Hawaii N 11 PDF Form

Frequently Asked Questions

-

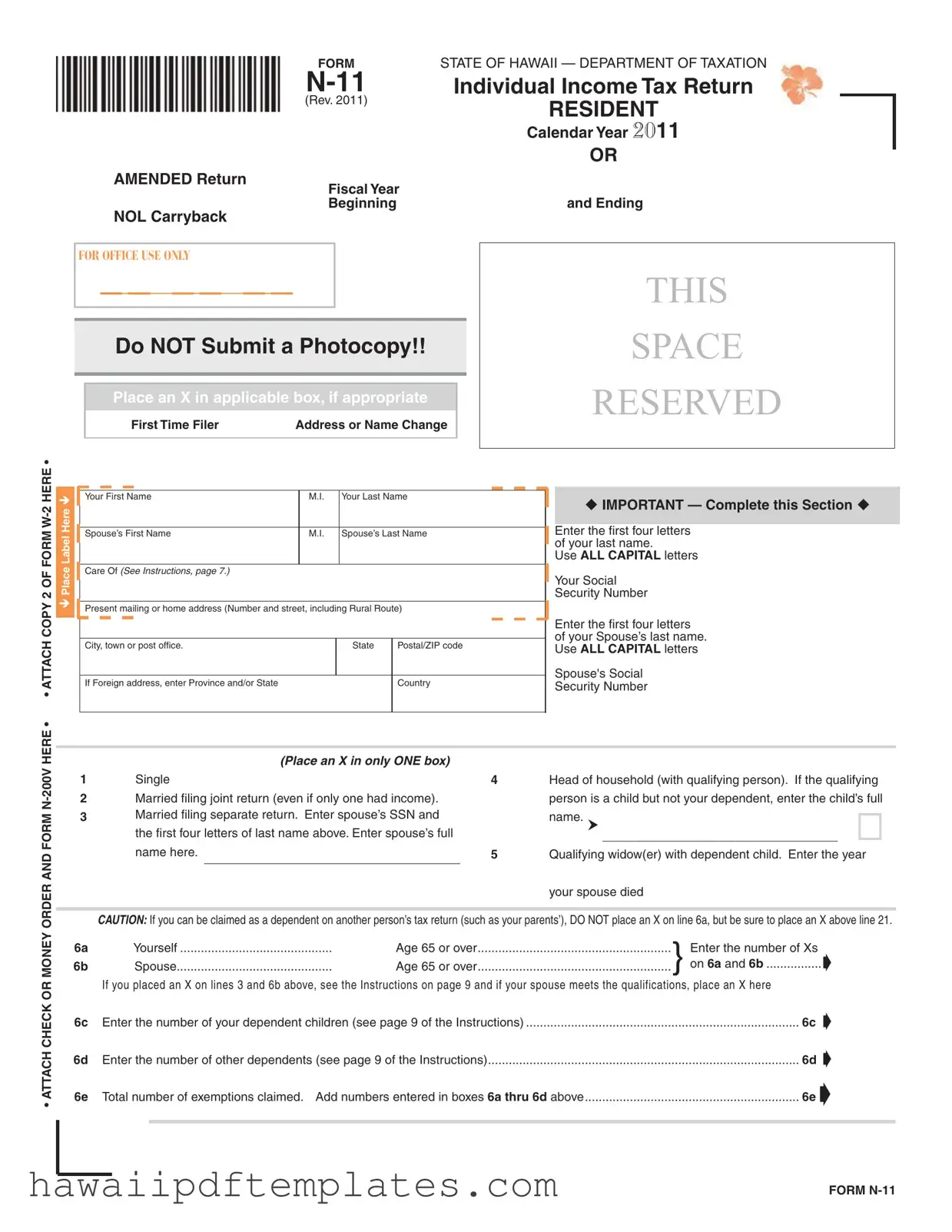

What is the Hawaii N-11 form?

The Hawaii N-11 form is the Individual Income Tax Return used by residents of Hawaii to report their income and calculate their state tax liability. It is specifically for individuals filing their taxes for the calendar year or for those submitting an amended return.

-

Who should file the N-11 form?

Individuals who are residents of Hawaii and are required to file a state income tax return should use the N-11 form. This includes those who earned income during the tax year, as well as those who may be eligible for tax credits or refunds.

-

What information is required to complete the N-11 form?

To complete the N-11 form, individuals need to provide personal information such as their name, address, Social Security number, and filing status. Additionally, details regarding income, deductions, and exemptions must be included. It is essential to have information about any dependents and relevant tax credits as well.

-

What are the filing statuses available on the N-11 form?

The N-11 form offers several filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er) with dependent child

-

Are there any deductions available on the N-11 form?

Yes, the N-11 form allows for various deductions. Taxpayers can choose between itemizing their deductions or taking the standard deduction. The form includes specific lines to report medical expenses, taxes, interest expenses, and other deductible items. The standard deduction varies based on filing status.

-

What should I do if I made a mistake on my N-11 form?

If a mistake is discovered after submitting the N-11 form, individuals should file an amended return using the N-11 form again, marking it as an amended return. Corrections must be clearly indicated, and any necessary documentation should be attached.

-

What are the deadlines for filing the N-11 form?

The deadline for filing the N-11 form is typically April 20th of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Extensions may be available, but taxpayers must follow the appropriate procedures to avoid penalties.

-

How can I check the status of my N-11 form after filing?

To check the status of an N-11 form after it has been filed, individuals can contact the Hawaii Department of Taxation directly. They may also have online resources available for tracking the status of tax returns. It is advisable to have personal information ready for verification when making inquiries.

Popular PDF Forms

Divorce Papers Hawaii - Either party can remarry after the Divorce Decree is effective.

When engaging in the sale of a motor vehicle, it's crucial to utilize the Florida Motor Vehicle Bill of Sale form to formalize the transaction and eliminate any potential ambiguities. This important document captures necessary details about the vehicle and both the buyer and seller, ensuring clarity and legal compliance. For those looking for a convenient way to obtain this essential form, be sure to visit Florida Forms.

Hawaiʻi Community College Admissions - Applicants must provide their full name in capital letters.

Steps to Writing Hawaii N 11

Filling out the Hawaii N-11 form is an essential step for residents to report their income and calculate their tax obligations. Once the form is completed, it must be submitted to the Hawaii Department of Taxation. Make sure to gather all necessary information and documents before you begin the process.

- Obtain the Hawaii N-11 form from the Hawaii Department of Taxation website or a local tax office.

- Indicate your filing status by marking the appropriate box. Choose from options such as Single, Married Filing Joint, or Head of Household.

- Fill in your personal information, including your name, address, and Social Security Number. Ensure that all names are in capital letters.

- If applicable, provide your spouse’s information, including their name and Social Security Number.

- Enter the number of exemptions you are claiming. This includes yourself, your spouse, and any dependents.

- Calculate your Federal Adjusted Gross Income (AGI) and enter it in the designated space.

- Complete the sections for Hawaii additions and subtractions to your AGI. Be sure to follow the instructions for each line carefully.

- Determine your taxable income by subtracting deductions from your AGI.

- Calculate your tax liability based on your taxable income. Refer to the tax table or worksheets as needed.

- List any refundable tax credits you are eligible for and add them together.

- Subtract your total refundable credits from your tax liability to find your balance due or refund amount.

- Sign and date the form. If filing jointly, both spouses must sign.

- Make copies of your completed form and any attachments for your records before submitting.

Misconceptions

Understanding the Hawaii N-11 form is crucial for residents filing their individual income tax returns. However, several misconceptions can lead to confusion. Here are nine common misunderstandings about the form:

- Only residents of Hawaii need to file the N-11 form. Many believe that only those who have lived in Hawaii for the entire year must file. However, anyone who earned income in Hawaii during the tax year is required to file, regardless of residency status.

- The N-11 form is only for individuals with high incomes. This is not true. The form applies to all individual taxpayers, regardless of income level. Even those with minimal income may need to file if they meet certain criteria.

- You can submit a photocopy of the N-11 form. This is a common misconception. The form must be submitted in its original format. Photocopies are not accepted, which can lead to processing delays.

- Filing an amended N-11 form is unnecessary if you made a mistake. Many people think they can ignore errors, but it's important to file an amended return to correct any mistakes. This ensures your tax records are accurate and up-to-date.

- All tax credits are automatically applied. Some taxpayers assume that all available credits will be applied without any action on their part. In reality, you must actively claim specific credits on the N-11 form to receive them.

- You cannot claim dependents if you are married filing separately. This is misleading. While there are restrictions, you can still claim dependents if you are married and filing separately, provided you meet certain requirements.

- There is no penalty for filing late. Many individuals believe that late filings are not penalized. However, failing to file on time can result in penalties and interest on any taxes owed.

- Only income earned in Hawaii is taxable. This is a misconception. While Hawaii taxes income earned within the state, it also considers certain types of income from outside sources, depending on your residency status.

- The N-11 form is the same every year. Taxpayers often think the form remains unchanged from year to year. However, tax laws and forms can change, so it’s essential to review the latest version each tax season.

By clearing up these misconceptions, taxpayers can navigate the Hawaii N-11 form more effectively and ensure compliance with state tax regulations.