Hawaii Hc 5 PDF Form

Frequently Asked Questions

-

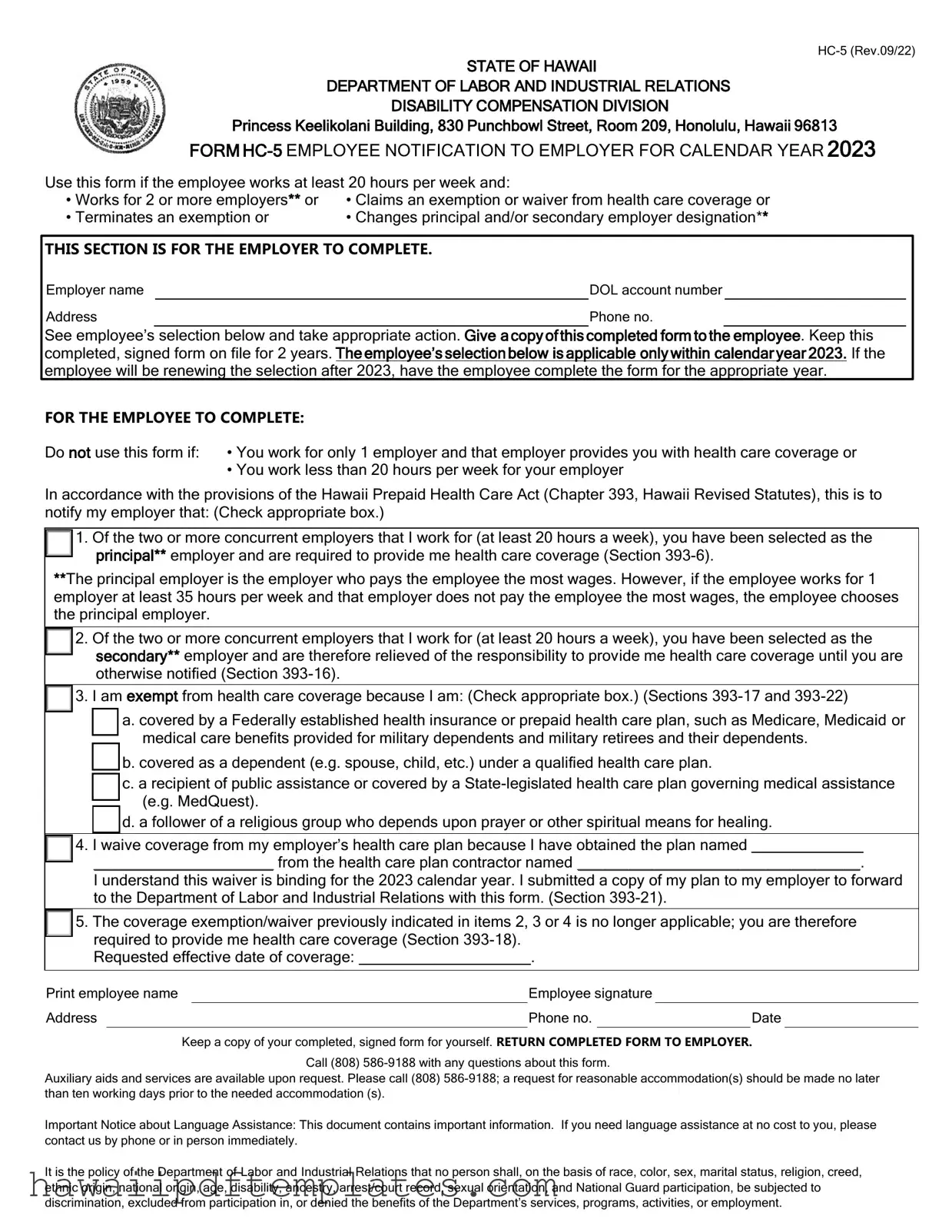

What is the purpose of the Hawaii HC 5 form?

The Hawaii HC 5 form is used by employees to notify their employers about their health care coverage status. This includes situations where an employee works for multiple employers, claims an exemption from health care coverage, or changes their primary employer designation.

-

Who should use the HC 5 form?

This form is intended for employees who:

- Work for two or more employers.

- Are claiming an exemption or waiver from health care coverage.

- Are terminating their exemption from health care coverage.

- Are changing their principal or secondary employer designation.

-

Who should not use the HC 5 form?

Employees should not use this form if they:

- Work for only one employer that provides health care coverage.

- Work less than 20 hours per week for their employer.

-

What information is required on the HC 5 form?

The form requires the employee's name, address, phone number, and signature. It also asks for the employer's name, address, and Department of Labor account number. Additionally, employees must indicate their health care coverage status by checking the appropriate boxes.

-

What does it mean to be a principal employer?

The principal employer is the one that pays the employee the most wages. If an employee works for multiple employers, they can choose which employer to designate as the principal if they work at least 35 hours a week for that employer.

-

How long must the employer keep the HC 5 form?

Employers are required to keep the completed and signed form for two years. They must also provide a copy to the employee.

-

What should an employee do if they have questions about the HC 5 form?

Employees can call the Department of Labor and Industrial Relations at (808) 586-9188 for any questions regarding the HC 5 form.

-

Is there a deadline for submitting the HC 5 form?

The form must be renewed every December 31. Employees should ensure that they submit the updated form to their employer by this date.

Popular PDF Forms

Hawaii State Tax - Forms VP-1 and VP-2 are also necessary for processing payments related to your application.

Hawaii Marriage License Application - Take this step confidently as you plan your wedding.

When engaging in a vehicle sale, it is crucial to utilize the proper documentation to avoid any potential disputes; thus, the Florida Forms for the Motor Vehicle Bill of Sale provides a reliable means to formally record the agreement between the buyer and seller, ensuring both parties have clarity regarding the transaction and ownership transfer.

Hawaii Form N-15 - Print numbers inside the boxes on the N-301 form clearly to ensure proper processing.

Steps to Writing Hawaii Hc 5

Completing the Hawaii HC-5 form is essential for notifying your employer about your health care coverage status. Follow the steps below to ensure that you fill out the form accurately and completely.

- Obtain the Hawaii HC-5 form from your employer or download it from the appropriate website.

- Fill in your employer's name in the designated space at the top of the form.

- Provide the employer's address, including the street, city, state, and zip code.

- Enter the employer's DOL account number, which is usually a series of numbers.

- Write down the employer's telephone number, including the area code.

- Check the appropriate box to indicate your employment situation:

- If you have selected a principal employer, check the first box.

- If you have selected a secondary employer, check the second box.

- If you are claiming an exemption, check the third box and specify the reason.

- If you are waiving coverage, check the fourth box and provide the name of your plan and contractor.

- If you are notifying your employer that a previous exemption or waiver is no longer applicable, check the fifth box.

- If applicable, write the requested effective date of coverage in the provided space.

- Print your name clearly in the designated area.

- Sign the form to validate your notification.

- Fill in your address, including street, city, state, and zip code.

- Provide your phone number, including the area code.

- Write the date you completed the form.

After filling out the form, keep a copy for your records. Submit the completed form to your employer as instructed. This will ensure that your health care coverage status is properly communicated and documented.

Misconceptions

Misconceptions about the Hawaii HC-5 form can lead to confusion regarding health care coverage responsibilities. Here are ten common misconceptions clarified:

- The HC-5 form is only for employees with one employer. This form is specifically designed for employees who work for two or more employers or need to make changes regarding their health care coverage.

- Only full-time employees need to use the HC-5 form. Part-time employees who work at least 20 hours a week for multiple employers must also use this form to notify their principal employer.

- Submitting the HC-5 form to the state is mandatory. Employees should not submit this form to the State Department of Labor & Industrial Relations unless specifically requested.

- The HC-5 form is only relevant for health care coverage waivers. The form can also be used to designate a principal employer or to notify of changes in health care coverage status.

- Once I submit the HC-5 form, I am permanently exempt from health care coverage. Any exemptions or waivers must be renewed annually, and changes in status may require a new form.

- Employers do not need to keep a copy of the HC-5 form. Employers are required to keep the completed, signed form for two years for their records.

- All employers are responsible for providing health care coverage. Only the designated principal employer is required to provide coverage based on the employee's selection.

- Employees cannot change their principal employer designation. Employees can change their principal employer designation by submitting a new HC-5 form when necessary.

- The HC-5 form is the same for every calendar year. The form must be renewed every December 31, and updates may occur from year to year.

- Health care coverage is optional for all employees. Employees who work for multiple employers and meet specific criteria are required to have health care coverage, as outlined in the Hawaii Prepaid Health Care Act.