Free Quitclaim Deed Document for Hawaii State

Frequently Asked Questions

-

What is a Hawaii Quitclaim Deed?

A Hawaii Quitclaim Deed is a legal document used to transfer ownership of real property from one person to another. This type of deed provides no warranty or guarantee regarding the title of the property. Essentially, the person transferring the property (the grantor) relinquishes any claim they have to the property, but they do not assure the recipient (the grantee) that the title is clear or free of liens.

-

When should I use a Quitclaim Deed in Hawaii?

A Quitclaim Deed is often used in specific situations, such as:

- Transferring property between family members, such as in a divorce or inheritance.

- Clearing up title issues, like removing a former spouse from the property title after a divorce.

- Transferring property into a trust or business entity.

It is important to assess your situation carefully, as a Quitclaim Deed does not provide any protection against claims from other parties.

-

How do I complete a Quitclaim Deed in Hawaii?

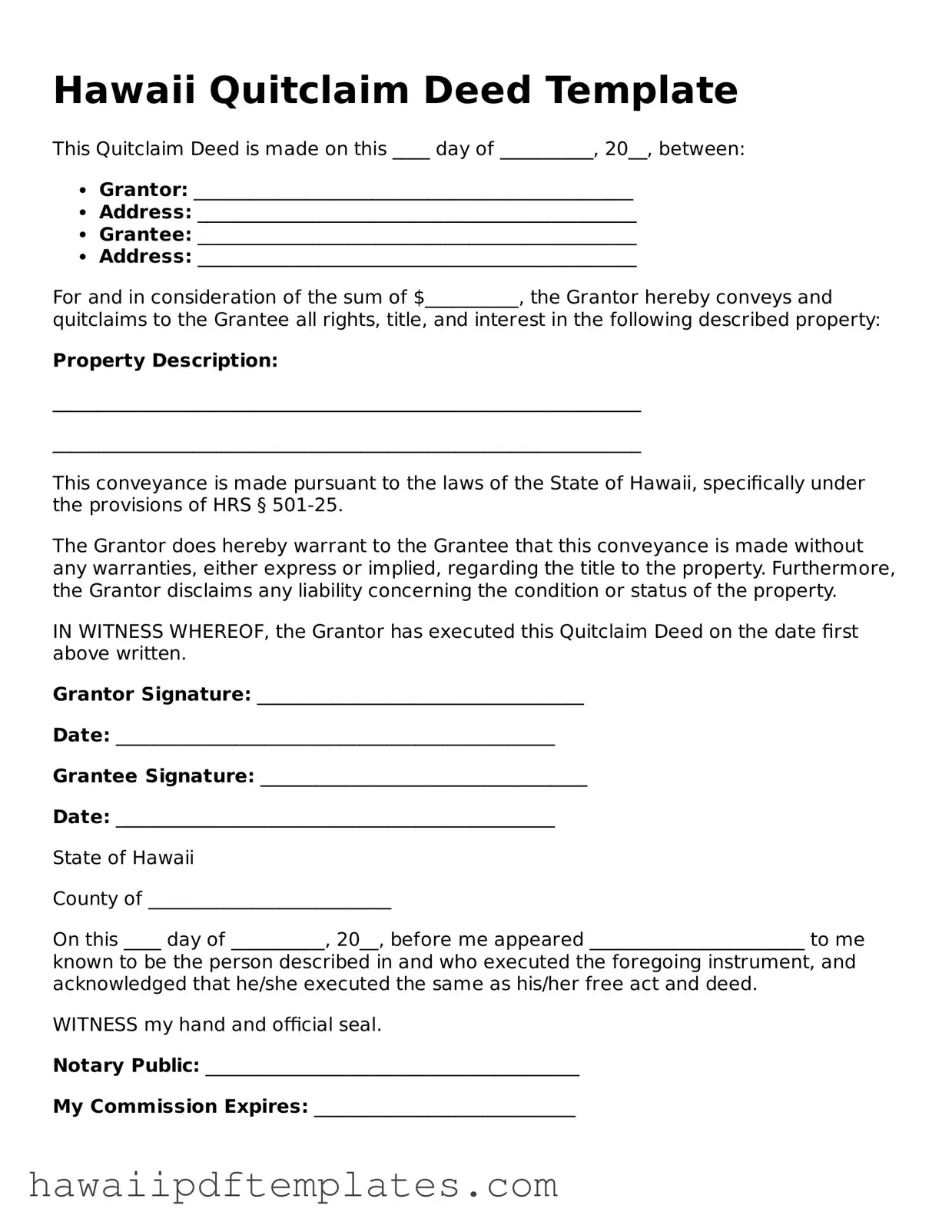

Completing a Quitclaim Deed involves several steps:

- Obtain a blank Quitclaim Deed form, which can be found online or through legal supply stores.

- Fill out the form with accurate information about the property, including the legal description and the names of the grantor and grantee.

- Have the document signed by the grantor in the presence of a notary public.

- Record the completed Quitclaim Deed with the Bureau of Conveyances in Hawaii to make the transfer official.

Double-check all details for accuracy before submission to avoid any complications.

-

Are there any fees associated with filing a Quitclaim Deed in Hawaii?

Yes, there are fees involved in filing a Quitclaim Deed. These fees can vary based on the county where the property is located. Typically, you will need to pay a recording fee when you submit the deed to the Bureau of Conveyances. Additionally, there may be costs associated with notarization. It is advisable to check with your local county office for the most accurate fee schedule.

Other Common Hawaii Forms

Hawaii Llc Operating Agreement - An Operating Agreement is vital for limiting personal liability.

Breg Bill Pay - Includes indemnification provisions for directors and officers.

For those looking to complete a transaction, the necessary Alabama Boat Bill of Sale form provides a structured means to ensure all vital details are captured accurately, facilitating smooth ownership transfer. You can find more information and access the form at the essential Alabama Boat Bill of Sale document.

Hawaii Power of Attorney - This form can include specific instructions and limitations for your agent.

Steps to Writing Hawaii Quitclaim Deed

After you have gathered the necessary information, you can proceed to fill out the Hawaii Quitclaim Deed form. This process involves providing specific details about the property and the parties involved. Once completed, the form will need to be signed and may require notarization before submission.

- Begin by entering the names of the parties involved in the deed. The person transferring the property is called the grantor, while the person receiving it is the grantee.

- Provide the address of the property being transferred. This should include the street address, city, and zip code.

- Include a legal description of the property. This can often be found on the property’s title or deed. It describes the boundaries and specifics of the property.

- State the date of the transfer. This is the date when the grantor intends to transfer the property to the grantee.

- Sign the document in the designated area. The grantor must sign the deed to make it valid.

- Have the deed notarized. A notary public will verify the identities of the signers and witness the signing of the document.

- Make copies of the completed deed for your records.

- Submit the original deed to the appropriate county office for recording. This usually involves a fee.

Misconceptions

When it comes to real estate transactions in Hawaii, the Quitclaim Deed form often generates confusion. Here are six common misconceptions about this legal document.

- A Quitclaim Deed transfers ownership of property. Many believe that this deed guarantees the transfer of ownership. In reality, it only transfers whatever interest the grantor has in the property, which may be none at all.

- A Quitclaim Deed is the same as a Warranty Deed. Some people think these two types of deeds are interchangeable. However, a Warranty Deed provides a guarantee that the property is free from claims, while a Quitclaim Deed does not offer any such assurance.

- You cannot use a Quitclaim Deed for property sales. There is a misconception that Quitclaim Deeds are only for transferring property between family members. In fact, they can be used in various situations, including sales, although they are less common for that purpose.

- A Quitclaim Deed eliminates all liens on the property. Some individuals mistakenly believe that using this deed clears any existing liens or debts associated with the property. In truth, any liens remain attached to the property, regardless of the deed used.

- You do not need to record a Quitclaim Deed. Many think that recording the deed is unnecessary. However, recording it with the county is crucial to protect the new owner's interest and provide public notice of the transfer.

- A Quitclaim Deed can be revoked at any time. Some assume that once a Quitclaim Deed is executed, it can easily be undone. In reality, revoking a deed typically requires a new legal process, such as executing another deed or obtaining a court order.

Understanding these misconceptions can help individuals navigate property transfers in Hawaii more effectively. Awareness of the true nature of a Quitclaim Deed is essential for anyone involved in real estate transactions.