Hawaii M 38 PDF Form

Frequently Asked Questions

-

What is the purpose of the Hawaii M 38 form?

The Hawaii M 38 form serves as an Exemption Certificate for diesel oil and liquefied petroleum gas used off public highways. It allows purchasers to affirm that the fuel they buy will be used in areas other than public highways, which can exempt them from certain taxes.

-

Who needs to fill out the Hawaii M 38 form?

Any individual, corporation, or partnership purchasing diesel oil or liquefied petroleum gas for use in a motor vehicle off public highways must complete this form. This applies to those using the fuel in internal combustion engines as well.

-

When should the Hawaii M 38 form be submitted?

The form should be provided to the fuel distributor annually or whenever there is a change in how the fuel will be used. For example, if fuel usage changes from on-highway to off-highway, a new certificate must be submitted.

-

What happens if the Hawaii M 38 form is not provided?

If the form is not furnished, the tax will be applied to all fuel sales as if it were intended for use on public highways. This means the purchaser may end up paying more in taxes than necessary.

-

Can I get a refund if I paid taxes without submitting the form?

Yes, if you paid taxes because you did not provide the Hawaii M 38 form but used the fuel off public highways, you can file for a refund. This is done using the Combined Claim for Refund of Fuel Taxes (FORM M-36).

-

What if I purchase both diesel oil and liquefied petroleum gas?

If you buy both types of fuel for off-highway use, you need to submit separate Hawaii M 38 forms for each type. This ensures that the tax exemption is correctly applied to each fuel type.

-

What additional information must I provide when using the form?

If the fuel will not be used off public highways, you must provide a separate statement at the time of purchase. This statement should detail how much diesel oil and liquefied petroleum gas will be used on and off public highways.

-

Am I liable for additional taxes if I misuse the exemption?

Yes, if you initially intended to use the fuel off public highways but later used it on public highways, you will be liable for any additional taxes. You must report this by filing the Quarterly Tax Return for Additional Fuel Taxes (FORM M-22).

Popular PDF Forms

Hawaii Form N-15 - The N15 form must clarify if the taxpayer can be claimed as a dependent on another's tax return.

The California Lease Agreement form is a legally binding document that outlines the terms and conditions between a landlord and a tenant for renting residential or commercial property. This form serves as a critical guide to protect the rights of both parties, ensuring clarity and mutual understanding regarding rent, duration, and responsibilities. For further information on creating a lease, you can refer to resources such as Top Forms Online. By carefully reviewing and signing this document, both landlords and tenants can foster a harmonious rental relationship.

Dnr Paperwork - Section B details medical interventions for patients who are breathing or have a pulse.

Hawaii Food Establishment Permit - Each application should remain organized and easily readable for review purposes.

Steps to Writing Hawaii M 38

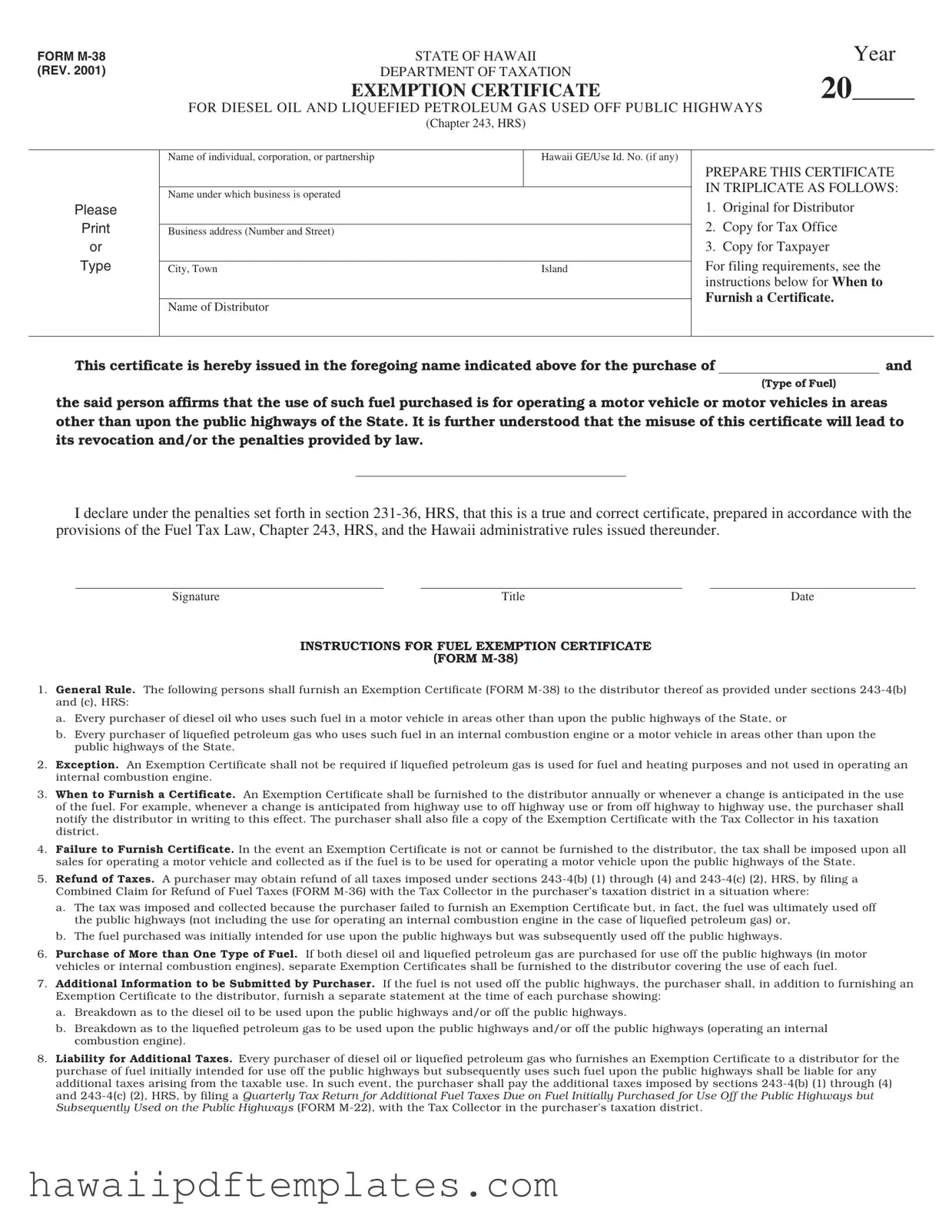

Completing the Hawaii M-38 form is essential for individuals or businesses purchasing diesel oil or liquefied petroleum gas for use off public highways. This form must be prepared in triplicate and submitted to the appropriate parties to ensure compliance with state regulations. Following the outlined steps will facilitate a smooth filing process.

- Begin by entering the name of the individual, corporation, or partnership on the designated line.

- If applicable, include the Hawaii GE/Use ID number.

- Provide the name under which the business operates.

- Fill in the business address, including the number and street, city, town, and island.

- Indicate the name of the distributor from whom you are purchasing the fuel.

- Specify the type of fuel being purchased (diesel oil or liquefied petroleum gas).

- Affirm that the fuel will be used for operating motor vehicles off public highways.

- Sign the form, including your title and the date of signing.

- Make two additional copies of the completed form for distribution: one for the distributor and one for the taxpayer's records.

After filling out the form, ensure it is submitted to the distributor and retained for your records. Remember to file a copy with the Tax Collector in your taxation district if required. This process helps maintain compliance with state tax laws regarding fuel usage.

Misconceptions

Here are some common misconceptions about the Hawaii M 38 form:

- Only businesses need to use the M 38 form. Many individuals who purchase diesel oil or liquefied petroleum gas for personal use may also need to complete this form if they use the fuel off public highways.

- The M 38 form is only for diesel oil. This form applies to both diesel oil and liquefied petroleum gas, as long as the fuel is used in areas other than public highways.

- You do not need to file the M 38 form if you use the fuel for heating. An exemption certificate is not required for liquefied petroleum gas used for heating, but it is necessary if the gas is used in an internal combustion engine.

- Once you file the M 38 form, you don’t need to do anything else. You must notify the distributor if there is any change in the intended use of the fuel, such as switching from off-highway to on-highway use.

- Filing the M 38 form guarantees you will not pay taxes. If the fuel is later used on public highways, you may still be liable for additional taxes, even if you filed the exemption certificate.

- One M 38 form covers all types of fuel. If you purchase both diesel oil and liquefied petroleum gas, you need to submit separate exemption certificates for each type of fuel.