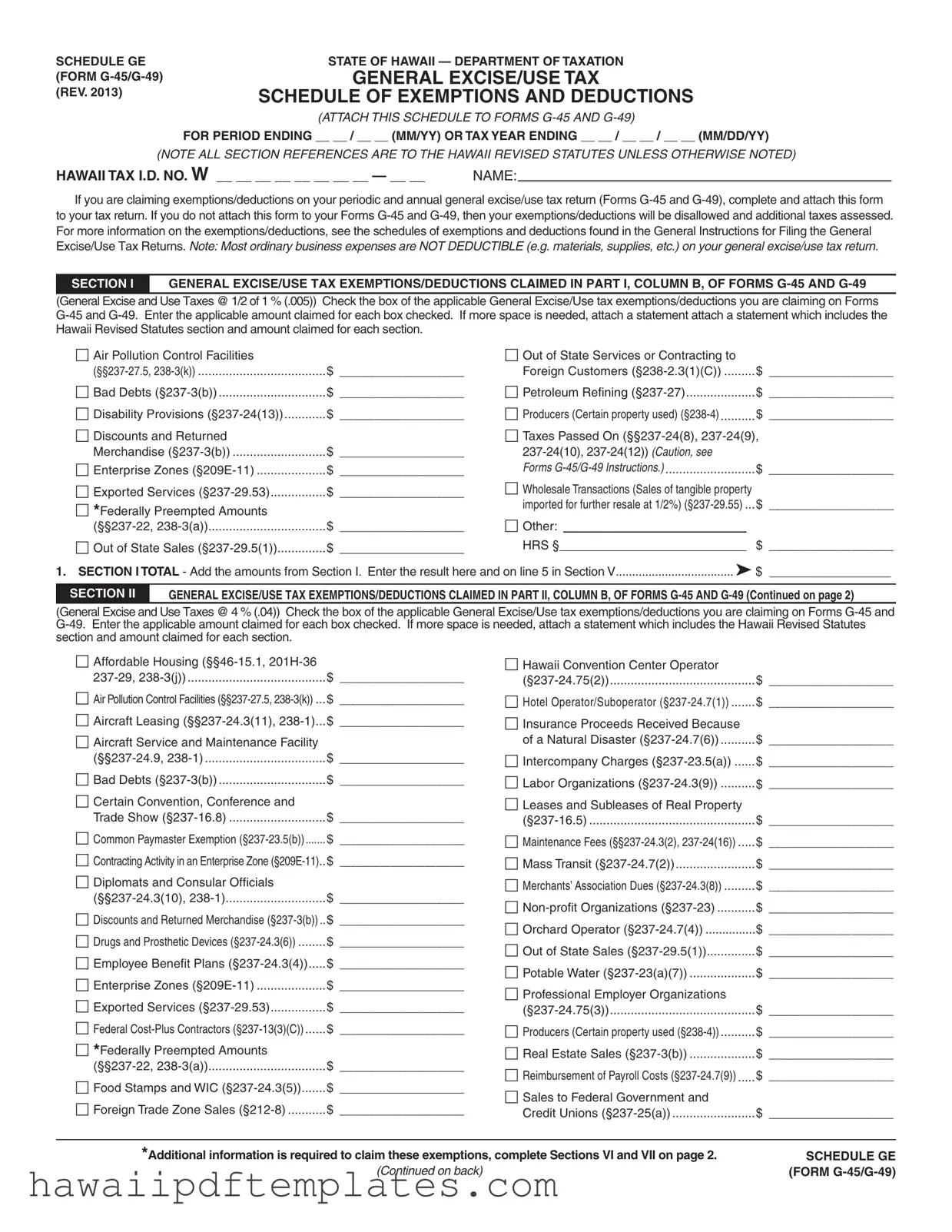

The G-45 form is a tax return used by businesses in Hawaii to report their general excise and use tax liabilities. This form allows businesses to claim various exemptions and deductions that may reduce their tax obligations. It is essential for ensuring compliance with Hawaii's tax regulations and for accurately calculating the amount of tax owed for a specific period or tax year.

-

Who needs to file the G-45 form?

Any business operating in Hawaii that is subject to the general excise tax must file the G-45 form. This includes sole proprietors, partnerships, corporations, and other entities engaged in business activities. If a business is making taxable sales or providing taxable services, it is required to report these activities using the G-45 form.

-

What happens if I do not attach the G-45 form to my tax return?

If the G-45 form is not attached to your tax return, any exemptions or deductions you are claiming will be disallowed. This means that you may face additional taxes assessed by the Department of Taxation. It is crucial to ensure that the G-45 form is completed accurately and submitted with your Forms G-45 and G-49 to avoid any complications.

-

What types of exemptions and deductions can be claimed on the G-45 form?

The G-45 form allows businesses to claim a variety of exemptions and deductions. These may include, but are not limited to, exemptions for out-of-state services, bad debts, certain sales to the federal government, and specific deductions related to enterprise zones. Each exemption or deduction has its own eligibility criteria, so it is important to review the instructions carefully and ensure that you meet the requirements for the exemptions you are claiming.

Popular PDF Forms

N-15 - Customers who produce more energy than they consume during a billing cycle are recognized as net producers.

For those navigating legal challenges, understanding the significance of a detailed Power of Attorney form can be crucial. This document acts as a safeguard, enabling individuals to ensure their financial and health-related decisions are managed by a trusted representative. Resources such as a guide on how to create a Power of Attorney effectively can be incredibly beneficial. You can explore more about this topic at the importance of having a Power of Attorney in place.

Hawaii Unemployment Eligibility - Completion of the form signifies a claimant’s commitment to finding work.

Steps to Writing G 45 Hawaii

Completing the G-45 form in Hawaii involves several steps to ensure that all necessary information is accurately provided. This form is important for claiming exemptions and deductions related to general excise and use taxes. Following the steps carefully will help prevent any issues with your tax return.

- Obtain the G-45 form from the Hawaii Department of Taxation website or your local tax office.

- Fill in your Hawaii Tax I.D. number at the top of the form.

- Enter your name in the designated field.

- Indicate the period ending date or tax year ending date in the appropriate format (MM/YY or MM/DD/YY).

- In Section I, check the boxes for the exemptions or deductions you are claiming. For each box checked, enter the applicable amount in the space provided.

- If you need more space, attach a separate statement that includes the relevant Hawaii Revised Statutes section and the amount claimed for each section.

- Add the amounts from Section I and enter the total on the designated line.

- Repeat the process for Section II, checking the appropriate boxes and entering the amounts for each exemption or deduction claimed.

- Add the amounts from Section II and enter the total on the designated line.

- Continue to Section III, checking the boxes for any exemptions or deductions you are claiming and entering the amounts.

- Add the amounts from Section III and enter the total on the designated line.

- In Section IV, select the county surcharge exemptions/deductions and enter the amounts claimed.

- Add the amounts from Section IV and enter the total on the designated line.

- In Section V, total the amounts from Sections I, II, III, and IV. This is your grand total.

- Finally, review all entries for accuracy before submitting the form along with your G-45 or G-49 tax return.

Misconceptions

- Misconception 1: The G-45 form is only for large businesses.

- Misconception 2: All business expenses can be deducted on the G-45 form.

- Misconception 3: You can submit the G-45 form without the G-49 form.

- Misconception 4: Once filed, the G-45 form cannot be amended.

This is not true. The G-45 form is required for all businesses operating in Hawaii, regardless of size. Whether you run a small shop or a large corporation, if you earn income in Hawaii, you need to file this form.

Many people believe that all expenses are deductible. However, most ordinary business expenses, such as materials and supplies, are not deductible on the G-45 form. Understanding what qualifies for deductions is crucial.

Some think that filing the G-45 alone is sufficient. In reality, if you are claiming exemptions or deductions, you must also submit the G-49 form. Failing to do so may result in disallowed claims.

This is a common misunderstanding. If you realize that you made an error after submitting the G-45 form, you can amend it. Corrections can help ensure that your tax obligations are accurately reflected.