Free Real Estate Purchase Agreement Document for Hawaii State

Frequently Asked Questions

-

What is the Hawaii Real Estate Purchase Agreement?

The Hawaii Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase property in Hawaii. It includes details such as the purchase price, property description, and closing date.

-

Who needs to sign the agreement?

Both the buyer and the seller must sign the agreement. If the buyer is a corporation or LLC, an authorized representative must sign on behalf of the entity. All parties involved in the transaction should review the document carefully before signing.

-

What information is required in the agreement?

The agreement requires specific information, including:

- The names and contact information of the buyer and seller.

- A detailed description of the property being sold.

- The purchase price and any deposit amount.

- Financing details, if applicable.

- Closing date and any contingencies.

-

Can the agreement be modified after signing?

Yes, the agreement can be modified after signing, but both parties must agree to any changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement.

-

What happens if either party breaches the agreement?

If either party fails to fulfill their obligations under the agreement, it is considered a breach. The non-breaching party may have the right to seek remedies, which can include monetary damages or specific performance, depending on the situation.

-

Is an attorney required to complete the agreement?

While it is not legally required to have an attorney complete the agreement, it is highly recommended. An attorney can provide valuable guidance and ensure that the agreement complies with local laws and regulations.

-

What is the role of a real estate agent in this process?

A real estate agent can assist both the buyer and seller in preparing the agreement. They help ensure that all necessary information is included and that the terms are fair and reasonable. Their expertise can streamline the process and prevent potential issues.

-

How can I obtain a copy of the Hawaii Real Estate Purchase Agreement?

The Hawaii Real Estate Purchase Agreement can typically be obtained through a real estate agent, attorney, or online real estate resources. Ensure that you are using the most current version of the form to avoid any complications.

Other Common Hawaii Forms

How to Transfer Property Title in Hawaii - Failure to properly execute the Deed may result in ownership disputes.

A California Non-disclosure Agreement (NDA) is a legal contract designed to protect sensitive information shared between parties. This agreement ensures that confidential information remains private and is not disclosed to unauthorized individuals. For further information, you can refer to the Non-disclosure Agreement form. By signing an NDA, parties can foster trust and facilitate open communication while safeguarding their proprietary information.

Non Compete Agreement Hawaii - Understanding the scope and limitations of a Non-compete Agreement can help avoid future legal issues.

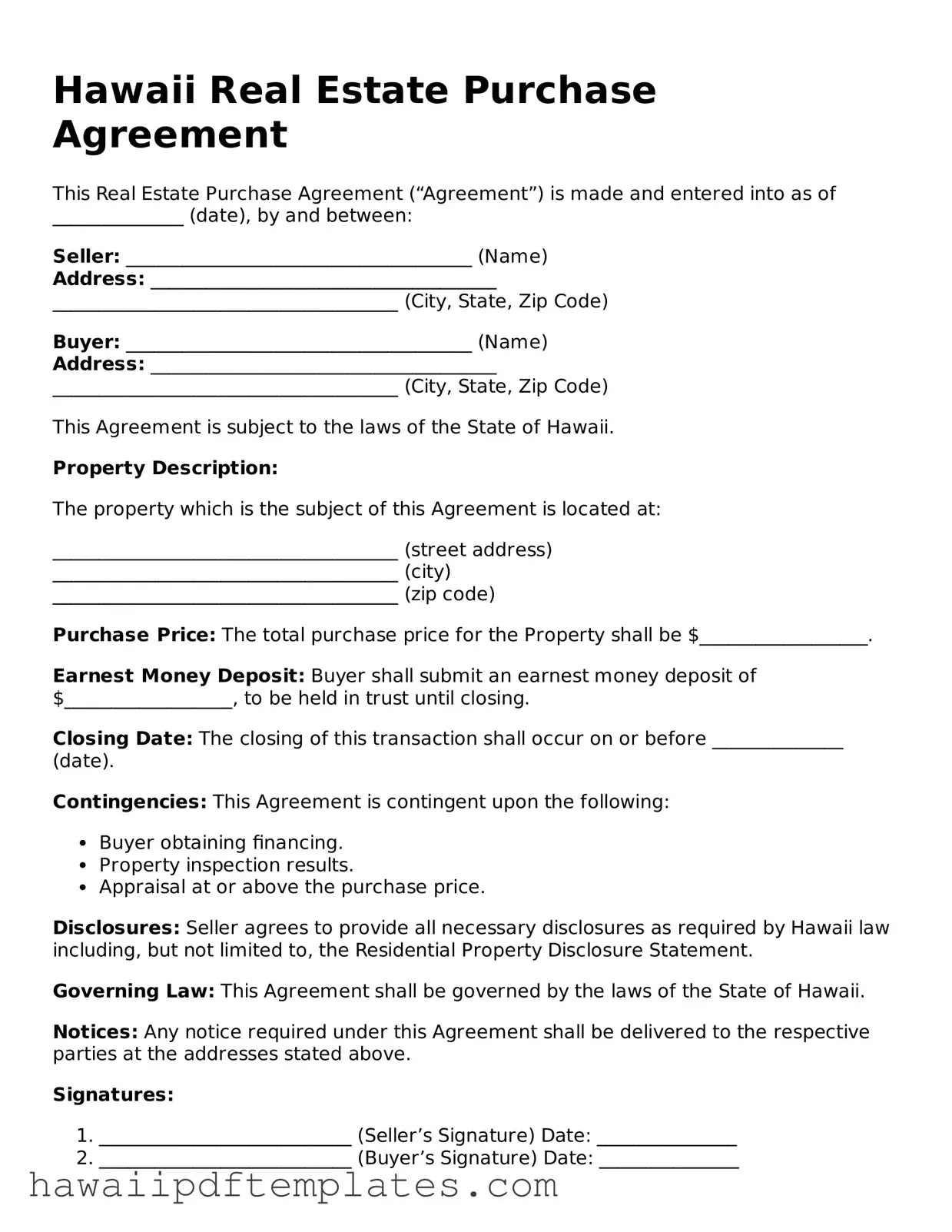

Steps to Writing Hawaii Real Estate Purchase Agreement

Filling out the Hawaii Real Estate Purchase Agreement form is a crucial step in the home buying process. Once completed, this form will serve as a binding contract between the buyer and seller. Be sure to have all necessary information on hand before you begin.

- Start with the date at the top of the form. Write the date when you are filling out the agreement.

- Fill in the names of the buyer(s) and seller(s) in the designated sections. Ensure that the names match the official identification documents.

- Provide the property address. Include the full street address, city, and zip code.

- Specify the purchase price. Write down the total amount the buyer agrees to pay for the property.

- Indicate the amount of the earnest money deposit. This is the initial payment made to show the buyer's commitment.

- Set the closing date. This is when the property transfer will officially take place.

- Include any contingencies. These are conditions that must be met for the sale to proceed, such as financing or inspection requirements.

- Sign and date the agreement. Both the buyer and seller must sign to make the agreement valid.

After completing the form, review it carefully to ensure all information is accurate. Once both parties have signed, the agreement can be submitted to the appropriate parties for processing.

Misconceptions

When it comes to real estate transactions in Hawaii, the Real Estate Purchase Agreement (REPA) form often generates a variety of misconceptions. Understanding these misconceptions can help buyers and sellers navigate the process more effectively. Below are seven common misunderstandings about the Hawaii REPA.

- The REPA is the only document needed for a real estate transaction. While the REPA is a critical document, it is not the only one. Additional paperwork, such as disclosures, title reports, and financing documents, is often required to complete the transaction.

- All real estate transactions in Hawaii use the same REPA form. This is not true. There are variations of the REPA that may be tailored to specific situations, such as residential or commercial transactions, which can affect the terms and conditions.

- The REPA is a legally binding contract as soon as it is signed. Although signing the REPA indicates agreement, it may not be legally binding until all parties have fulfilled certain conditions, such as obtaining financing or completing inspections.

- Buyers can make changes to the REPA without notifying the seller. Any modifications to the REPA must be communicated to all parties involved. Changes made unilaterally may lead to misunderstandings and potential disputes.

- Real estate agents can fill out the REPA without any legal oversight. While agents can assist in completing the REPA, it is advisable for buyers and sellers to consult with legal professionals to ensure that their interests are adequately protected.

- The REPA guarantees the sale will go through. The REPA outlines the terms of the sale, but it does not guarantee that the transaction will be completed. Factors like financing issues or inspection results can derail a deal.

- Once the REPA is signed, the seller cannot back out. Sellers may have options to withdraw from the agreement under certain conditions, such as if contingencies are not met. It is essential to understand the specific terms outlined in the agreement.

Awareness of these misconceptions can empower both buyers and sellers in their real estate endeavors in Hawaii. Proper understanding of the REPA will lead to a smoother transaction experience.