Hawaii Direct Deposit PDF Form

Frequently Asked Questions

-

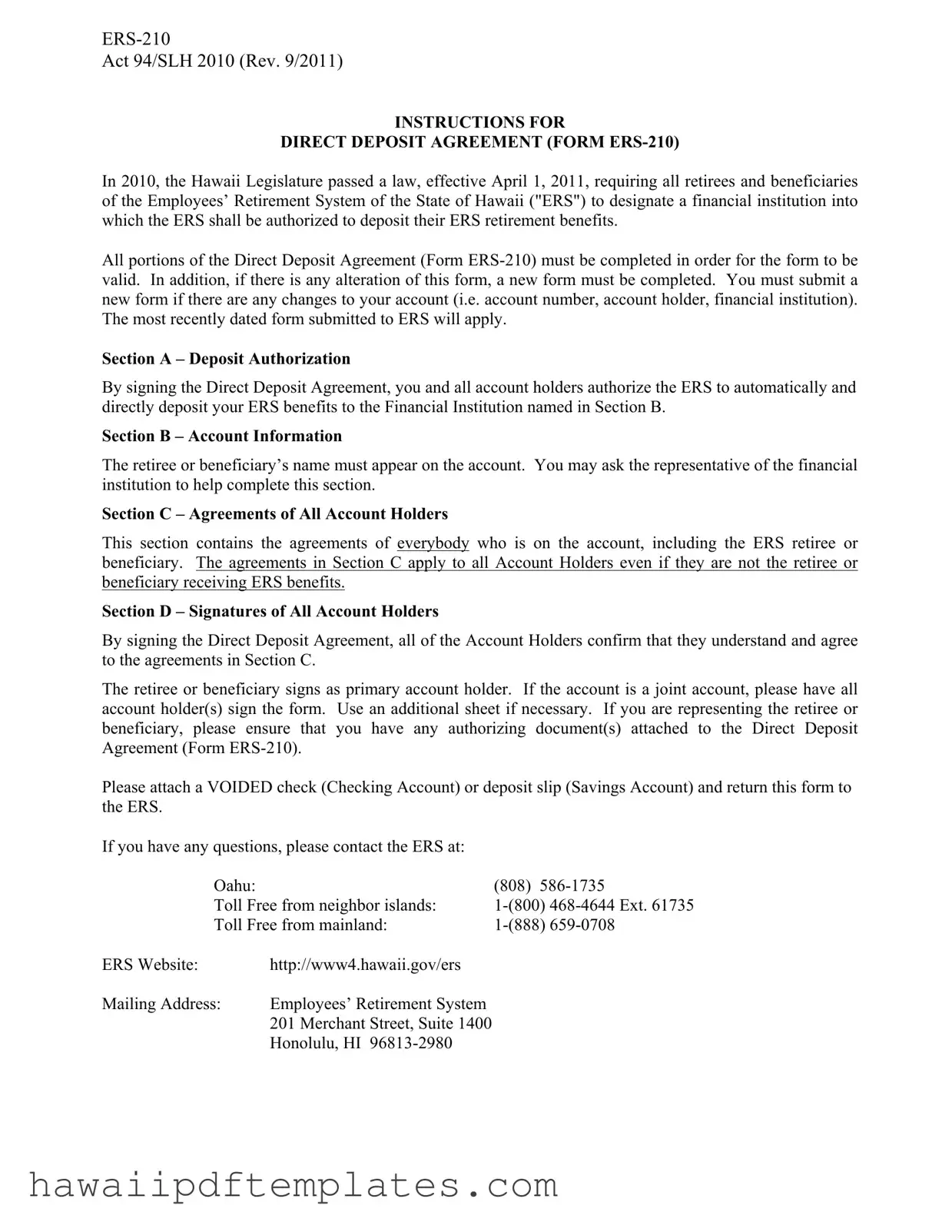

What is the purpose of the Hawaii Direct Deposit form (ERS-210)?

The Hawaii Direct Deposit form, known as ERS-210, is used by retirees and beneficiaries of the Employees’ Retirement System (ERS) to authorize the direct deposit of their retirement benefits into a designated financial institution. This requirement became effective on April 1, 2011, following a law passed by the Hawaii Legislature.

-

Who needs to complete the Direct Deposit Agreement?

All retirees and beneficiaries receiving benefits from the ERS must complete the Direct Deposit Agreement. This includes anyone who is designated to receive retirement benefits. If there are multiple account holders, all must sign the form to authorize the deposit.

-

What information is required to fill out the form?

To complete the form, you need to provide:

- Your name and Social Security number.

- Your mailing address.

- The name of the financial institution where you want your benefits deposited.

- Your account number and routing number.

- Indicate whether the account is a checking or savings account.

Additionally, you must ensure that the retiree or beneficiary's name appears on the account.

-

What should I do if my account information changes?

If there are any changes to your account, such as a new account number or a change in the financial institution, you must complete a new Direct Deposit Agreement. The most recent form submitted will take precedence over any previous agreements.

-

How do I submit the Direct Deposit Agreement?

Once you have completed the form, attach a VOIDED check if you are using a checking account or a deposit slip if you are using a savings account. Return the completed form to the Employees’ Retirement System at their mailing address:

Employees’ Retirement System

201 Merchant Street, Suite 1400

Honolulu, HI 96813-2980If you have any questions, you can contact the ERS directly at their phone numbers provided in the instructions.

Popular PDF Forms

Hawaii Food Establishment Permit - The initial event date will set the clock for your 120-day period of permitted sales.

To navigate the complexities of starting your business, having a well-structured comprehensive Operating Agreement document is crucial. This form not only outlines key operational procedures but also ensures that all members are aligned regarding their roles and responsibilities. Filling it out accurately will provide clarity and a solid foundation for your LLC.

Hawaii State Tax - Available for various types of taxes including General Excise and Transient Accommodations.

Hawaii Llc Cost - For individuals with special needs, the material can be made available upon request.

Steps to Writing Hawaii Direct Deposit

After completing the Hawaii Direct Deposit form, it is essential to ensure that all required information is accurately filled out. This will help facilitate a smooth process for your retirement benefits. Below are the steps to guide you through filling out the form correctly.

- Obtain the Form: Download or request the Hawaii Direct Deposit Agreement (Form ERS-210).

- Fill in Personal Information: In the designated area, enter your last name, first name, middle initial, mailing address, Social Security number, and day phone number.

- Section A - Deposit Authorization: Read the authorization statement carefully. By signing in Section D, you agree to allow the ERS to deposit your benefits directly into your account.

- Section B - Account Information: Provide the name of the account holder(s), the name of the financial institution, the routing number, and the account number. Indicate whether the account is a checking or savings account. If needed, seek assistance from your financial institution.

- Section C - Agreements of All Account Holders: Understand the agreements outlined. By signing in Section D, all account holders consent to the terms mentioned.

- Section D - Signatures: All account holders must sign and date the form. The primary account holder should sign first. If it is a joint account, ensure all account holders sign the form. Use an additional sheet if necessary.

- Attach Required Documents: Include a VOIDED check if you have a checking account, or a deposit slip if you have a savings account.

- Submit the Form: Return the completed form and attachments to the Employees’ Retirement System at the provided mailing address.

Once submitted, the ERS will process your request. If you have any questions during this process, do not hesitate to reach out to the ERS for assistance.

Misconceptions

Understanding the Hawaii Direct Deposit form can help retirees and beneficiaries navigate their financial arrangements more effectively. However, several misconceptions can lead to confusion. Here are some of the most common misunderstandings:

- All retirees must submit the form immediately. Many believe that they must submit the Direct Deposit Agreement as soon as they retire. In reality, the requirement to submit the form applies only if they wish to receive benefits through direct deposit.

- Only one financial institution can be designated. Some think they can only choose one bank for direct deposit. However, retirees can switch banks or accounts by submitting a new form whenever necessary.

- Changes to the account do not require a new form. It is a common misconception that simply changing account details does not necessitate a new form. In fact, any change in account number or financial institution requires a new Direct Deposit Agreement to be submitted.

- Signatures from all account holders are optional. Many assume that only the primary account holder needs to sign. However, all account holders must sign the form to ensure that everyone agrees to the terms outlined in the agreement.

- A voided check is not necessary. Some retirees believe they can submit the form without attaching a voided check or deposit slip. In truth, this attachment is crucial for verifying account details.

- The form can be altered if needed. Some individuals think they can make changes directly on the form. However, any alteration invalidates the document, necessitating the completion of a new form.

- Direct deposit guarantees immediate access to funds. There is a belief that direct deposit means funds will be available instantly. While direct deposit can expedite access to funds, delays can still occur based on the financial institution's processing times.

- Contacting ERS is unnecessary after submitting the form. Many retirees think they won’t need to reach out to ERS once the form is submitted. However, it’s always a good idea to confirm that the form has been processed correctly, especially if there are any concerns about deposits.

Being aware of these misconceptions can help ensure that the process of setting up direct deposit is smooth and efficient. If there are any questions or uncertainties, reaching out to ERS is recommended.