Hawaii N15 Tax PDF Form

Frequently Asked Questions

-

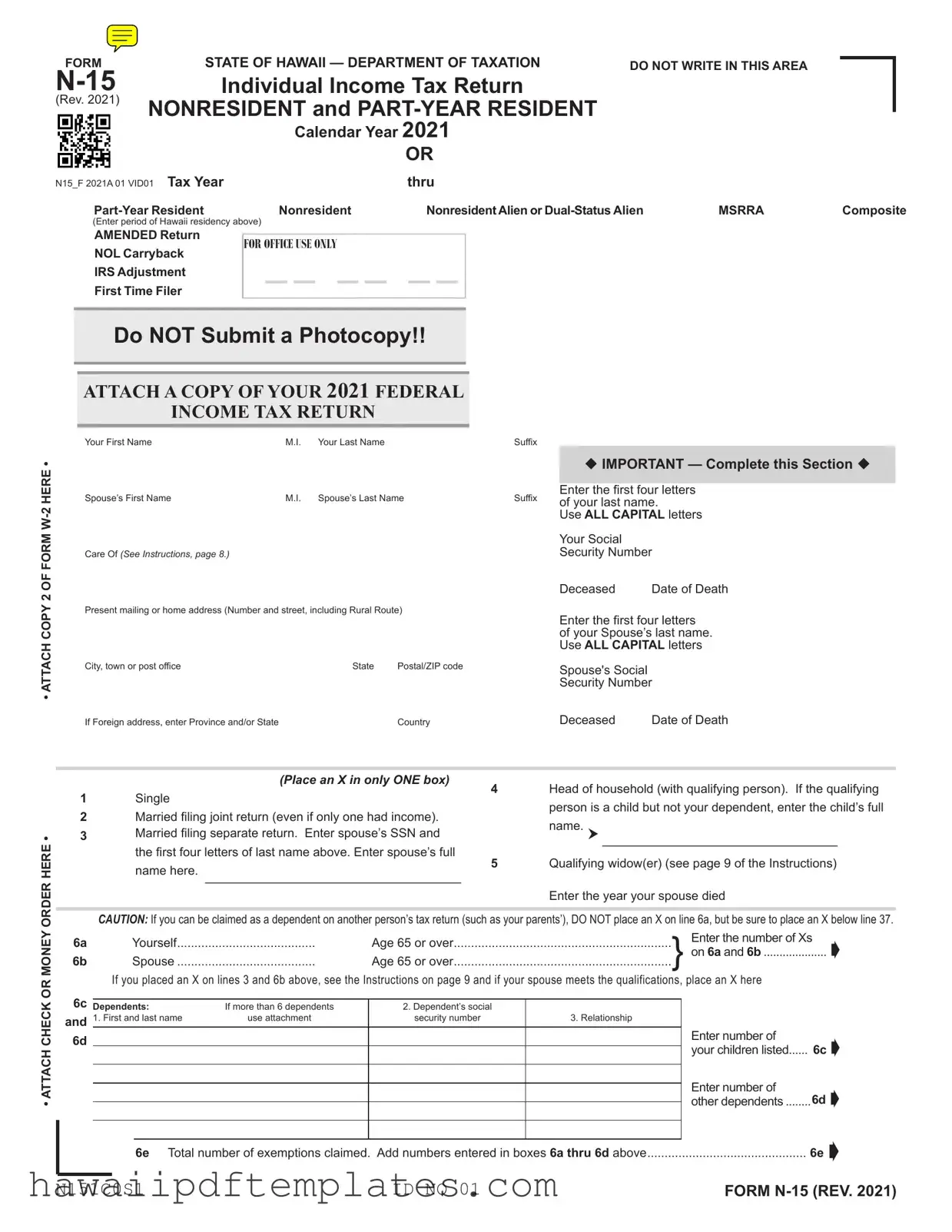

What is the Hawaii N15 Tax Form?

The Hawaii N15 Tax Form is used by nonresidents and part-year residents to report their income and calculate their state tax liability. This form is specifically for individuals who do not reside in Hawaii for the entire tax year but earn income from Hawaii sources.

-

Who should file the N15 form?

If you lived in Hawaii for part of the year or earned income from Hawaii sources while living elsewhere, you need to file the N15 form. This includes nonresident aliens and dual-status aliens. Make sure you meet the eligibility criteria before filing.

-

What documents do I need to attach?

You must attach a copy of your federal income tax return and a copy of Form W-2 for any wages earned. If applicable, include any additional schedules or forms that support your income and deductions.

-

How do I calculate my Hawaii income?

To calculate your Hawaii income, you will need to report your total income from all sources on the form. Then, determine the amount of that income that is sourced in Hawaii. Use the provided worksheets in the instructions to help with this calculation.

-

What if I can be claimed as a dependent?

If someone else can claim you as a dependent, you must follow specific instructions outlined in the form. You should not mark certain boxes, but you still need to file your return accurately to reflect your income and any applicable credits.

-

What are the penalties for filing late?

Filing your N15 form late can result in penalties and interest on any unpaid taxes. It is crucial to file on time or apply for an extension to avoid these additional costs. Check the instructions for specific details on penalties.

-

How do I make a payment if I owe taxes?

If you owe taxes, you can submit a payment online at hitax.hawaii.gov. Alternatively, you can attach a check or money order made out to “Hawaii State Tax Collector” with your N15 form.

-

Can I designate someone to discuss my return?

Yes, you can designate another person to discuss your return with the Hawaii Department of Taxation. Complete the designee section on the form with their name and contact information. This does not grant them full power of attorney.

Popular PDF Forms

Maui Get Rate - Businesses must retain a copy of the filed G-45 for their records.

The Florida Residential Lease Agreement form is a legally binding document outlining the terms and conditions between a landlord and tenant for the rental of residential property. It serves as a crucial tool for setting clear expectations and protecting the rights of both parties involved in a rental agreement. For comprehensive details, you can refer to the document available at https://floridaforms.net/blank-residential-lease-agreement-form, which is key to navigating the rental process successfully in Florida.

Trademark Search Hawaii - Assignment details are crucial for maintaining business intellectual property rights.

Steps to Writing Hawaii N15 Tax

Filling out the Hawaii N15 Tax form can seem daunting, but breaking it down into manageable steps can make the process much easier. This form is specifically for nonresidents and part-year residents, so it’s important to gather all necessary information before you begin. Follow these steps to ensure you complete the form accurately and efficiently.

- Start by downloading the Hawaii N15 Tax form from the official website or obtain a physical copy.

- At the top of the form, make sure to fill in your personal information, including your name, Social Security number, and address. If you're filing jointly, include your spouse’s details as well.

- Indicate your filing status by placing an "X" in the appropriate box. Choose from options like "Single," "Married filing jointly," or "Head of household."

- List your dependents in Section 6, providing their names, Social Security numbers, and relationship to you.

- In the income section (lines 7-19), enter your total income from various sources, such as wages, dividends, and other income. Make sure to attach any necessary forms, like W-2s.

- Calculate your total income by adding lines 7 through 19 and write the sum on line 20.

- Next, move to the adjustments section (lines 21-34). Enter any deductions or adjustments to your income, such as student loan interest or IRA deductions.

- Subtract your total adjustments from your total income to find your Adjusted Gross Income (line 35).

- Proceed to the deductions section. If you are itemizing, follow the instructions to fill in your deductions from lines 38a to 38f. If not, enter the standard deduction based on your filing status on line 40a.

- Calculate your taxable income by subtracting your deductions from your Adjusted Gross Income (line 43).

- Determine your tax amount using the tax table or tax rate schedule, and enter it on line 44.

- List any refundable credits you qualify for on lines 45-49, and calculate your total refundable credits on line 50.

- Subtract your total refundable credits from your tax amount to find your adjusted tax liability (line 51).

- Include any nonrefundable tax credits on line 52 and subtract them from your adjusted tax liability to find your balance (line 53).

- Fill out the payment section, including any amounts withheld or estimated tax payments made, and calculate your total payments on line 58.

- If you have an overpayment, calculate it on line 59. If you owe taxes, fill in the amount on line 65.

- Lastly, sign and date the form. If filing jointly, your spouse must also sign.

After completing the form, ensure you attach any required documents, such as W-2 forms and your federal income tax return. Double-check all entries for accuracy before submitting your N15 Tax form to the Hawaii Department of Taxation. This careful attention to detail will help you avoid delays and ensure your tax return is processed smoothly.

Misconceptions

- Misconception 1: The N-15 form is only for residents of Hawaii.

- Misconception 2: You can submit a photocopy of the N-15 form.

- Misconception 3: Filing the N-15 form is optional for nonresidents.

- Misconception 4: All income earned in Hawaii is taxable.

- Misconception 5: You do not need to attach your federal tax return.

- Misconception 6: You cannot claim dependents on the N-15 form.

- Misconception 7: The N-15 form is the same as the federal tax return.

This form is specifically designed for nonresidents and part-year residents. Individuals who have earned income in Hawaii but do not reside there full-time are required to use this form.

The instructions clearly state that photocopies should not be submitted. Only the original form should be filed to ensure proper processing.

Nonresidents who earn income in Hawaii must file the N-15 form. Failing to do so can lead to penalties and interest on any unpaid taxes.

While many forms of income are taxable, certain types, such as some retirement income, may have specific exemptions. It is important to review the instructions for details on taxable income.

It is required to attach a copy of your federal income tax return when filing the N-15. This helps the state verify your income and deductions.

Dependents can be claimed on the N-15 form, provided they meet the necessary criteria. This can affect the amount of exemptions and credits available to you.

The N-15 form is distinct from federal tax forms. It is tailored to Hawaii's tax laws and requirements, which may differ from federal regulations.