Hawaii Hw 14 PDF Form

Frequently Asked Questions

-

What is the purpose of the Hawaii HW-14 form?

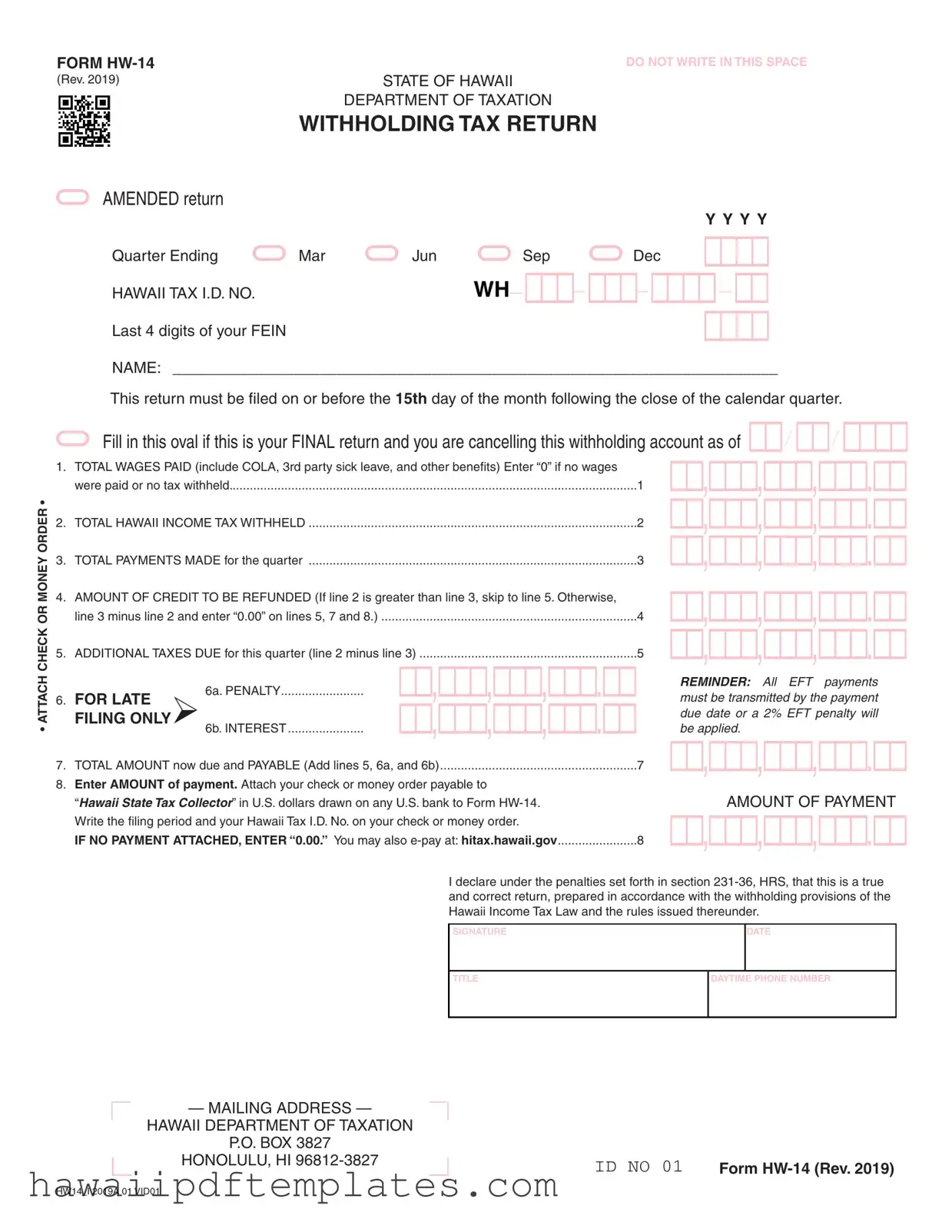

The Hawaii HW-14 form is used to report withholding tax for wages paid to employees in the state of Hawaii. Employers must submit this form quarterly to ensure compliance with state tax laws. It allows the Department of Taxation to track tax withholdings and ensure that the appropriate amounts are being collected and remitted.

-

When is the HW-14 form due?

This form must be filed on or before the 15th day of the month following the end of each calendar quarter. For example, if you are reporting for the quarter ending in March, the form is due by April 15th. Timely submission is essential to avoid penalties.

-

What information is required on the HW-14 form?

To complete the HW-14 form, you will need to provide your Hawaii Tax I.D. number, the last four digits of your Federal Employer Identification Number (FEIN), and your name. Additionally, you must report total wages paid, total Hawaii income tax withheld, total payments made, and any credits or additional taxes due for the quarter.

-

What should I do if I did not pay any wages during the quarter?

If no wages were paid or no tax was withheld, you should enter “0” on the line for total wages paid. It is still necessary to file the form, even if the amounts are zero, to maintain compliance with filing requirements.

-

What happens if I file the HW-14 form late?

Filing the HW-14 form late may result in penalties and interest charges. Specifically, there is a penalty for late filing, and interest will accrue on any unpaid taxes. It is crucial to file on time to avoid these additional costs.

-

How do I make a payment when submitting the HW-14 form?

When submitting the HW-14 form, you can attach a check or money order made payable to “HAWAII STATE TAX COLLECTOR.” Ensure that your payment is drawn on a U.S. bank and includes the filing period and your Hawaii Tax I.D. number. Alternatively, you may also opt to make an electronic payment through the Hawaii tax website.

-

What if I need to cancel my withholding account?

If you are closing your withholding account, you should indicate this by filling in the designated oval on the HW-14 form. This will signal to the Department of Taxation that this is your final return.

-

Can I amend my HW-14 form after submitting it?

Yes, if you discover an error after submitting the HW-14 form, you can file an amended return. It is important to correct any inaccuracies to ensure that your tax records are accurate and up to date.

-

Where do I send the completed HW-14 form?

Once you have completed the HW-14 form, you should mail it to the Hawaii Department of Taxation at the following address: P.O. Box 3827, Honolulu, HI 96812-3827. Ensure that you send it well before the due date to allow for processing time.

-

What should I do if I have more questions about the HW-14 form?

If you have further questions or need assistance with the HW-14 form, consider reaching out to the Hawaii Department of Taxation directly. They can provide guidance and clarification regarding your specific situation and ensure that you have the information you need to comply with tax regulations.

Popular PDF Forms

Hawaii Department of Revenue - Bad debts claimed in multiple sections must be properly detailed.

State Of Hawaii Hrd 278 - The application process includes a certification statement affirming the truthfulness of provided information.

When engaging in a vehicle sale in Florida, it is crucial to complete the Florida Motor Vehicle Bill of Sale form to formalize the transaction. This document acts as proof of the sale, capturing vital details about the vehicle and both parties involved. For those looking for templates, Florida Forms provides convenient resources to facilitate this process, ensuring that all legal requirements are met and protecting the rights of both the seller and the buyer.

Hawaii Form N-15 - Taxpayers must follow specific guidelines to avoid processing delays when submitting the N-301.

Steps to Writing Hawaii Hw 14

Filling out the Hawaii HW-14 form requires careful attention to detail. This form is essential for reporting withholding taxes for the specified quarter. Ensure that all information is accurate and complete before submitting.

- Obtain the HW-14 form. You can download it from the Hawaii Department of Taxation website or request a physical copy.

- Identify the quarter for which you are filing. Mark the appropriate oval for the quarter ending in March, June, September, or December.

- Enter your Hawaii Tax I.D. number in the designated field.

- Fill in your name in the provided space.

- If this is your final return and you are canceling your withholding account, mark the corresponding oval.

- Report the total wages paid in line 1. Include all relevant income such as COLA and third-party sick leave. If no wages were paid, enter "0."

- In line 2, enter the total Hawaii income tax withheld.

- For line 3, indicate the total payments made for the quarter.

- Calculate line 4. If the amount in line 2 is greater than line 3, skip to line 5. Otherwise, subtract line 2 from line 3 and enter the result. If this results in a negative number, enter "0.00" on lines 5, 7, and 8.

- For line 5, calculate any additional taxes due by subtracting line 3 from line 2.

- If applicable, fill out line 6a for any penalties incurred due to late filing.

- Complete line 6b for any interest owed.

- Add lines 5, 6a, and 6b to determine the total amount now due and payable. Enter this total on line 7.

- Enter the amount of payment on line 8. Attach your check or money order made out to "HAWAII STATE TAX COLLECTOR." Ensure to write the filing period and your Hawaii Tax I.D. number on the payment.

- If no payment is attached, enter "0.00" on line 8.

- Review the declaration statement and sign where indicated to confirm the accuracy of the return.

- Mail the completed form along with any payment to the Hawaii Department of Taxation at the address provided.

Misconceptions

The Hawaii HW-14 form is an essential document for employers in Hawaii to report withholding tax. However, several misconceptions exist regarding its use and requirements. Here are nine common misunderstandings:

- The HW-14 is only for large businesses. This form is required for all employers who withhold Hawaii income tax from employee wages, regardless of the size of the business.

- You can file the HW-14 at any time. The form must be filed on or before the 15th day of the month following the close of each calendar quarter. Late submissions may incur penalties.

- It’s optional to report zero wages. If no wages were paid or no tax was withheld during the quarter, you must still file the HW-14 and enter “0” on line 1.

- Payments can be made in any form. Payments must be made via check or money order, or electronically through the designated e-payment system. Ensure that payments are in U.S. dollars and drawn on a U.S. bank.

- Only the final return needs to be marked. If you are canceling your withholding account, you must indicate this by filling in the appropriate oval on the form, regardless of whether it is your final return.

- All penalties and interest are automatically calculated. While the form provides sections for penalties and interest, it is the responsibility of the filer to calculate these amounts accurately.

- Filing the HW-14 is the same as filing other tax forms. The HW-14 specifically focuses on withholding tax and has unique requirements that differ from other tax forms.

- You can submit the form electronically. Currently, the HW-14 must be submitted via mail. Electronic filing is not an option for this form.

- Once filed, the HW-14 cannot be amended. If errors are found after submission, you can file an amended return to correct any mistakes.

Understanding these misconceptions can help ensure compliance and avoid penalties when filing the Hawaii HW-14 form.