Hawaii X 8 PDF Form

Frequently Asked Questions

-

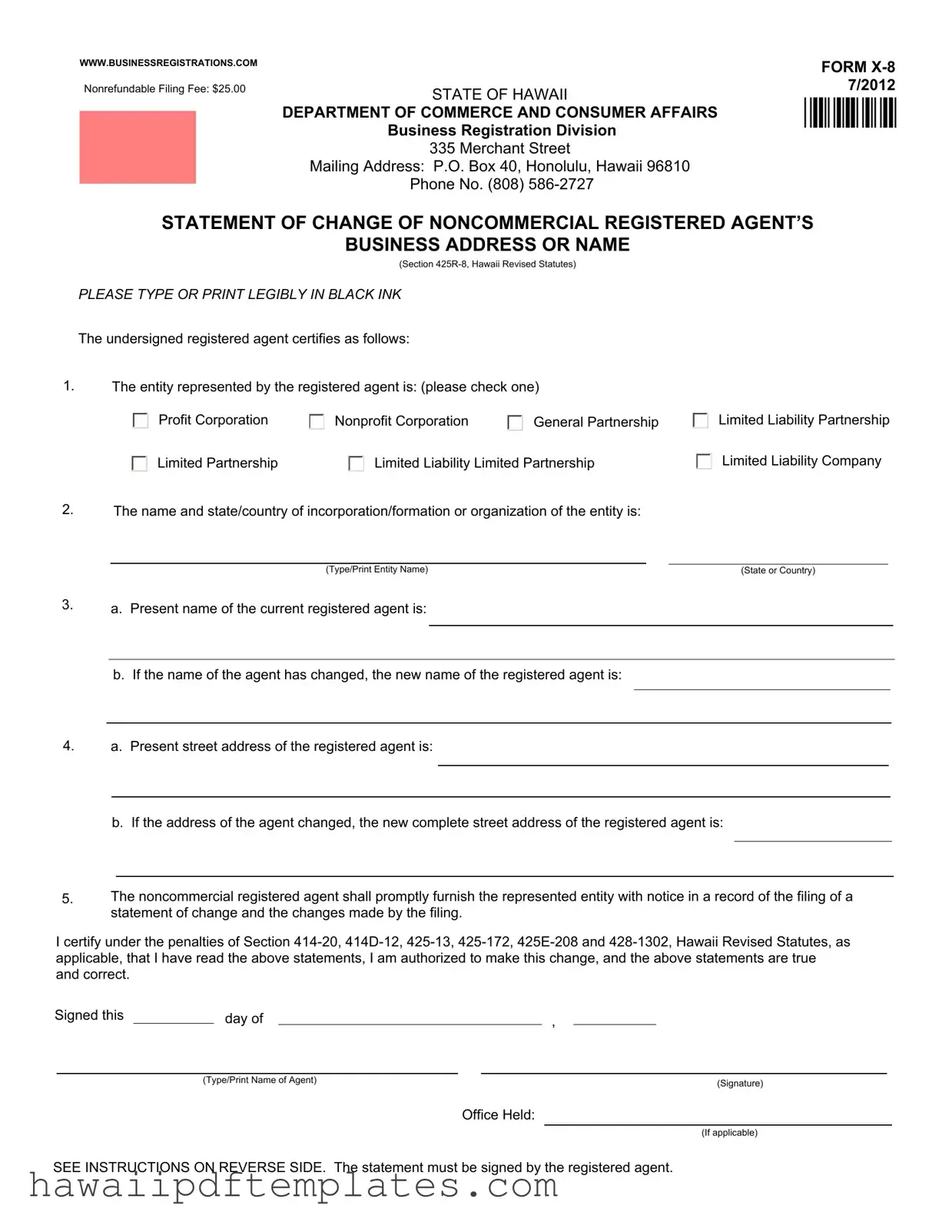

What is the purpose of the Hawaii X 8 form?

The Hawaii X 8 form is used to officially notify the state of a change in the business address or name of a noncommercial registered agent. This form is essential for maintaining accurate records with the Department of Commerce and Consumer Affairs, ensuring that all legal communications are directed to the correct agent.

-

Who is required to file the Hawaii X 8 form?

Any registered agent representing a business entity in Hawaii must file the Hawaii X 8 form if there is a change in their name or business address. This includes agents for profit corporations, nonprofit corporations, partnerships, and limited liability companies. It is the responsibility of the registered agent to ensure that the information on file is current and accurate.

-

What information is needed to complete the form?

To complete the Hawaii X 8 form, the following information is required:

- The type of entity represented (e.g., profit corporation, nonprofit corporation).

- The name and state or country of incorporation of the entity.

- The current name of the registered agent, and if applicable, the new name.

- The current street address of the registered agent, and if applicable, the new address.

All information must be typed or printed clearly in black ink.

-

What is the filing fee for the Hawaii X 8 form?

The filing fee for submitting the Hawaii X 8 form is $25.00. This fee is nonrefundable, meaning that once it is paid, it cannot be returned. If there are more than 200 affected entities, the fee is reduced to $1.00 for each additional entity beyond the first 200.

-

How should the form be submitted?

The completed Hawaii X 8 form must be submitted in its original form, along with the appropriate filing fee. It can be mailed to the Business Registration Division at the address provided on the form. Alternatively, inquiries can be made via phone at (808) 586-2727 for further assistance.

-

What happens if the form is not filed?

If the Hawaii X 8 form is not filed when there is a change in the registered agent's name or address, it can lead to significant issues. Legal documents may not reach the intended recipient, potentially resulting in missed deadlines or legal consequences. Keeping the registered agent information up to date is crucial for compliance with state regulations.

Popular PDF Forms

Maui Get Rate - The total tax calculation is clearly outlined in Part VI of the G-45 form.

To effectively plan for the future and ensure your wishes are honored, it's crucial to understand the Florida Last Will and Testament form, which serves as a legal document detailing asset distribution after death. For those looking for reliable resources to navigate this process, the Florida Forms can provide vital information and assistance.

Hawaii Department of Revenue - Out-of-state services may qualify for exemptions under specific statutes.

Steps to Writing Hawaii X 8

Completing the Hawaii X 8 form requires careful attention to detail. This form is used to update the business address or name of a noncommercial registered agent. It is important to ensure that all information is accurate and legible before submission.

- Obtain the Hawaii X 8 form from a reliable source.

- Use black ink or type the information to ensure legibility.

- In Line 1, check the box that corresponds to the type of entity represented by the registered agent.

- In Line 2, type or print the full name of the entity and the state or country of its incorporation or formation.

- In Line 3a, enter the current name of the registered agent. If applicable, in Line 3b, provide the new name of the registered agent.

- In Line 4a, state the present street address of the registered agent. In Line 4b, enter the new complete street address, including the number, street, city, state, and zip code.

- Review the statements to ensure accuracy. The registered agent must certify the information is true and correct.

- Sign and date the form in the designated area. Include the name of the agent and the office held, if applicable.

- Prepare a payment of $25 for the filing fee. Make checks payable to the Department of Commerce and Consumer Affairs.

- Submit the completed form along with the payment to the appropriate address listed on the form.

Misconceptions

Here are five common misconceptions about the Hawaii X 8 form:

- Misconception 1: The form can be submitted without a signature.

- Misconception 2: The filing fee is refundable.

- Misconception 3: Any type of ink can be used to complete the form.

- Misconception 4: The form can be submitted electronically.

- Misconception 5: Only the registered agent can fill out the form.

This is incorrect. The Hawaii X 8 form must be signed by the registered agent. If the registered agent is a business entity, an authorized official must sign.

The filing fee of $25 is nonrefundable. Once submitted, it cannot be returned, regardless of the outcome.

The instructions specify that only black ink should be used. This ensures that the document is legible and meets submission standards.

The Hawaii X 8 form must be submitted in its original paper format. Electronic submissions are not accepted.

While the registered agent must sign the form, anyone authorized to act on behalf of the registered agent can fill out the form. However, the agent must review and certify its accuracy.