Hawaii Agreement Of Sale PDF Form

Frequently Asked Questions

-

What is the Hawaii Agreement of Sale form?

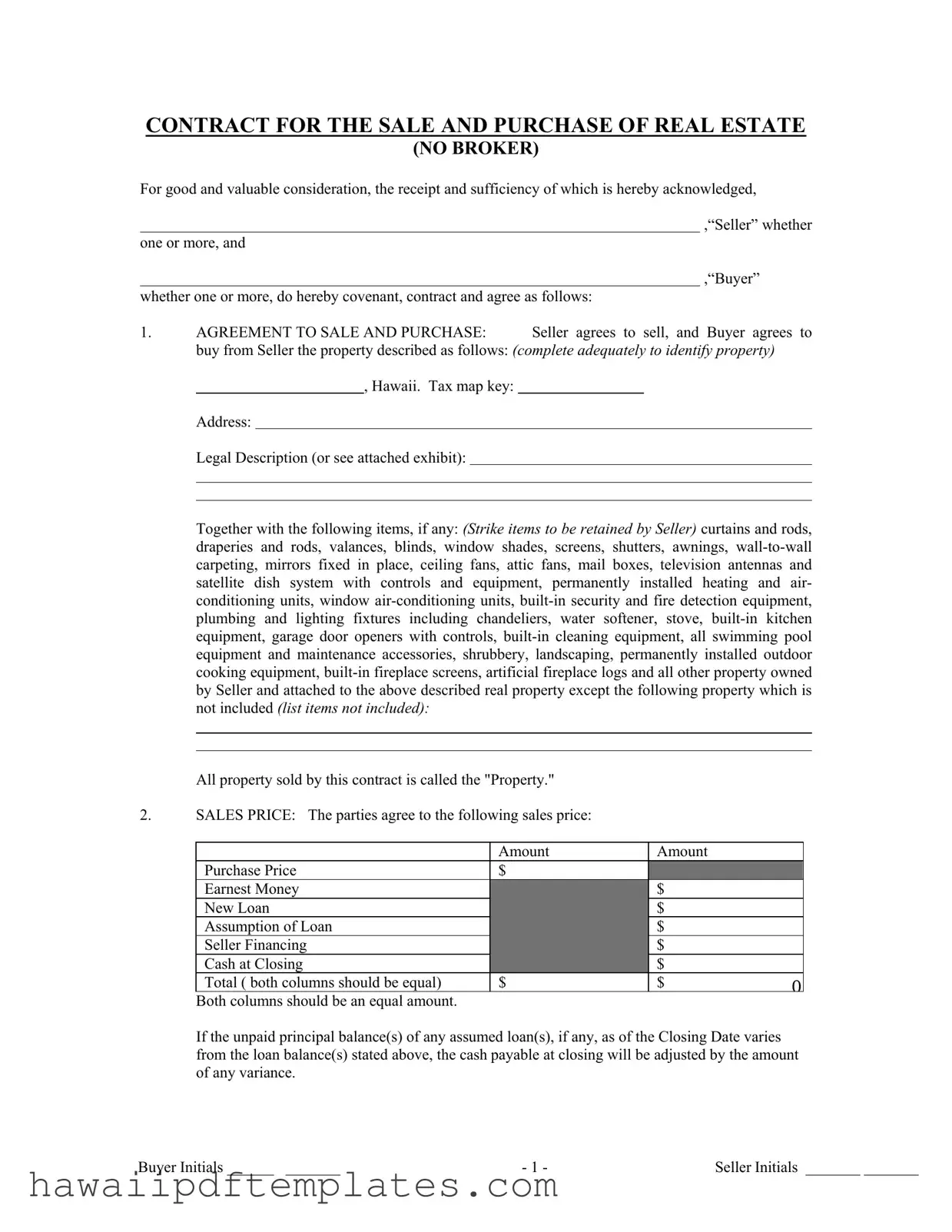

The Hawaii Agreement of Sale form is a legal document used for the sale and purchase of real estate in Hawaii. It outlines the terms and conditions agreed upon by the seller and buyer. This contract includes details such as the property description, sales price, financing arrangements, and responsibilities of both parties. It's important for both the seller and buyer to understand this document fully before signing.

-

What information is required to complete the form?

To complete the Hawaii Agreement of Sale form, you need to provide specific details about the property being sold. This includes the property's tax map key, address, and legal description. Additionally, you must specify the items included in the sale, such as appliances or fixtures. The sales price and financing details, including any earnest money deposit, must also be clearly stated. All parties involved should initial the form to indicate their agreement.

-

What happens if the buyer cannot secure financing?

If the buyer cannot secure financing, the contract will typically terminate. The buyer must apply for financing within a specified timeframe after the contract's effective date. If the buyer does not obtain approval within that period, they are entitled to a refund of the earnest money. This clause protects the buyer from being locked into a contract if they cannot secure the necessary funds to purchase the property.

-

What is the role of earnest money in the agreement?

Earnest money is a deposit made by the buyer to show their serious intent to purchase the property. This amount is typically specified in the agreement and is held in trust until closing. If the sale goes through, the earnest money is applied to the purchase price. If the buyer defaults on the contract without a valid reason, the seller may keep the earnest money as compensation for the breach. This arrangement helps ensure that both parties are committed to the transaction.

-

What should buyers know about property condition disclosures?

Buyers should be aware that the seller must disclose any known issues with the property's condition. This includes any lead-based paint hazards if the property was built before 1978. Buyers are encouraged to inspect the property thoroughly. If defects are found during an inspection, buyers have the option to negotiate repairs, cancel the contract, or proceed with the sale despite the issues. Understanding these disclosures helps buyers make informed decisions about their purchase.

Popular PDF Forms

Comprehensive Financial Planning Hawaii - Your participation can significantly impact your retirement lifestyle.

When engaging in the sale of a motor vehicle in Florida, it is crucial to complete the Florida Motor Vehicle Bill of Sale form, which acts as a legal record of the transaction. This document not only details the necessary information about the vehicle and the parties involved but also safeguards the interests of both buyers and sellers. To learn more about the necessary documentation for a smooth transaction, you can visit Florida Forms.

Religious Exemption Form Hawaii - VAERS data highlights incidents of injury or death linked to vaccinations, underscoring the need for careful evaluation before immunization.

Trademark Search Hawaii - Filing will not be processed without legible information and signature.

Steps to Writing Hawaii Agreement Of Sale

Filling out the Hawaii Agreement of Sale form is a critical step in the real estate transaction process. It requires careful attention to detail to ensure that all necessary information is accurately provided. Once the form is completed, both parties can move forward with the sale, pending any necessary approvals or conditions outlined in the agreement.

- Identify the Parties: Fill in the names of the Seller(s) and Buyer(s) in the designated areas.

- Property Description: Provide a complete description of the property, including the tax map key, address, and legal description.

- Included Items: List any items included in the sale (e.g., appliances, fixtures) and strike through any items the Seller intends to retain.

- Sales Price: Enter the purchase price and detail the breakdown of earnest money, new loan, assumption of loan, seller financing, and cash at closing.

- Financing Terms: Specify the financing terms, including whether it is a cash sale, owner financing, or contingent on obtaining a new loan.

- Earnest Money: Indicate the amount of earnest money to be deposited and the name of the entity holding it.

- Property Condition: Acknowledge the Seller’s disclosure regarding lead-based paint and the Buyer’s acceptance of the property in its current condition.

- Closing Date: Set the closing date and note any conditions that may extend this date.

- Title and Conveyance: Specify how the title will be conveyed and any necessary documents to be provided at closing.

- Closing Costs: Detail the allocation of closing costs between the Buyer and Seller.

- Prorations: Outline how taxes and other fees will be prorated through the closing date.

- Casualty Loss: Include provisions regarding damage to the property after the contract date.

- Default Terms: State the consequences of default by either party.

- Signatures: Ensure that both the Buyer(s) and Seller(s) sign and date the agreement.

Misconceptions

-

Misconception 1: The Hawaii Agreement of Sale form is only for cash transactions.

This is not true. The form accommodates various financing options, including seller financing, new loans, and assumptions of existing loans. Buyers can choose the method that best suits their financial situation.

-

Misconception 2: Buyers are responsible for all repairs before closing.

In reality, the form specifies that buyers accept the property "as-is." However, it also allows for inspections. If defects are found, buyers can negotiate repairs or cancel the contract within a specified time frame.

-

Misconception 3: The seller must disclose every detail about the property’s condition.

While sellers are required to disclose certain known issues, they are not obligated to provide a complete history of the property. Buyers are encouraged to conduct their own inspections to assess the property's condition.

-

Misconception 4: Earnest money is non-refundable under all circumstances.

This is incorrect. The agreement outlines conditions under which the earnest money can be refunded, such as if financing is not approved or if the buyer cancels the contract due to inspection findings.