The Hawaii Employee Handbook form is a vital document that outlines workplace policies, employee rights, and expectations for both employers and employees in Hawaii. This form serves as a guide to help create a positive work environment and ensure compliance...

The Hawaii Firearm Bill of Sale form serves as a legal document that records the transfer of ownership of a firearm between parties in Hawaii. This form is essential for ensuring compliance with state laws and protecting both the buyer...

The G 45 Hawaii form is a schedule used for reporting general excise and use tax exemptions and deductions. This form must be attached to the G-45 and G-49 tax returns to ensure that claimed exemptions are recognized by the...

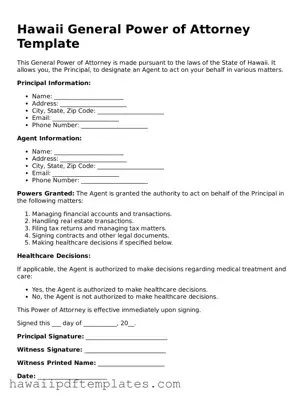

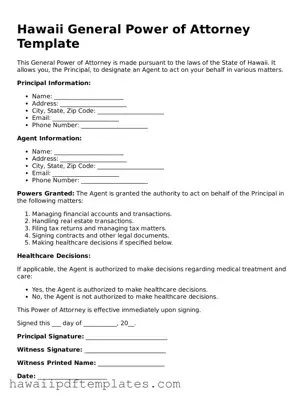

A Hawaii General Power of Attorney form is a legal document that allows one person to appoint another to make decisions on their behalf regarding financial and legal matters. This form is crucial for ensuring that your wishes are respected,...

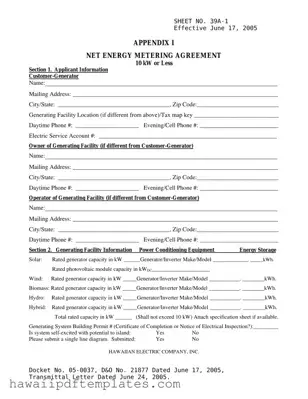

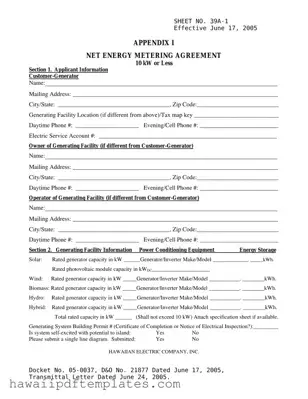

The Hawaii 39A form is a Net Energy Metering Agreement designed for customer-generators with systems rated at 10 kW or less. This form is essential for those looking to connect their renewable energy generation facilities to the Hawaiian Electric Company’s...

The Hawaii Agreement of Sale form is a legally binding document that outlines the terms for the sale and purchase of real estate in Hawaii, without the involvement of a broker. This form establishes key details such as the property...

The Hawaii DHS 1128 form is a critical document used to report disabilities for individuals seeking assistance from the state’s Med-Quest Division within the Department of Human Services. This form requires detailed information about a patient's physical and mental health...

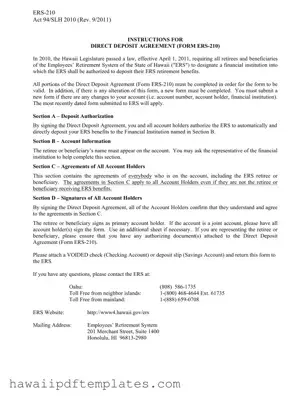

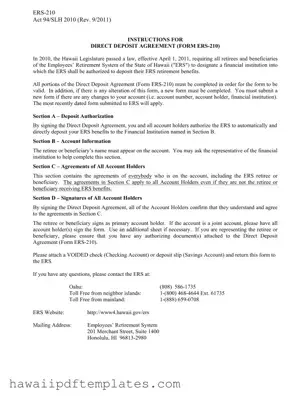

The Hawaii Direct Deposit form, officially known as Form ERS-210, is a crucial document for retirees and beneficiaries of the Employees' Retirement System of the State of Hawaii. This form allows individuals to designate a financial institution where their retirement...

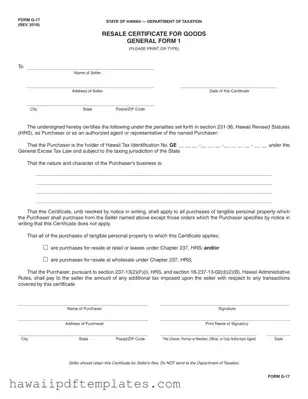

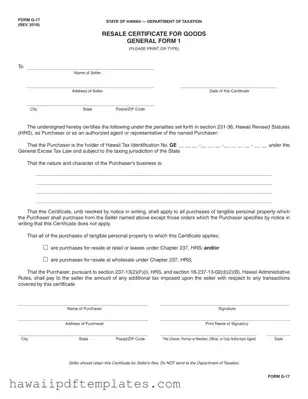

The Hawaii G 17 form is a Resale Certificate for Goods, issued by the State of Hawaii's Department of Taxation. This form enables purchasers to certify their eligibility to buy tangible personal property for resale without incurring sales tax. It...

The Hawaii G-45 form is a General Excise/Use Tax Return that businesses in Hawaii must file to report their gross income and calculate the taxes owed. This form is essential for ensuring compliance with Hawaii's tax laws and accurately reporting...

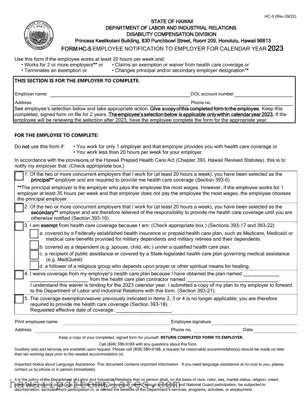

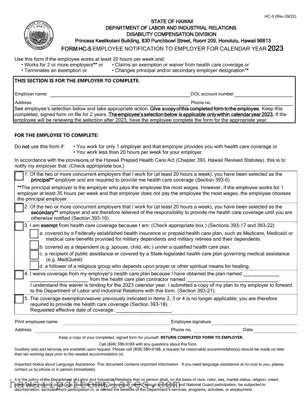

The Hawaii HC-5 form is an essential document used by employees to notify their employers about health care coverage status under the Hawaii Prepaid Health Care Act. This form is particularly important for those working for multiple employers, claiming exemptions,...

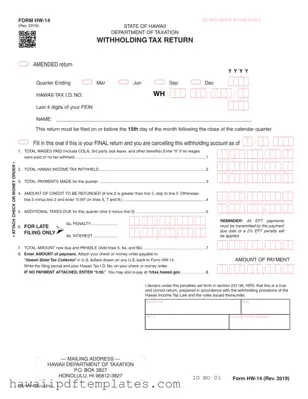

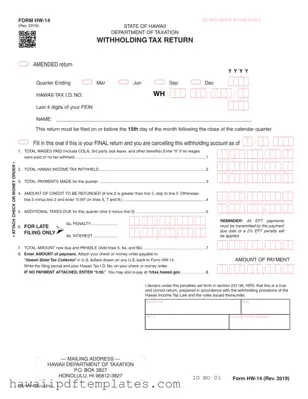

The Hawaii HW-14 form is a withholding tax return used by employers in Hawaii to report wages paid and taxes withheld for a specific quarter. This form is essential for ensuring compliance with state tax regulations. To complete your filing,...