Hawaii Llc 3 PDF Form

Frequently Asked Questions

-

What is the purpose of the Hawaii LLC-3 form?

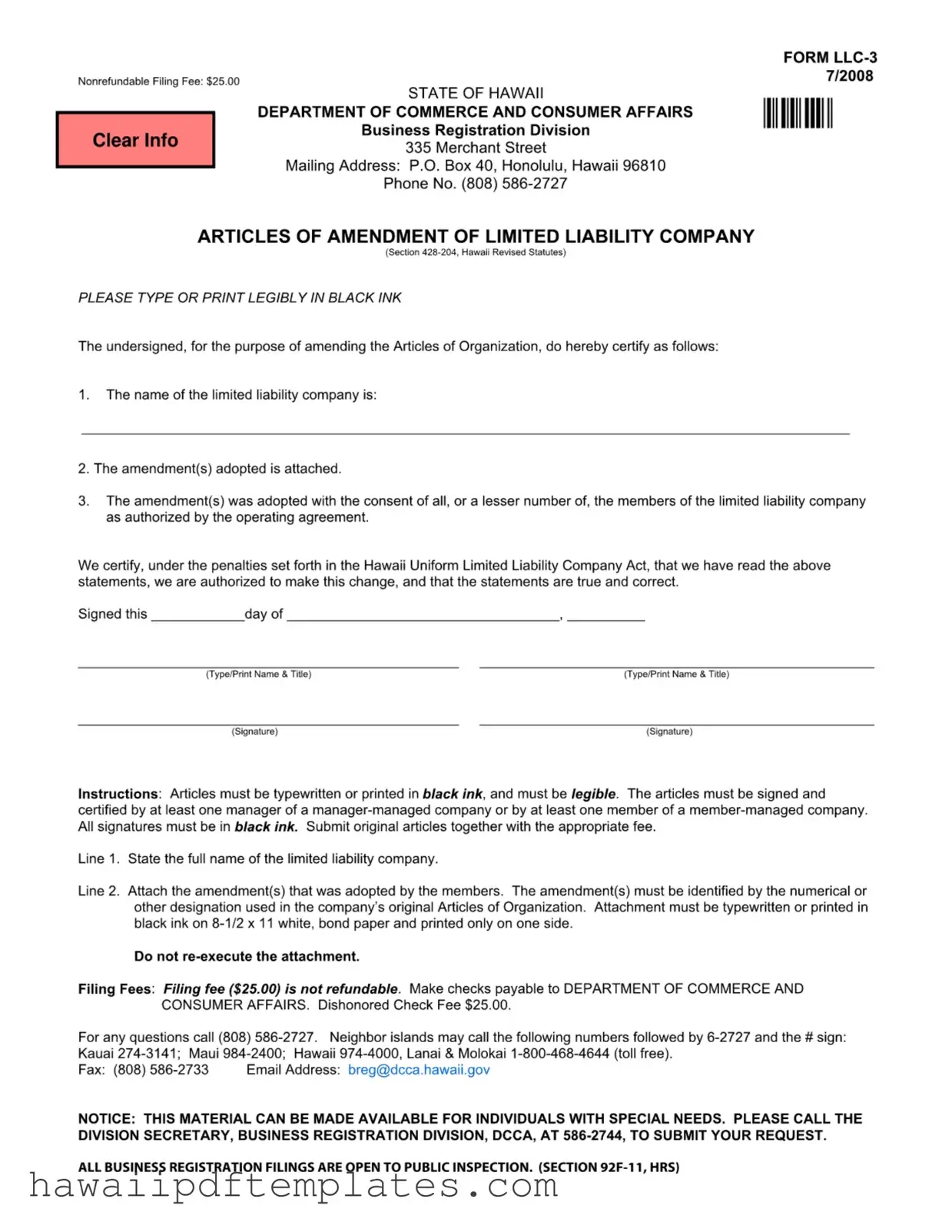

The Hawaii LLC-3 form is used to amend the Articles of Organization for a limited liability company (LLC) in Hawaii. This form allows LLCs to officially document changes such as name changes, changes in management structure, or any other modifications that need to be made to the original Articles of Organization.

-

What is the filing fee for the Hawaii LLC-3 form?

The filing fee for submitting the Hawaii LLC-3 form is $25.00. It is important to note that this fee is nonrefundable, meaning that even if the amendment is not approved, the fee will not be returned.

-

Who needs to sign the Hawaii LLC-3 form?

The form must be signed and certified by at least one manager if the LLC is manager-managed, or by at least one member if it is member-managed. All signatures must be in black ink, and it is essential that the signers are authorized to make the changes being requested.

-

How should the amendments be documented?

Amendments must be attached to the LLC-3 form and should be identified by the numerical or other designation used in the original Articles of Organization. The amendments should be typewritten or printed in black ink on standard 8-1/2 x 11 white bond paper, and printed on one side only.

-

What if I need assistance with the form?

If you have questions or need help with the Hawaii LLC-3 form, you can contact the Business Registration Division at (808) 586-2727. For those on neighbor islands, there are specific numbers to call, such as Kauai 274-3141, Maui 984-2400, Hawaii 974-4000, and Lanai & Molokai 1-800-468-4644 (toll free).

-

Where should I send the completed form?

The completed Hawaii LLC-3 form, along with the appropriate filing fee, should be submitted to the Business Registration Division at the following address:

335 Merchant Street

P.O. Box 40

Honolulu, Hawaii 96810 -

What happens if my check is dishonored?

If the payment check is dishonored, a fee of $25.00 will be assessed. It is advisable to ensure that sufficient funds are available to avoid this additional charge.

-

Can I request accommodations for special needs?

Yes, if you require assistance or accommodations due to special needs, you can call the Division Secretary at (808) 586-2744 to submit your request. The Business Registration Division aims to make its materials accessible to everyone.

Popular PDF Forms

Comprehensive Financial Planning Hawaii - Your participation in the plan is a valuable investment in your future.

Boh Routing - Section C emphasizes the mutual agreements and responsibilities of everyone associated with the bank account.

For those looking to complete a motor vehicle transaction, utilizing the Florida Motor Vehicle Bill of Sale is crucial, and additional resources such as Florida Forms can provide necessary guidance to help ensure all aspects of the sale are properly executed.

Ono Hawaiian Bbq Hiring - Your signature will confirm the accuracy of the information provided.

Steps to Writing Hawaii Llc 3

Filling out the Hawaii LLC 3 form is an important step in amending your limited liability company's Articles of Organization. Make sure to have all necessary information ready before you begin. Once completed, the form will need to be submitted along with the required fee.

- Obtain the Hawaii LLC 3 form. Ensure it is the most current version.

- Type or print the form in black ink. Make sure all entries are legible.

- In Line 1, enter the full name of your limited liability company.

- In Line 2, attach the amendment(s) that were adopted by the members. Clearly identify the amendment(s) by the numerical or other designation used in the original Articles of Organization.

- Ensure the attachment is typewritten or printed in black ink on 8-1/2 x 11 white bond paper, printed only on one side.

- Sign the form. At least one manager or member must sign in black ink.

- Include the date of signing.

- Prepare a check for the nonrefundable filing fee of $25. Make it payable to the Department of Commerce and Consumer Affairs.

- Submit the completed form and payment to the Business Registration Division at the address provided on the form.

Misconceptions

Misconceptions about the Hawaii LLC 3 form can lead to confusion and errors. Here are eight common misunderstandings:

- It's Free to File: Many believe that filing the LLC 3 form is free. In reality, there is a nonrefundable filing fee of $25.00.

- Any Member Can Sign: Some think that any member of the LLC can sign the form. However, it must be signed by at least one manager or member, depending on the company's management structure.

- Amendments Can Be Verbal: A common myth is that amendments can be communicated verbally. All amendments must be documented in writing and attached to the form.

- Black Ink Isn't Necessary: Many underestimate the importance of using black ink. The form must be completed in black ink to be considered valid.

- Only One Signature Is Required: Some believe that only one signature is needed for the form. Depending on the management structure, more than one signature may be required.

- Changes Can Be Made After Filing: There is a misconception that changes can be made to the form after it has been submitted. Once filed, amendments cannot be altered without submitting a new form.

- Filing Is Optional: Some think that filing the LLC 3 form is optional. In fact, if amendments to the Articles of Organization are made, filing is required to keep the company in compliance.

- All Attachments Are Accepted: There is a belief that any type of attachment can be included. Attachments must be typewritten on specific paper and formatted correctly to be accepted.