Hawaii Pts Enrollment PDF Form

Frequently Asked Questions

-

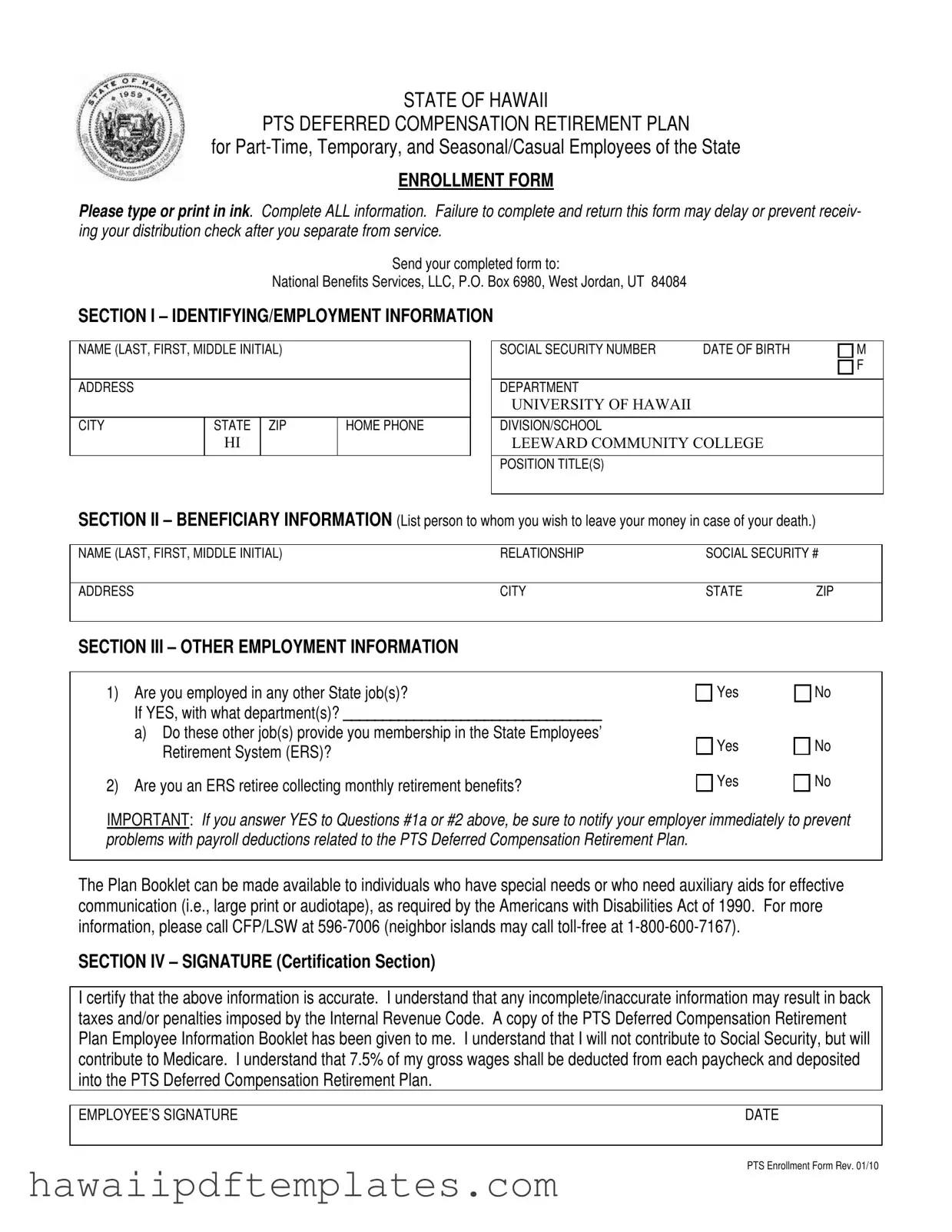

What is the Hawaii PTS Enrollment Form?

The Hawaii PTS Enrollment Form is a document for part-time, temporary, and seasonal/casual employees of the State of Hawaii. It allows employees to enroll in the PTS Deferred Compensation Retirement Plan. Completing this form is essential for managing retirement savings effectively.

-

Who needs to fill out this form?

Any part-time, temporary, or seasonal/casual employee of the State of Hawaii should complete this form if they wish to participate in the PTS Deferred Compensation Retirement Plan. It is important for employees to provide accurate information to ensure proper enrollment.

-

What information is required on the form?

The form requires personal details such as your name, address, phone number, Social Security number, date of birth, and employment information, including your department and position title. Additionally, you will need to provide beneficiary information for your retirement savings.

-

What happens if I don’t complete the form?

If you do not complete and return the form, it may delay or prevent you from receiving your distribution check after you separate from service. Therefore, it is crucial to fill out the form completely and accurately.

-

Where should I send the completed form?

You should send your completed form to National Benefits Services, LLC, P.O. Box 6980, West Jordan, UT 84084. Make sure to mail it promptly to avoid any delays in processing your enrollment.

-

What if I have other State jobs?

If you are employed in other State jobs, you need to indicate this on the form. You must also inform your employer if these jobs provide membership in the State Employees’ Retirement System (ERS) or if you are an ERS retiree collecting monthly benefits. This information is vital to ensure proper payroll deductions.

-

What is the contribution rate to the PTS plan?

Employees will contribute 7.5% of their gross wages from each paycheck to the PTS Deferred Compensation Retirement Plan. It’s important to understand that you will not contribute to Social Security but will contribute to Medicare.

-

What if I need assistance with the form?

If you require special accommodations or auxiliary aids for effective communication, such as large print or audiotape, the Plan Booklet can be made available to you. For more information, you can contact CFP/LSW at 596-7006 or toll-free at 1-800-600-7167 for those on neighbor islands.

-

What is the certification section about?

The certification section is where you confirm that all the information provided is accurate. By signing this section, you acknowledge that any incomplete or inaccurate information may lead to back taxes or penalties imposed by the Internal Revenue Code.

-

How often should I review my enrollment?

It’s a good practice to review your enrollment and contributions regularly, especially if your employment situation changes or if you have changes in your personal circumstances, such as a new beneficiary. Keeping your information up to date ensures that your retirement savings are managed according to your current needs.

Popular PDF Forms

Hawaii Animal Import - Be aware that the hours of operation for pet visitations are specific and should be noted.

A Florida Last Will and Testament form is a legal document that outlines an individual's wishes regarding the distribution of their assets after death. This form ensures that personal belongings and financial matters are handled according to the individual's desires. Understanding its components and requirements is essential for effective estate planning in Florida, and many people turn to resources like Florida Forms for guidance in creating this important document.

Guardianship Vs Power of Attorney - Petitioners must be transparent about any past relationships with the proposed ward.

Steps to Writing Hawaii Pts Enrollment

Completing the Hawaii PTS Enrollment form is an essential step for part-time, temporary, and seasonal employees who wish to enroll in the retirement plan. After filling out the form, it must be sent to the designated address to ensure timely processing. Below are the steps to fill out the form accurately.

- Begin with SECTION I – IDENTIFYING/EMPLOYMENT INFORMATION. Write your full name, including last, first, and middle initial.

- Provide your complete address, including city, state, and ZIP code.

- Enter your home phone number and your Social Security number.

- Fill in your date of birth and indicate your gender.

- List your department and the University of Hawaii division or school you are associated with.

- State your position title(s).

- Move to SECTION II – BENEFICIARY INFORMATION. Enter the name of the person you wish to designate as your beneficiary.

- Provide the relationship of your beneficiary to you.

- Include your beneficiary's Social Security number and address, along with their city, state, and ZIP code.

- Proceed to SECTION III – OTHER EMPLOYMENT INFORMATION. Answer whether you are employed in any other State job(s) and specify the department(s) if applicable.

- Indicate if these jobs provide membership in the State Employees’ Retirement System (ERS).

- State whether you are an ERS retiree collecting monthly retirement benefits.

- Finally, complete SECTION IV – SIGNATURE (CERTIFICATION SECTION). Sign and date the form, certifying that all information provided is accurate.

- Make sure to keep a copy of the PTS Deferred Compensation Retirement Plan Employee Information Booklet for your records.

Once you have filled out the form completely, send it to National Benefits Services, LLC, at the address provided. This ensures that your enrollment is processed without delay.

Misconceptions

Understanding the Hawaii PTS Enrollment form is crucial for part-time, temporary, and seasonal employees. However, several misconceptions can lead to confusion. Below are some common misunderstandings:

- Misconception 1: The form is only for full-time employees.

- Misconception 2: Completing the form is optional.

- Misconception 3: Only certain employees can designate beneficiaries.

- Misconception 4: The information provided is not confidential.

This is incorrect. The Hawaii PTS Enrollment form specifically caters to part-time, temporary, and seasonal employees. It provides these individuals with the opportunity to participate in the Deferred Compensation Retirement Plan, ensuring they have a financial safety net.

Many believe that filling out the form is not mandatory. In reality, failing to complete and return this form can delay or even prevent the receipt of distribution checks after separating from service. Therefore, it is essential to complete all sections of the form.

Some may think that only long-term employees have the right to name beneficiaries. However, all employees using the PTS Enrollment form are encouraged to list a beneficiary. This ensures that their funds are directed to the desired individual in the event of their passing.

There is a belief that the information shared on the enrollment form is public. In truth, the details provided are kept confidential and are only used for the purposes outlined in the plan. This privacy is crucial for protecting personal and financial information.