Hawaii N 289 PDF Form

Frequently Asked Questions

-

What is the purpose of the Hawaii N-289 form?

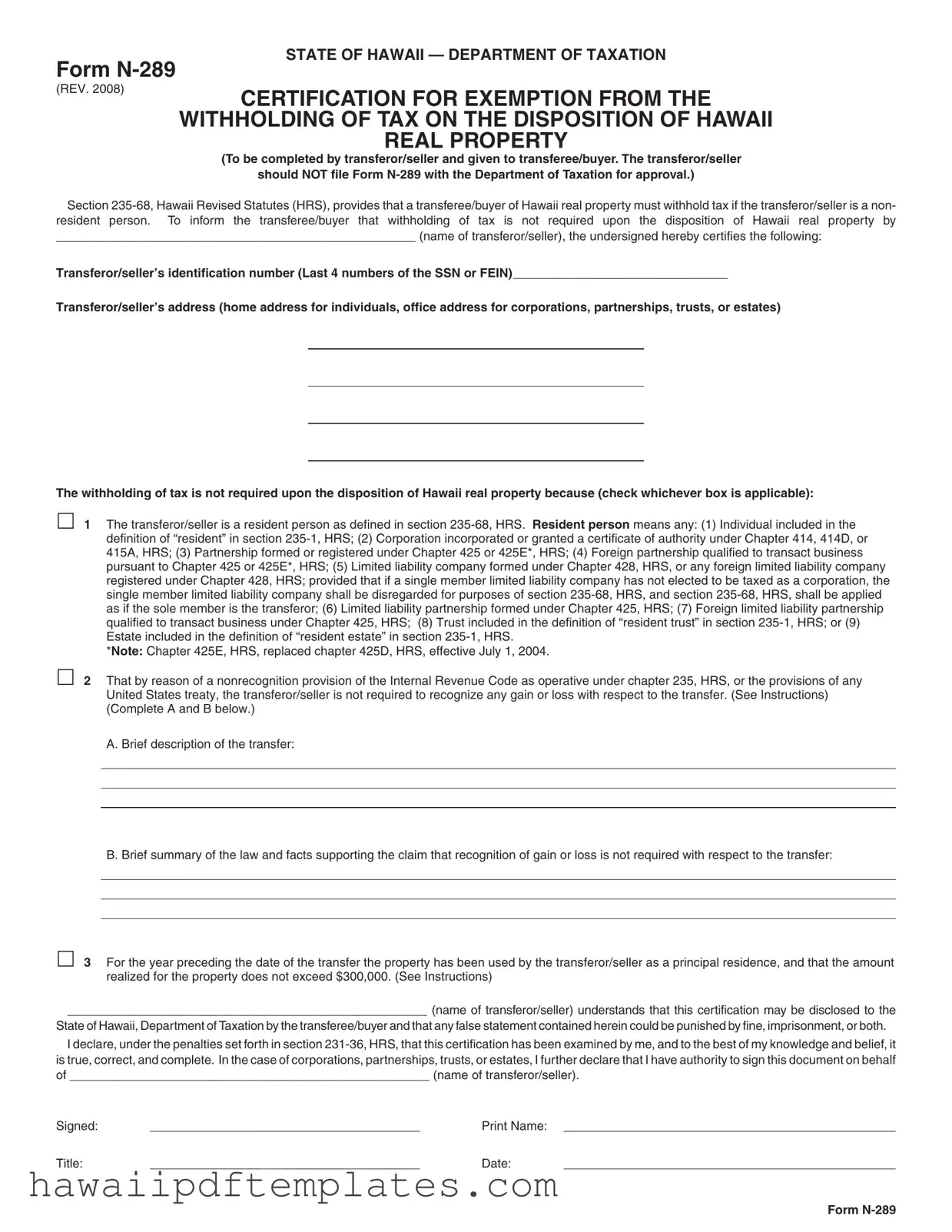

The Hawaii N-289 form is used to certify that the withholding of tax is not required when selling Hawaii real property. This form is completed by the seller (transferor) and provided to the buyer (transferee). It serves as a notification to the buyer that they do not need to withhold tax based on specific exemptions outlined in Hawaii law.

-

Who is responsible for completing the N-289 form?

The transferor or seller of the property is responsible for completing the N-289 form. They must provide accurate information about their residency status and the nature of the property transaction. It is important that this form is filled out correctly to avoid any issues during the sale process.

-

What are the conditions under which tax withholding is not required?

There are three main conditions that can exempt a seller from tax withholding:

- The seller is a resident person as defined in Hawaii law.

- The seller is not required to recognize any gain or loss due to a nonrecognition provision in the Internal Revenue Code or a U.S. treaty.

- The property has been used as the seller's principal residence for the year prior to the sale, and the sale amount does not exceed $300,000.

-

Where should the N-289 form be sent once completed?

The completed N-289 form should not be filed with the Department of Taxation. Instead, the transferor must give it directly to the transferee. The transferee should keep this form for their records and only submit it to the Department of Taxation if there are multiple sellers, in which case they must attach it to other required forms.

-

What information is required on the N-289 form?

The form requires the seller's name, identification number (the last four digits of their Social Security Number or Federal Employer Identification Number), and address. Additionally, the seller must check the appropriate box to indicate why tax withholding is not required and provide a brief description of the transfer along with supporting legal facts if applicable.

-

What happens if the information on the N-289 form is incorrect?

If any information on the N-289 form is found to be false or misleading, there could be serious consequences. The seller may face penalties, including fines or even imprisonment. Therefore, it is crucial to ensure that all information provided is accurate and complete before signing the form.

Popular PDF Forms

Cslb Rmo - Passing a relevant examination is necessary for obtaining a contractor's license.

Hawaii Animal Import - Advance grooming appointment scheduling is necessary, as no grooming is provided on certain days.

For those looking to ensure a smooth transaction in the sale of their vessel, the form known as the "official New York Boat Bill of Sale" is crucial for documenting the transfer of ownership and protecting both parties involved in the process. More information can be found on the reliable Boat Bill of Sale resources.

Hawaii Llc Cost - Each member's consent, if required, must be documented carefully for the amendment.

Steps to Writing Hawaii N 289

Completing the Hawaii N-289 form is a straightforward process that helps clarify the tax withholding requirements for the sale of Hawaii real property. The form must be filled out by the transferor or seller and provided to the buyer or transferee. Once completed, this form will serve as a certification that withholding is not necessary under specific conditions.

- At the top of the form, write the transferor/seller's name.

- Enter the transferor/seller's identification number. This can be the last four digits of the Social Security Number (SSN) or the Federal Employer Identification Number (FEIN).

- Provide the transferor/seller's address. For individuals, this should be their home address; for corporations, partnerships, trusts, or estates, it should be the office address.

- Check the applicable box to indicate why withholding of tax is not required. You have three options:

- Box 1: The transferor/seller is a resident person as defined in section 235-68, HRS.

- Box 2: The transferor/seller is not required to recognize any gain or loss due to a nonrecognition provision of the Internal Revenue Code or a U.S. treaty.

- Box 3: The property has been used as a principal residence for the year preceding the transfer, and the amount realized does not exceed $300,000.

- If you checked Box 2, complete sections A and B. Provide a brief description of the transfer in section A and summarize the law and facts supporting your claim in section B.

- Sign the form. The transferor/seller or an authorized agent must sign it, ensuring they have the authority to do so.

- Print the name of the person signing the form and include their title, if applicable.

- Finally, enter the date on which the form is signed.

After completing the form, provide it to the buyer or transferee. Remember, the transferor/seller does not need to file this form with the Department of Taxation. The buyer should retain it for their records, especially if all transferors have provided a certification of exemption.

Misconceptions

Understanding the Hawaii N-289 form is essential for anyone involved in the disposition of real property in Hawaii. However, several misconceptions can lead to confusion. Below are four common misunderstandings about this form.

- The form must be filed with the Department of Taxation. Many believe that the transferor/seller is required to submit the N-289 form to the Department of Taxation for approval. In reality, the form is meant to be given directly to the transferee/buyer. The transferor/seller does not file it with the Department.

- Only non-residents need to worry about withholding tax. Some individuals think that withholding tax only concerns non-residents. In fact, the form serves to certify that withholding is not required when the transferor/seller is a resident person or meets other specific criteria outlined in the form.

- All sellers must complete the form. There is a misconception that every seller involved in a transaction must complete the N-289 form. However, it is only necessary for those who qualify for an exemption from withholding tax. If a seller does not meet the criteria, the form is not needed.

- Completing the form guarantees exemption from taxes. Some individuals mistakenly believe that filling out the N-289 form automatically exempts them from all taxes. While it certifies that withholding tax is not required in certain situations, it does not absolve the transferor/seller from filing an income tax return to report the sale.

Addressing these misconceptions can help ensure that individuals navigate the process of property disposition in Hawaii more smoothly and with greater confidence.