Free Last Will and Testament Document for Hawaii State

Frequently Asked Questions

-

What is a Last Will and Testament in Hawaii?

A Last Will and Testament is a legal document that outlines how a person’s assets will be distributed after their death. In Hawaii, this document allows individuals to specify beneficiaries, appoint guardians for minor children, and name an executor to manage the estate. It ensures that your wishes are honored and can help avoid disputes among family members.

-

Who can create a Last Will and Testament in Hawaii?

Any person who is at least 18 years old and of sound mind can create a Last Will and Testament in Hawaii. It’s important that the individual understands the implications of their decisions and is capable of making informed choices regarding their estate.

-

What are the requirements for a valid will in Hawaii?

For a will to be valid in Hawaii, it must be in writing and signed by the person making the will (the testator). Additionally, it should be witnessed by at least two individuals who are present at the same time. These witnesses should not be beneficiaries of the will to avoid potential conflicts of interest.

-

Can I change or revoke my Last Will and Testament?

Yes, you can change or revoke your Last Will and Testament at any time while you are alive. To make changes, you can create a new will or add a codicil, which is an amendment to the existing will. If you wish to revoke the will entirely, you can do so by physically destroying it or by stating your intention to revoke it in writing.

-

What happens if I die without a will in Hawaii?

If you die without a will, your estate will be distributed according to Hawaii’s intestacy laws. This means that the state will determine how your assets are divided, which may not align with your wishes. To ensure your preferences are honored, it’s advisable to have a will in place.

-

How can I ensure my Last Will and Testament is executed properly?

To ensure proper execution of your will, consider consulting with a legal professional who specializes in estate planning. They can help you navigate the process, ensure all legal requirements are met, and provide guidance on best practices for drafting and storing your will. Additionally, keep your will in a safe place and inform your executor of its location.

Other Common Hawaii Forms

How to Transfer Property Title in Hawaii - It may also address obligations such as maintenance or repairs.

A California Bill of Sale form serves as a written document that outlines the transfer of ownership of personal property from one party to another. This form is crucial for ensuring that the buyer receives clear title and for providing the seller with proof of the transaction. For those looking to create or understand this important document, they can find helpful resources at Documents PDF Online. Understanding its importance can help individuals navigate property transfers smoothly and securely.

Transfer on Death Deed Hawaii - This type of deed does not replace other estate planning tools but complements them.

Is Hawaii a 50/50 Divorce State - It can reaffirm commitments to co-parenting even during separation.

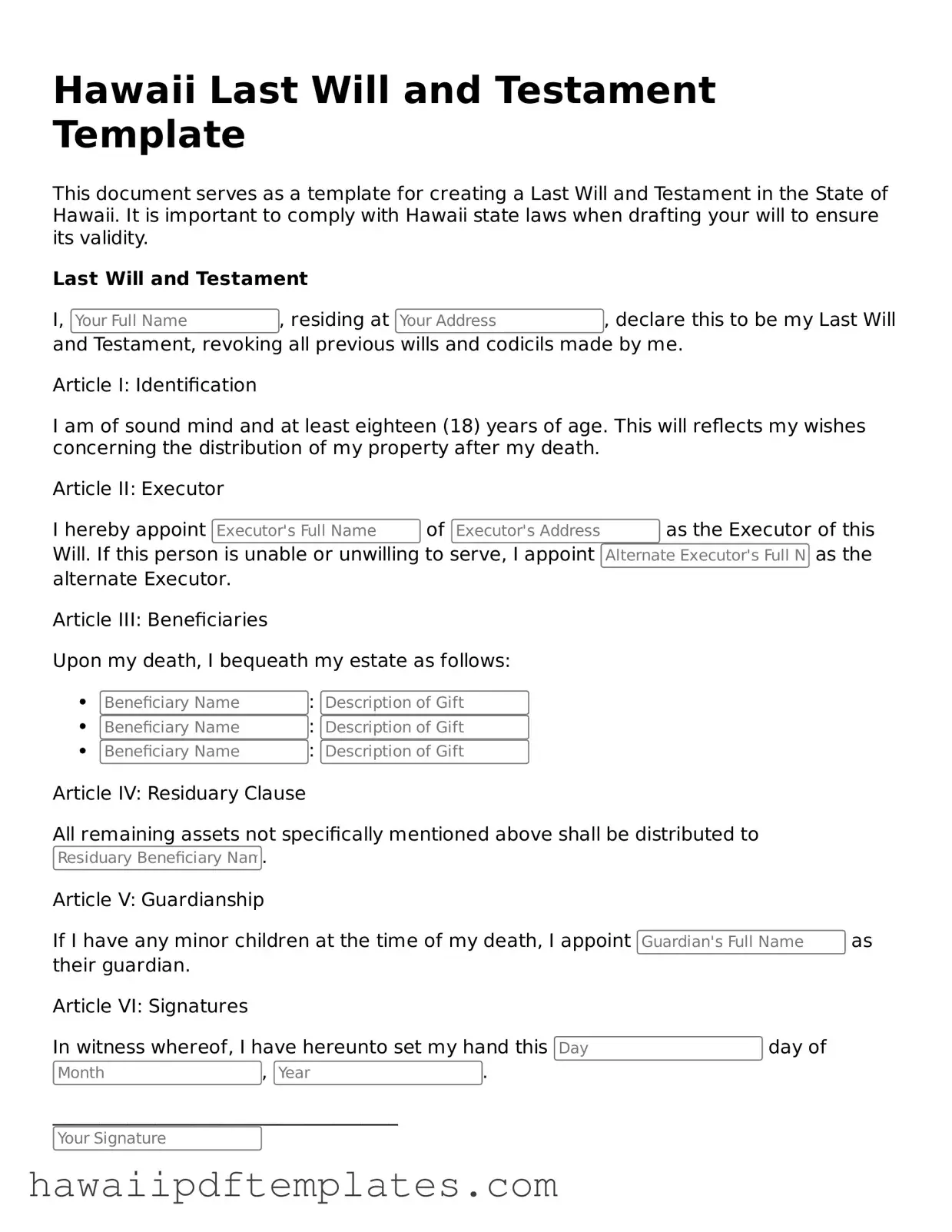

Steps to Writing Hawaii Last Will and Testament

Once you have the Hawaii Last Will and Testament form ready, it’s time to fill it out accurately. This document is crucial for outlining your wishes regarding the distribution of your assets. Follow these steps to complete the form properly.

- Begin by entering your full name at the top of the form.

- Provide your current address, including city, state, and zip code.

- State your date of birth clearly.

- Identify your marital status. Indicate whether you are single, married, or divorced.

- List your children, if any, by providing their full names and ages.

- Designate an executor. This person will carry out your wishes as stated in the will. Include their full name and contact information.

- Outline your assets. This includes property, bank accounts, investments, and personal belongings.

- Specify how you want your assets distributed among your beneficiaries. Be clear and detailed.

- Sign the form in the presence of at least two witnesses. Make sure they also sign the document.

- Finally, store the completed will in a safe place and inform your executor where to find it.

Misconceptions

When it comes to creating a Last Will and Testament in Hawaii, there are several common misconceptions that people may have. Understanding these misconceptions can help ensure that your estate planning is done correctly and effectively.

- A will is only for wealthy individuals. Many believe that only those with significant assets need a will. In reality, a will is important for anyone who wants to ensure their wishes are followed after their death, regardless of their financial status.

- Verbal wills are legally binding. Some people think that simply stating their wishes verbally is sufficient. However, Hawaii law requires a written will to be legally valid.

- All wills must be notarized. While notarization can help validate a will, it is not a requirement in Hawaii. A will can be valid without a notary as long as it is signed by the testator and witnessed appropriately.

- Handwritten wills are not valid. This is a common belief, but Hawaii recognizes holographic wills (handwritten wills) as valid, provided they meet certain criteria.

- Once a will is created, it cannot be changed. People often think that a will is set in stone once it is signed. In fact, a will can be modified or revoked at any time as long as the testator is of sound mind.

- All assets must go through probate. Some believe that every asset must go through the probate process. However, certain assets, like those held in a trust or joint ownership, may bypass probate.

- Only a lawyer can create a valid will. While legal assistance can be beneficial, individuals can create a valid will on their own in Hawaii, as long as they follow the state's legal requirements.

- Wills are only necessary for adults. This misconception overlooks the fact that even minors can benefit from having a will, particularly regarding guardianship and asset distribution.

- Once a will is filed, it cannot be changed. Some individuals believe that filing a will with the court prevents any future changes. However, you can update or revoke a will even after it has been filed.

By clarifying these misconceptions, individuals can better navigate the process of creating a Last Will and Testament in Hawaii, ensuring their wishes are honored and their loved ones are taken care of.