Hawaii N 335 PDF Form

Frequently Asked Questions

-

What is the Hawaii N-335 form?

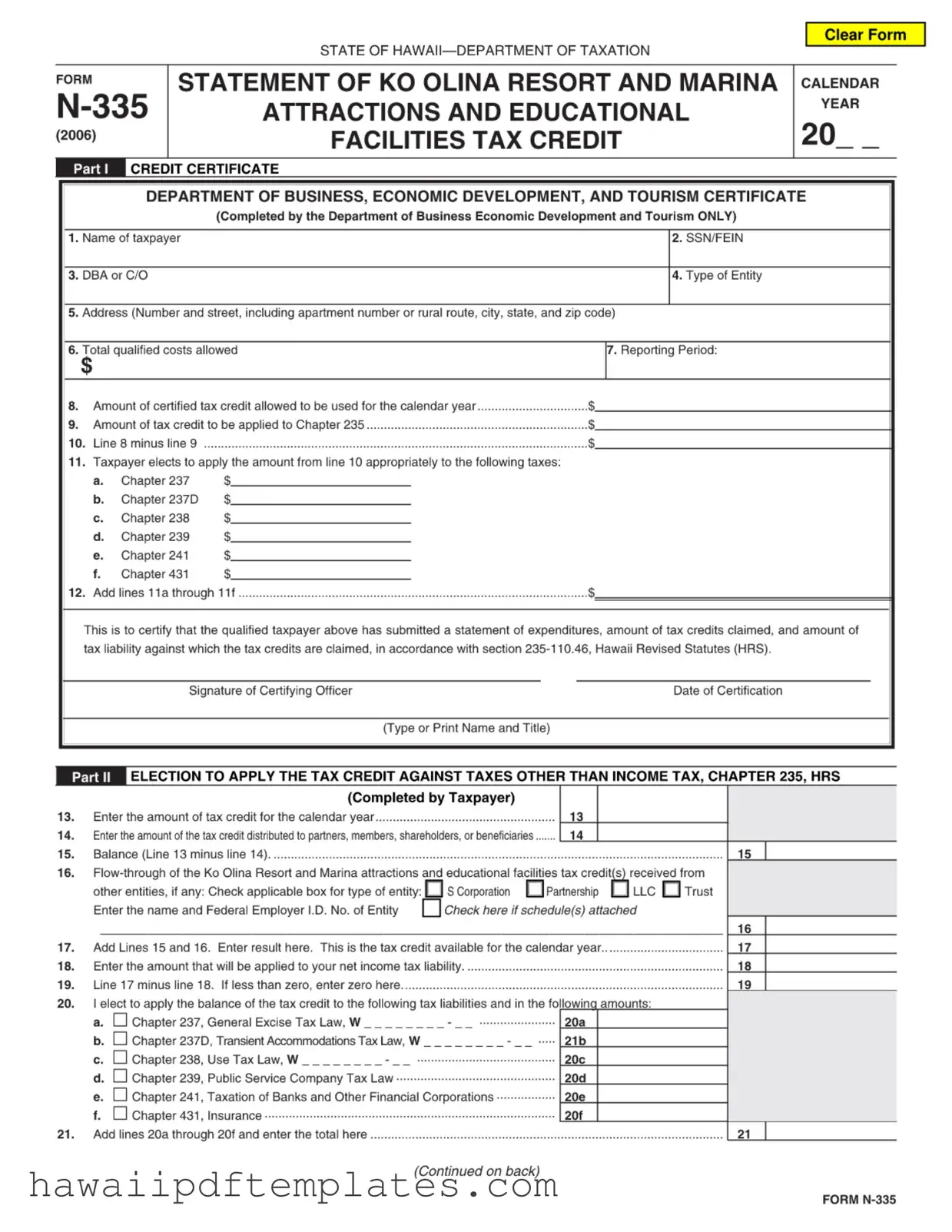

The Hawaii N-335 form is a tax document used by taxpayers to claim the Ko Olina Resort and Marina Attractions and Educational Facilities Tax Credit. This form allows eligible taxpayers to report their qualified costs and apply for tax credits against various tax liabilities in Hawaii.

-

Who is eligible to use the N-335 form?

Eligibility for the N-335 form typically extends to businesses and individuals who have incurred qualified expenses related to attractions and educational facilities at the Ko Olina Resort. Taxpayers must ensure they meet the criteria outlined in section 235-110.46 of the Hawaii Revised Statutes to qualify for this credit.

-

What information is required to complete the N-335 form?

To complete the N-335 form, you will need to provide several key pieces of information, including:

- Your name and Social Security Number (SSN) or Federal Employer Identification Number (FEIN).

- Your business address and type of entity.

- The total qualified costs incurred and the amount of tax credit you are claiming.

- Details about any tax credits distributed to partners or shareholders.

-

How do I determine the amount of tax credit I can claim?

The amount of tax credit you can claim is calculated based on your total qualified costs and any applicable distributions to partners or shareholders. You will need to subtract the amount distributed from your total credit to find the balance available for your use. This balance can then be applied to various tax liabilities as indicated on the form.

-

Can I apply the tax credit to taxes other than income tax?

Yes, the N-335 form allows you to elect to apply the tax credit against several types of taxes, not just income tax. You can allocate the credit to the General Excise Tax, Transient Accommodations Tax, Use Tax, Public Service Company Tax, and others as specified on the form.

-

What happens if I do not use the entire tax credit in one year?

If you do not use the entire tax credit in one calendar year, you may be able to carry forward the unused portion to future tax years, depending on the specific provisions of the tax credit law. It is essential to keep accurate records and consult with a tax professional for guidance on how to manage any remaining credits.

-

Is there a deadline for submitting the N-335 form?

The N-335 form must be submitted along with your tax return by the due date for that return. It is crucial to stay informed about deadlines to ensure that you do not miss the opportunity to claim your tax credit.

-

Where can I find assistance if I have questions about the N-335 form?

If you have questions about completing the N-335 form or the tax credit process, you can contact the Hawaii Department of Taxation or consult with a tax professional who is familiar with Hawaii tax laws. Additionally, resources and guidance may be available on the Department of Taxation's official website.

-

What should I do if I make a mistake on my N-335 form?

If you discover an error on your N-335 form after submission, you should take steps to correct it as soon as possible. This may involve submitting an amended return or contacting the tax department for guidance on how to rectify the mistake. Keeping clear records of all communications and documents is advisable.

Popular PDF Forms

Eft Format - Once processed, the bank's response will be documented to maintain transparency.

The Florida Motor Vehicle Bill of Sale form is a vital document that not only indicates the sale of a motor vehicle in Florida but also outlines the necessary details pertinent to the transaction. To facilitate this process and avoid any potential misunderstandings, utilizing resources like Florida Forms can be exceptionally helpful in obtaining the correct documentation needed for a seamless transfer of ownership.

Maui Get Rate - Part V of the form requires taxpayers to indicate their business districts accurately.

Steps to Writing Hawaii N 335

Filling out the Hawaii N 335 form requires careful attention to detail. This form is important for reporting tax credits related to attractions and educational facilities. After completing the form, it will be submitted to the appropriate department for processing. Ensure all information is accurate to avoid delays in your tax credit application.

- Obtain the form: Download or request a physical copy of the Hawaii N 335 form from the Department of Taxation.

- Fill in your personal information: In Part I, enter your name, Social Security Number (SSN) or Federal Employer Identification Number (FEIN), and the type of entity you represent.

- Provide your address: Include your complete address, including any apartment number or rural route, city, state, and zip code.

- Report total qualified costs: Indicate the total qualified costs allowed in the designated field.

- Enter the reporting period: Specify the reporting period for the tax credit.

- State the certified tax credit: Fill in the amount of certified tax credit allowed for the calendar year.

- Calculate the tax credit application: Subtract the amount of tax credit to be applied to Chapter 235 from the certified tax credit to find the amount to be applied to other taxes.

- Select applicable taxes: Indicate the taxes to which you wish to apply the remaining tax credit.

- Complete the election section: In Part II, report the amount of tax credit for the calendar year and any amounts distributed to partners, members, shareholders, or beneficiaries.

- Calculate the balance: Subtract the distributed amount from the total tax credit to find the remaining balance.

- Detail flow-through credits: If applicable, check the appropriate box for your entity type and enter the name and Federal Employer I.D. No. of the entity providing the flow-through credits.

- Allocate tax credits: In Part III, allocate the tax credit to shareholders, partners, members, or beneficiaries, providing their names, addresses, and the amount allocated to each.

- Sign and date the form: Make sure to sign and print your name, title, and date at the declaration section to certify the accuracy of the information provided.

Misconceptions

Understanding the Hawaii N-335 form can be challenging due to various misconceptions. Here are nine common misunderstandings about this tax credit form:

- The N-335 form is only for large corporations. Many believe that only big businesses can apply for the Ko Olina Resort and Marina attractions tax credit. In reality, any qualified taxpayer, including small businesses and individual entities, can benefit from this credit.

- You need to be a resident of Hawaii to use the N-335 form. This is not true. While the form is specific to Hawaii tax credits, non-residents who earn income from Hawaii sources may also be eligible to file.

- The N-335 form is only applicable to tourism-related businesses. While the form is associated with attractions and educational facilities, it can apply to a broader range of entities that meet the qualifications outlined in the tax code.

- Completing the N-335 form guarantees a tax refund. Many assume that filling out the form will automatically result in a refund. However, the tax credit only reduces tax liability; it does not guarantee a refund.

- You can submit the N-335 form at any time during the year. Some individuals think they can file this form whenever they want. In fact, it must be submitted within the designated tax filing period for the calendar year.

- All expenditures qualify for the tax credit. This is a misconception. Only specific, qualified costs as defined by the Hawaii Revised Statutes are eligible for the credit. Taxpayers should carefully review the guidelines to determine what qualifies.

- Once you claim the credit, you cannot amend your application. Many believe that the N-335 form is final once submitted. However, taxpayers can amend their application if they discover errors or if circumstances change.

- The N-335 form is the same as other tax forms. Some individuals think that the N-335 is interchangeable with other tax forms. Each form has unique requirements and purposes, so it is crucial to use the correct form for the specific tax credit.

- You do not need to keep records once the N-335 form is submitted. This is a common misunderstanding. Taxpayers should maintain thorough records of all expenditures and documentation related to the N-335 form for potential audits or reviews.

By clarifying these misconceptions, taxpayers can better navigate the complexities of the Hawaii N-335 form and ensure they are taking full advantage of the available tax credits.