Free Promissory Note Document for Hawaii State

Frequently Asked Questions

-

What is a Hawaii Promissory Note?

A Hawaii Promissory Note is a legal document in which one party, known as the borrower, promises to pay a specified amount of money to another party, known as the lender. This note outlines the terms of the loan, including the amount borrowed, the interest rate, the repayment schedule, and any penalties for late payments. It serves as a written record of the agreement between the two parties.

-

What are the key components of a Promissory Note in Hawaii?

Several essential elements must be included in a Hawaii Promissory Note to ensure its validity:

- Parties Involved: The names and addresses of both the borrower and the lender.

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The percentage charged on the principal amount, which can be fixed or variable.

- Repayment Terms: A detailed schedule indicating when payments are due and the amount of each payment.

- Default Conditions: Terms that specify what constitutes a default and the consequences of such an event.

- Governing Law: A statement indicating that the note is governed by the laws of the State of Hawaii.

-

Is a Promissory Note legally binding in Hawaii?

Yes, a Promissory Note is legally binding in Hawaii as long as it meets the necessary legal requirements. Both parties must agree to the terms, and the document should be signed by the borrower. While it is not required to be notarized, having a notary public witness the signatures can provide additional legal protection and help verify the identities of the parties involved.

-

Can a Promissory Note be modified after it has been signed?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note. This helps prevent misunderstandings and provides a clear record of the agreed-upon changes.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make the required payments, the lender has several options. The lender may choose to initiate legal proceedings to recover the owed amount, which could involve filing a lawsuit. Additionally, the lender may be entitled to charge late fees or take possession of any collateral that was pledged as security for the loan, depending on the terms outlined in the note.

-

Are there any specific laws governing Promissory Notes in Hawaii?

Yes, Promissory Notes in Hawaii are subject to both state laws and federal regulations. The Uniform Commercial Code (UCC), which has been adopted by Hawaii, governs negotiable instruments, including Promissory Notes. This means that certain provisions and protections apply to these documents. It is crucial for both lenders and borrowers to be aware of their rights and obligations under these laws to ensure compliance and protect their interests.

Other Common Hawaii Forms

Quit Claim Deed Hawaii - Using a Quitclaim Deed may have tax implications, so it’s wise to consult a tax professional.

Selling Car in Hawaii - Can aid in claims of depreciation for tax purposes.

For a smooth transaction, understanding the necessary paperwork is vital; thus, having an informative guide on how to complete a New York bill of sale form can be invaluable. You can find useful resources about this process, including the requirements for the document, at helpful tips for a bill of sale.

Hawaii DNR Order - Patients should keep a copy of the DNR order accessible to medical personnel in emergencies.

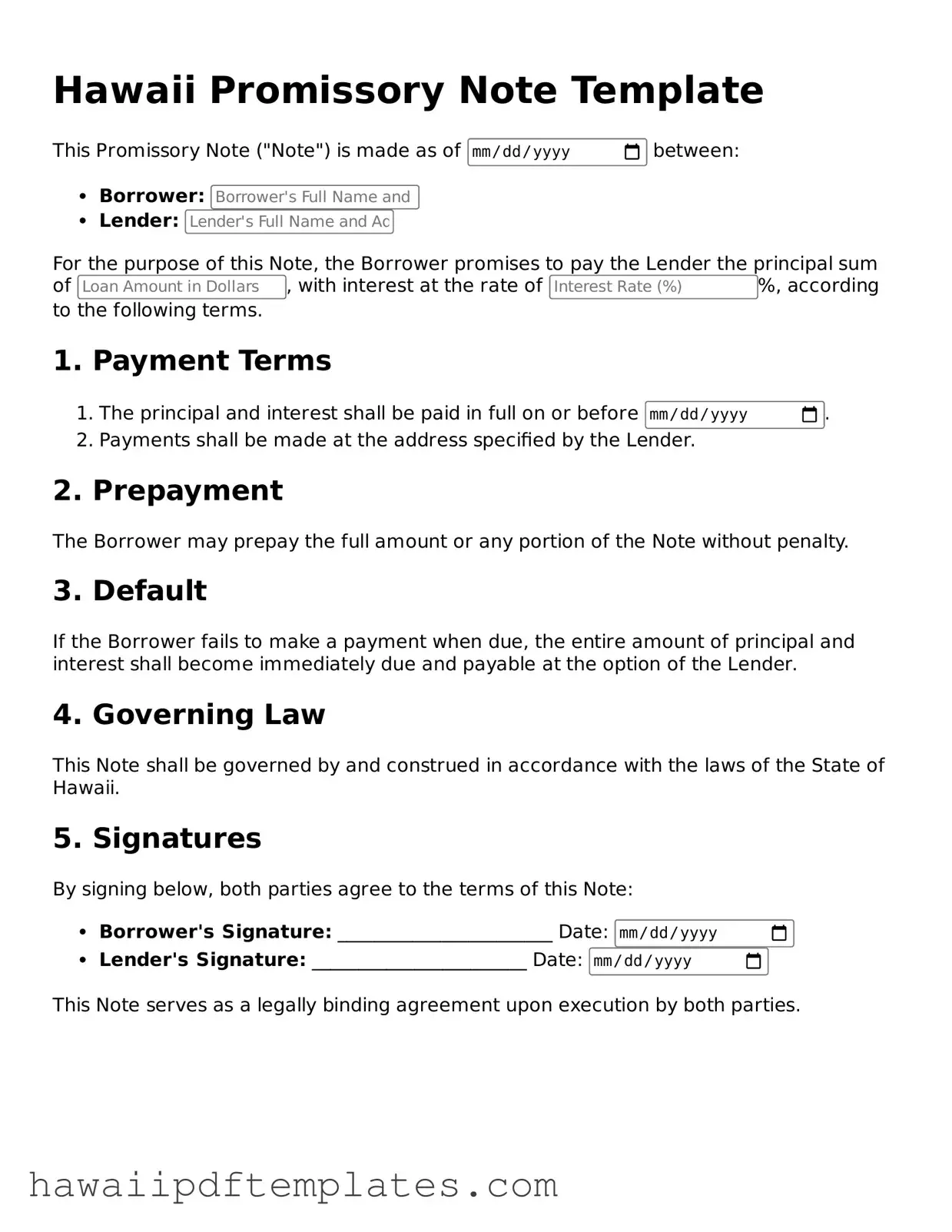

Steps to Writing Hawaii Promissory Note

Once you have the Hawaii Promissory Note form in hand, the next steps involve carefully filling out each section to ensure that all necessary information is accurately provided. This form is essential for documenting a loan agreement between a borrower and a lender, detailing the terms of repayment. Following these instructions will help streamline the process and minimize potential errors.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- In the first section, write the name and address of the borrower. Ensure that the information is complete and clearly legible.

- Next, provide the name and address of the lender in the designated area. This should also be accurate and easy to read.

- Indicate the principal amount of the loan in the appropriate field. This is the total amount being borrowed.

- Specify the interest rate. If there is no interest, indicate that the rate is 0%.

- Outline the repayment schedule. Include details such as the frequency of payments (monthly, quarterly, etc.) and the due date for the first payment.

- In the section for late fees, specify any penalties for late payments, if applicable. Clearly state the amount or percentage of the fee.

- Include any prepayment terms. If the borrower can pay off the loan early without penalties, note that here.

- Both parties should sign and date the form at the bottom. Ensure that the signatures are clear and match the names provided earlier in the form.

Misconceptions

Understanding the Hawaii Promissory Note form is essential for anyone involved in lending or borrowing money in Hawaii. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- All Promissory Notes are the Same: Many believe that all promissory notes are identical regardless of the state. In reality, Hawaii has specific requirements and formats that must be followed for the note to be legally binding.

- Only Banks Can Use Promissory Notes: Some think that promissory notes are exclusively for banks and financial institutions. In fact, individuals can create and use promissory notes for personal loans between friends or family members.

- A Promissory Note Does Not Require Signatures: There is a misconception that a promissory note can be valid without signatures. However, for a promissory note to be enforceable, it must be signed by both the borrower and the lender.

- Promissory Notes Are Always Enforceable: Not everyone realizes that a promissory note may not always be enforceable in court. Factors such as improper execution, lack of consideration, or illegal terms can render a note void.

Being aware of these misconceptions can help ensure that your use of the Hawaii Promissory Note form is effective and legally sound.