Hawaii G 17 PDF Form

Frequently Asked Questions

-

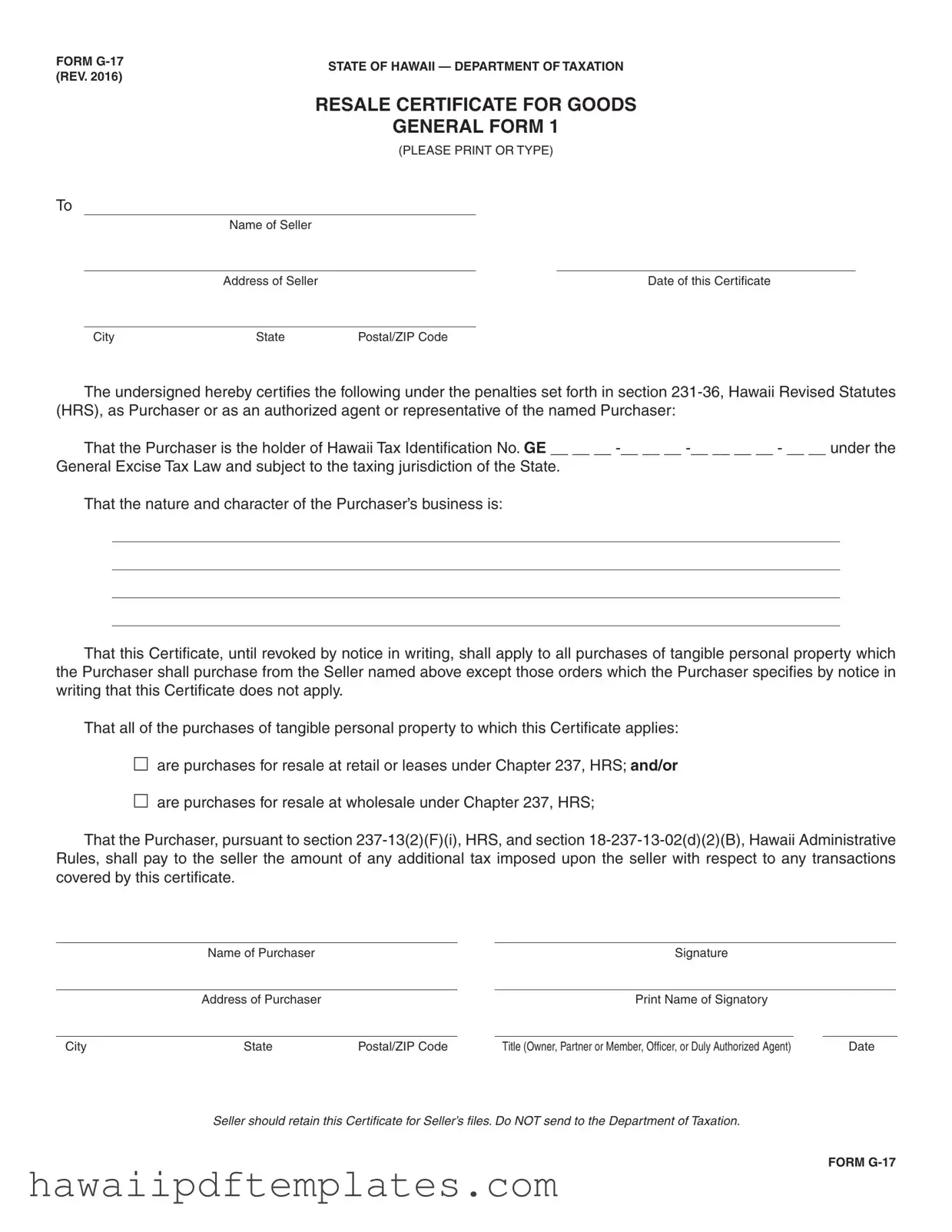

What is the Hawaii G 17 form?

The Hawaii G 17 form is a Resale Certificate for Goods. It is used by purchasers in Hawaii to certify that they are buying tangible personal property for resale. This form helps businesses avoid paying sales tax on items they intend to sell rather than use for personal consumption.

-

Who needs to fill out the G 17 form?

Any business or individual in Hawaii that purchases goods for resale needs to complete the G 17 form. This includes retailers and wholesalers who plan to sell the items to customers. It is important that the purchaser has a valid Hawaii Tax Identification Number under the General Excise Tax Law.

-

How do I complete the G 17 form?

To complete the form, you will need to provide the seller's name and address, the date, and your business details. You must also indicate whether the purchases are for retail or wholesale resale. Finally, sign the form and include your title and the date. Make sure all information is accurate to avoid issues later.

-

Do I need to send the G 17 form to the Department of Taxation?

No, you do not need to send the G 17 form to the Department of Taxation. Instead, the seller should retain the certificate for their records. This helps both parties keep track of tax-exempt purchases and comply with state regulations.

-

How long is the G 17 form valid?

The G 17 form remains valid until it is revoked by written notice from the purchaser. This means that as long as the form is in effect, it applies to all purchases of tangible personal property from the seller, unless specified otherwise.

-

What happens if I misuse the G 17 form?

Misusing the G 17 form can lead to penalties. If a purchaser uses the form to buy items for personal use rather than resale, they may be held liable for unpaid taxes. Additionally, penalties under section 231-36 of the Hawaii Revised Statutes may apply, which can result in fines or other legal consequences.

-

Can a seller refuse to accept the G 17 form?

Yes, a seller can refuse to accept the G 17 form if they have reasonable doubts about its validity or the purchaser's intention. Sellers are encouraged to verify the information provided, including the Hawaii Tax Identification Number, to ensure compliance with tax laws.

-

What if I need to update my G 17 form information?

If you need to update any information on the G 17 form, such as your business address or tax ID number, you should complete a new form and provide it to the seller. This ensures that all records are current and accurate, helping to avoid any potential tax issues in the future.

Popular PDF Forms

Hawaii Form N-15 - Keep all records related to the N-301 submission for potential future reference.

The California Notice to Quit form is a vital tool for landlords aiming to communicate their intent to terminate a rental agreement, ensuring that tenants are well-informed about the need to vacate. For a better understanding of this process and to ensure compliance with legal standards, landlords and tenants alike should familiarize themselves with the Notice to Quit form, as it outlines essential rights and responsibilities during an eviction proceeding.

Boh Routing - The form is a critical document for anyone wishing to receive their retirement benefits efficiently.

Steps to Writing Hawaii G 17

After completing the Hawaii G 17 form, it is important to ensure that all information is accurate. The seller will keep this certificate on file and does not need to send it to the Department of Taxation. Follow these steps to fill out the form correctly.

- Enter the Seller's Information: Fill in the name, address, city, state, and postal/ZIP code of the seller at the top of the form.

- Fill in the Date: Write the date when you are completing the certificate.

- Provide Purchaser Information: Enter the name of the purchaser and their address, including city, state, and postal/ZIP code.

- Tax Identification Number: Write the Hawaii Tax Identification Number of the purchaser in the designated area.

- Describe the Business: State the nature and character of the purchaser's business.

- Specify Purchase Type: Indicate whether the purchases are for resale at retail, wholesale, or both by checking the appropriate boxes.

- Signature: The purchaser or an authorized representative must sign the form. Include the printed name of the signatory and their title.

- Retain the Certificate: Ensure the seller keeps this certificate for their records. Do not send it to the Department of Taxation.

Misconceptions

Misconceptions about the Hawaii G 17 form can lead to confusion for both sellers and purchasers. Here are five common misunderstandings:

- The G 17 form is only for retail purchases. This form can be used for both retail and wholesale purchases. It applies to any tangible personal property that the purchaser intends to resell.

- Once submitted, the G 17 form is permanent. The certificate remains valid until the purchaser revokes it in writing. This means that if circumstances change, a new certificate can be issued.

- Only large businesses need to use the G 17 form. Any business making purchases for resale, regardless of size, must use this form to avoid paying unnecessary taxes on resale items.

- The seller must send the G 17 form to the Department of Taxation. This is incorrect. Sellers should keep the form for their records and do not need to submit it to the Department of Taxation.

- The G 17 form guarantees tax exemption on all purchases. While the form allows for tax exemption on eligible purchases, it does not exempt the purchaser from paying any additional taxes that may be imposed on the seller.

Understanding these misconceptions can help businesses navigate the requirements of the Hawaii G 17 form more effectively.