State Hawaii Tdi 45 PDF Form

Frequently Asked Questions

-

What is the purpose of the TDI-45 form?

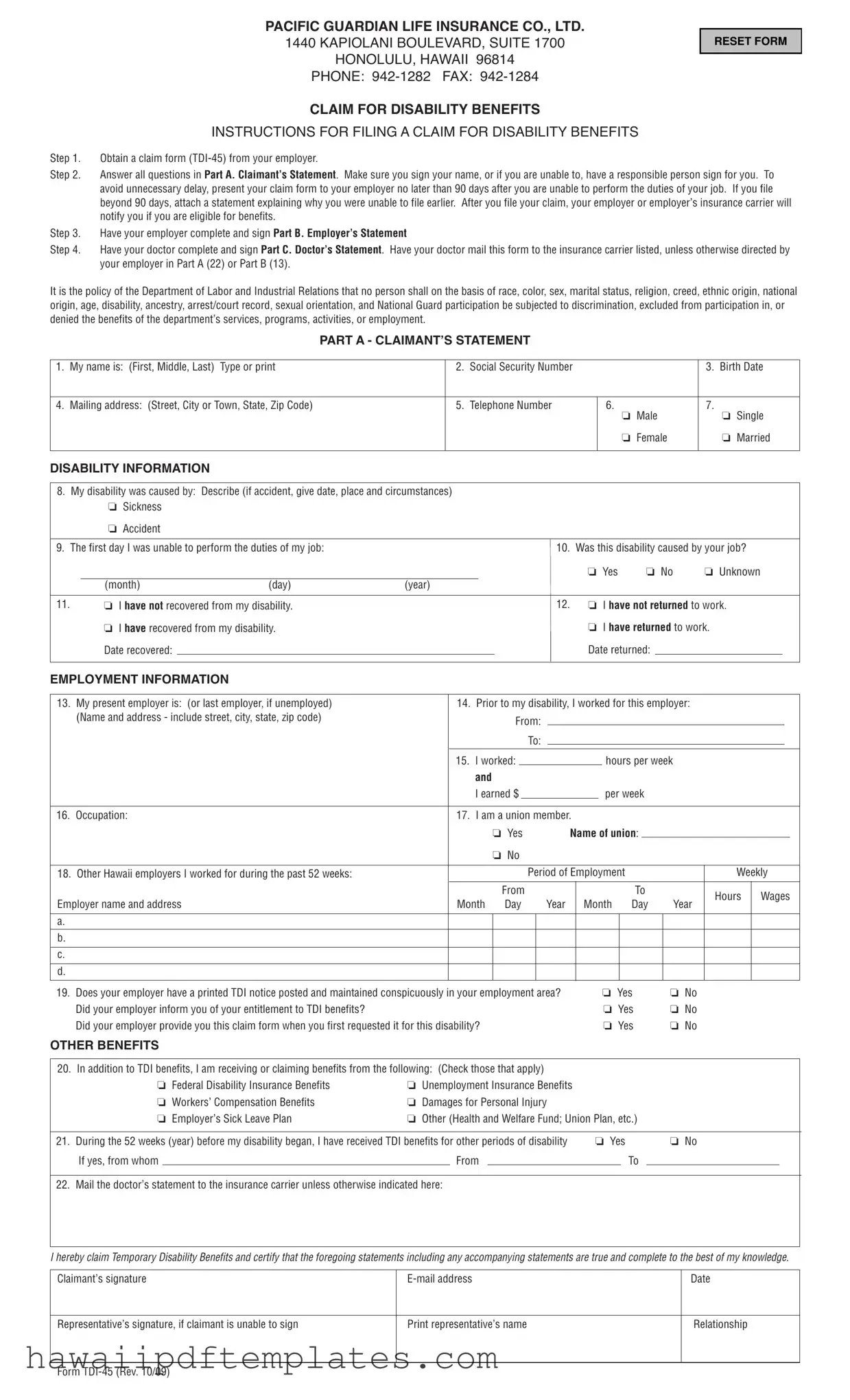

The TDI-45 form is used to apply for Temporary Disability Insurance (TDI) benefits in Hawaii. If you are unable to work due to a disability, this form allows you to claim benefits to help you during your recovery period. It requires information from you, your employer, and your doctor to assess your eligibility for benefits.

-

How do I fill out the TDI-45 form?

Filling out the TDI-45 form involves several steps:

- Step 1: Obtain the form from your employer.

- Step 2: Complete Part A, which is your statement. Answer all questions, sign your name, or have someone sign for you if necessary.

- Step 3: Have your employer fill out and sign Part B, which is their statement.

- Step 4: Have your doctor complete and sign Part C, which is their statement. Your doctor should mail this part to the insurance carrier.

Make sure to submit the form within 90 days of your inability to work to avoid delays.

-

What if I miss the 90-day deadline to submit my claim?

If you submit your claim after the 90-day deadline, you must include a statement explaining why you were unable to file earlier. This will help the insurance carrier understand your situation and may allow your claim to be processed despite the delay.

-

What information do I need to provide in Part A of the form?

In Part A, you will need to provide personal information such as your name, Social Security number, date of birth, and contact details. You will also need to explain the nature of your disability, including whether it was caused by an accident or illness, and provide details about your employment history and any other benefits you may be receiving.

-

What happens after I submit the TDI-45 form?

Once you submit the TDI-45 form, your employer or their insurance carrier will review your claim. They will notify you of your eligibility for benefits. It is important to keep in touch with your employer and follow up on the status of your claim to ensure that everything is processed in a timely manner.

Popular PDF Forms

Hawaii Form N-15 - A reminder to sign and date the form to validate the submission is specified.

The Florida Residential Lease Agreement form is a legally binding document outlining the terms and conditions between a landlord and tenant for the rental of residential property. It serves as a crucial tool for setting clear expectations and protecting the rights of both parties involved in a rental agreement. You can download the form from this link: https://floridaforms.net/blank-residential-lease-agreement-form, and understanding this form is key to navigating the rental process successfully in Florida.

Maui Get Rate - It's essential to keep abreast of any changes in tax laws affecting the G-45 filings.

Steps to Writing State Hawaii Tdi 45

Completing the State Hawaii TDI 45 form requires careful attention to detail to ensure that all necessary information is accurately provided. After submitting the form, the next steps involve your employer and doctor completing their respective sections, which will then be reviewed by the insurance carrier for eligibility determination.

- Obtain the TDI-45 claim form from your employer.

- In Part A, Claimant’s Statement, fill in your name, Social Security Number, birth date, mailing address, and telephone number. Indicate your gender and marital status.

- Provide details about your disability, including the cause, first day unable to work, and whether it was job-related.

- State your recovery status and employment information, including your employer's name, address, and the duration of your employment.

- List your weekly hours and earnings, and indicate your occupation. Mention if you are a union member and provide details of any other employers you worked for in the past 52 weeks.

- Answer questions regarding any additional benefits you are receiving or claiming.

- Sign and date the form. If you cannot sign, have a responsible person sign on your behalf.

- Request your employer to complete and sign Part B, Employer’s Statement.

- Have your doctor fill out and sign Part C, Doctor’s Statement. Ensure they mail this section to the insurance carrier as directed.

Misconceptions

Here are seven misconceptions about the State of Hawaii TDI 45 form, along with clarifications for each:

- Only full-time employees can file a claim. This is not true. Both full-time and part-time employees are eligible to file a claim for disability benefits.

- The claim must be filed immediately after the disability occurs. While it is recommended to file as soon as possible, you have up to 90 days to submit your claim. If you file after this period, you must provide an explanation.

- The employer is responsible for filing the claim on behalf of the employee. This is incorrect. The employee must complete and submit the claim form, but the employer must provide their part of the information.

- Only injuries at work qualify for TDI benefits. This misconception is misleading. Disabilities caused by both work-related incidents and non-work-related illnesses or accidents can qualify for benefits.

- Once the claim is submitted, the employee will automatically receive benefits. This is false. After submission, the employer or insurance carrier must review the claim and determine eligibility before any benefits are issued.

- All medical information must be included in the initial claim. While the claim form requires certain medical details, the doctor will provide comprehensive information in their section of the form.

- Receiving other benefits disqualifies you from TDI benefits. This is not accurate. You can receive TDI benefits while also receiving other types of benefits, but you must disclose this information on the claim form.