Hawaii Tax Bb1X PDF Form

Frequently Asked Questions

-

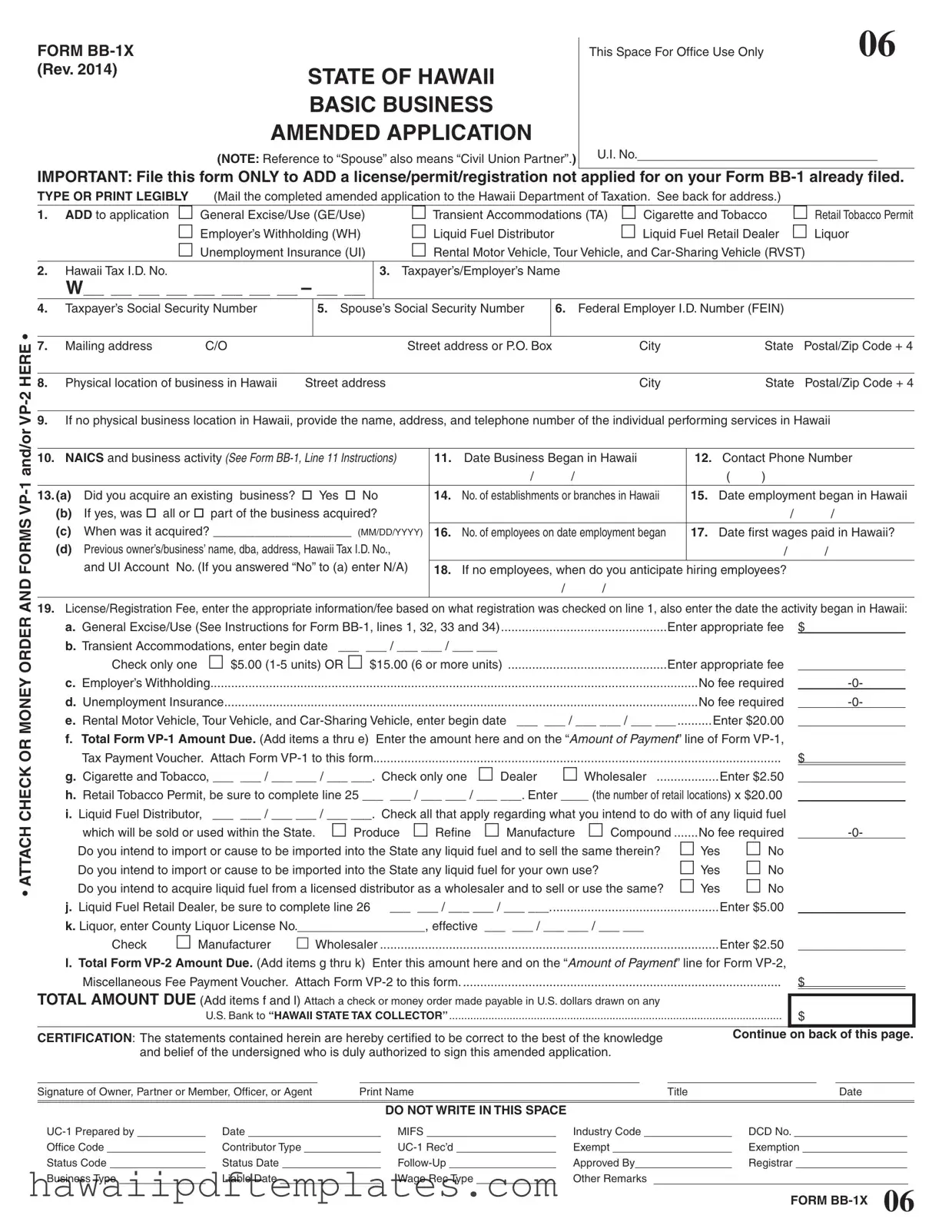

What is the purpose of the Hawaii Tax BB1X form?

The Hawaii Tax BB1X form is used to amend your Basic Business Application. If you need to add a new license, permit, or registration that you did not include in your original Form BB-1, this is the form to file. It allows businesses to update their tax information with the Hawaii Department of Taxation.

-

Who needs to file the BB1X form?

Any business that is already registered in Hawaii and wants to add additional licenses or permits must file this form. This includes businesses seeking to add General Excise/Use Tax, Transient Accommodations Tax, and other specific permits related to their operations in Hawaii.

-

What information do I need to provide on the BB1X form?

When filling out the BB1X form, you will need to provide various details such as:

- Your Hawaii Tax I.D. Number

- Your business name and address

- Social Security Numbers for you and your spouse (if applicable)

- Federal Employer I.D. Number (FEIN)

- Details about the type of business activity and the date your business began in Hawaii

Additionally, you will need to indicate which licenses or permits you wish to add and provide the corresponding fees.

-

How do I submit the BB1X form?

Once you have completed the BB1X form, you should mail it to the Hawaii Department of Taxation. Be sure to attach any required fees and additional forms, such as Form VP-1 or VP-2, as necessary. The mailing address is provided on the back of the form. If you have questions, you can also contact the Department of Taxation directly for assistance.

Popular PDF Forms

Hawaii Food Establishment Permit - Submit your application at least ten working days before your event to allow for approval.

Having a reliable legal Power of Attorney document can ensure that your financial and legal matters are handled appropriately if you become unable to manage them yourself. This document empowers designated individuals to act on your behalf, making it crucial for anyone looking to secure their interests in times of need.

State Of Hawaii Hrd 278 - It is designed to gather pertinent information to assess applicant suitability for non-civil roles.

Hawaii Form N-15 - Paying the income tax balance due is required when submitting the N-301 form.

Steps to Writing Hawaii Tax Bb1X

Filling out the Hawaii Tax BB1X form is a straightforward process, but it's important to complete each section carefully to ensure accuracy. The form is used to amend your business application, allowing you to add licenses or registrations that weren't included in your initial filing. Follow these steps to complete the form effectively.

- Start by indicating the type of application you are adding in section 1. Check the appropriate box for General Excise/Use, Transient Accommodations, or other relevant categories.

- Enter your Hawaii Tax I.D. number in section 2.

- In section 3, fill in your taxpayer's or employer's name.

- Provide your Social Security number in section 4, and your spouse’s Social Security number in section 5 if applicable.

- Enter your Federal Employer I.D. Number (FEIN) in section 6.

- Complete section 7 with your mailing address, including C/O, street address or P.O. Box, city, state, and postal/zip code.

- In section 8, provide the physical location of your business in Hawaii, including street address, city, state, and postal/zip code.

- If there is no physical location in Hawaii, list the name, address, and telephone number of the individual performing services in section 9.

- Fill in the NAICS code and business activity in section 10.

- Indicate the date your business began in Hawaii in section 11.

- Provide a contact phone number in section 12.

- Answer the question in section 13 about acquiring an existing business with a yes or no.

- In section 14, indicate the number of establishments or branches in Hawaii.

- Fill in the date employment began in Hawaii in section 15.

- If applicable, provide details about the previous owner's name, business address, Hawaii Tax I.D. number, and UI Account number in section 15(d).

- In section 18, indicate when you anticipate hiring employees if you have none.

- Enter the appropriate license/registration fee information in section 19 based on the selections made in section 1.

- Calculate the total amount due and enter it in the designated area.

- Sign and date the certification section at the bottom of the form.

- Mail the completed form along with any required attachments and payment to the Hawaii Department of Taxation.

Misconceptions

Misconception 1: The BB1X form is only for new businesses.

This is incorrect. The BB1X form is specifically designed for businesses that need to amend their existing applications. If you need to add a license, permit, or registration that was not included in your original BB-1 form, you must use this amended application.

Misconception 2: There is a fee for every type of registration listed on the BB1X form.

While some registrations do require a fee, others do not. For instance, the Employer’s Withholding and Unemployment Insurance registrations do not incur any fees. Always check the specific requirements for each registration type.

Misconception 3: You can submit the BB1X form without any additional documentation.

This is misleading. When filing the BB1X form, you must attach a check or money order, along with Forms VP-1 and/or VP-2, as applicable. Failing to include these documents may delay your application process.

Misconception 4: The BB1X form can be filed at any time without restrictions.

This is not true. The BB1X form should only be filed when there is a need to add a license or permit that was not applied for on the original BB-1 form. Make sure to follow the guidelines for timing and submission to avoid complications.