Free Small Estate Affidavit Document for Hawaii State

Frequently Asked Questions

-

What is a Hawaii Small Estate Affidavit?

The Hawaii Small Estate Affidavit is a legal document that allows heirs or beneficiaries to claim the assets of a deceased person without going through the formal probate process. This form is typically used when the total value of the estate is below a certain threshold, making the probate process unnecessary.

-

What is the value limit for a small estate in Hawaii?

As of October 2023, the value limit for a small estate in Hawaii is $100,000 for personal property and $200,000 for real property. If the total value of the estate falls below these amounts, the Small Estate Affidavit may be used.

-

Who is eligible to use the Small Estate Affidavit?

Eligible individuals include heirs or beneficiaries named in the deceased person's will or, if there is no will, those who are entitled to inherit under Hawaii law. The person using the affidavit must also be at least 18 years old.

-

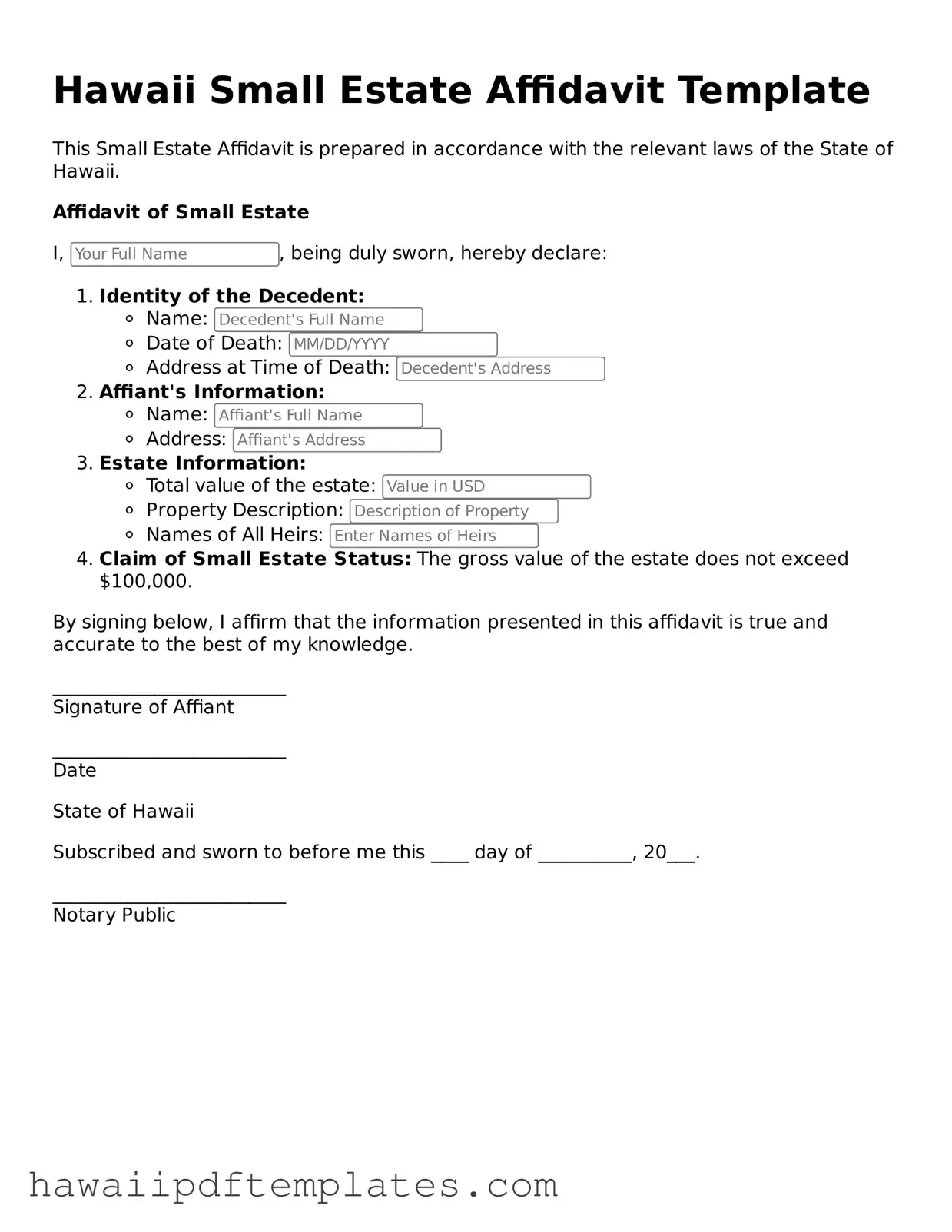

What information is required to complete the Small Estate Affidavit?

The affidavit requires specific details, including the name and address of the deceased, the date of death, a description of the property, and the names and addresses of all heirs or beneficiaries. Additionally, the affiant must affirm that the estate qualifies as a small estate.

-

How is the Small Estate Affidavit filed?

The Small Estate Affidavit must be signed in front of a notary public. Once notarized, it can be presented to financial institutions, banks, or other entities holding the deceased's assets. There is no need to file the affidavit with the court unless a dispute arises.

-

Can the Small Estate Affidavit be used for real estate?

Yes, the Small Estate Affidavit can be used to transfer real estate, provided the total value of the estate does not exceed the specified limits. However, it is important to ensure that all legal requirements are met when transferring real property.

-

What happens if the estate exceeds the small estate limits?

If the estate exceeds the small estate limits, the formal probate process must be initiated. This involves filing a petition with the court and may require the appointment of a personal representative to manage the estate.

-

Is legal assistance necessary to complete the Small Estate Affidavit?

While legal assistance is not required to complete the Small Estate Affidavit, it may be beneficial, especially if there are complex issues or disputes among heirs. Consulting with an attorney can provide clarity and ensure compliance with all legal requirements.

Other Common Hawaii Forms

Hawaii Residential Lease Agreement - Specifies any restrictions on the use of the property, such as commercial activities.

The Florida Motor Vehicle Power of Attorney form is a legal document that allows an individual to appoint another person to act on their behalf regarding motor vehicle transactions. This form is essential for those who may be unable to handle their vehicle-related matters due to various circumstances. For those looking to understand the intricacies of such forms, visiting Florida Forms can provide valuable insights and guidance.

Hawaii Power of Attorney - A Medical Power of Attorney allows you to designate someone you trust to make healthcare decisions on your behalf.

Steps to Writing Hawaii Small Estate Affidavit

After gathering the necessary information and documents, you are ready to fill out the Hawaii Small Estate Affidavit form. This form is essential for handling the estate of a deceased person when the estate's total value is below a certain threshold. Follow these steps carefully to ensure that the form is completed accurately.

- Obtain the Hawaii Small Estate Affidavit form. You can find it online or at your local courthouse.

- Enter the name of the deceased person at the top of the form.

- Provide the date of death of the deceased. This information is crucial for the affidavit.

- List the names and addresses of all heirs. Include their relationship to the deceased.

- Detail the assets of the estate. Include real property, bank accounts, and any other significant assets.

- Indicate the total value of the estate. Ensure it is below the threshold required for a small estate affidavit.

- Sign and date the affidavit. Your signature confirms the information provided is accurate.

- Have the affidavit notarized. A notary public will validate your signature and the document.

- File the completed affidavit with the appropriate court in Hawaii.

Once you have submitted the form, the court will review it. If everything is in order, you will receive the necessary approval to proceed with the distribution of the estate's assets.

Misconceptions

The Hawaii Small Estate Affidavit is a useful legal tool for settling the estates of individuals who have passed away. However, several misconceptions exist about its use and requirements. Below are some common misunderstandings:

- Only estates under a certain dollar amount qualify. Many believe that the Small Estate Affidavit is only for estates valued below a specific threshold. While there is a limit, it is important to understand that this limit can change and may not be the only factor in determining eligibility.

- All assets can be transferred using the Small Estate Affidavit. Some people think that all types of assets, including real estate, can be transferred through this affidavit. However, certain assets, like real property, often require different procedures.

- The form is only for heirs. There is a misconception that only heirs can use the Small Estate Affidavit. In reality, it can also be utilized by other individuals, such as personal representatives, who may have a legitimate interest in the estate.

- Filing the affidavit is a quick process. Many assume that completing and filing the Small Estate Affidavit is a straightforward and quick task. While it may be simpler than formal probate, it still requires careful attention to detail and can take time to process.

- Legal assistance is not necessary. Some individuals believe they can complete the Small Estate Affidavit without legal help. Although it is possible to do so, consulting with a legal professional can help ensure that all requirements are met and that the process goes smoothly.

- Once filed, the affidavit cannot be challenged. There is a belief that once the Small Estate Affidavit is submitted, it is immune to challenges. In fact, interested parties may still contest the affidavit under certain circumstances, which could complicate the process.

- It is only applicable for residents of Hawaii. Some think that only Hawaii residents can use the Small Estate Affidavit. However, this form can also apply to estates of individuals who may have lived elsewhere but owned property in Hawaii.