Free Transfer-on-Death Deed Document for Hawaii State

Frequently Asked Questions

-

What is a Transfer-on-Death Deed in Hawaii?

A Transfer-on-Death Deed (TODD) is a legal document that allows an individual to transfer real property to a designated beneficiary upon the individual's death, without the need for probate. This means that the property can pass directly to the beneficiary, simplifying the process and potentially reducing costs associated with estate administration.

-

How do I create a Transfer-on-Death Deed in Hawaii?

To create a TODD in Hawaii, the property owner must complete a specific form that includes details about the property and the designated beneficiary. The form must be signed by the property owner in the presence of a notary public. After signing, the deed should be recorded with the Bureau of Conveyances in Hawaii to ensure its validity and to provide public notice of the transfer.

-

Can I change or revoke a Transfer-on-Death Deed once it is created?

Yes, a Transfer-on-Death Deed can be changed or revoked. The property owner may execute a new deed that alters the beneficiary or may formally revoke the existing deed. To ensure that the changes are legally recognized, the new or revocation deed should also be recorded with the Bureau of Conveyances.

-

What are the benefits of using a Transfer-on-Death Deed?

The benefits of using a Transfer-on-Death Deed include:

- Avoiding probate, which can be a lengthy and costly process.

- Maintaining control over the property during the owner's lifetime, as the transfer occurs only after death.

- Providing a clear and straightforward way to designate beneficiaries, which can help prevent disputes among heirs.

Overall, a TODD can be an effective estate planning tool for individuals looking to streamline the transfer of real property to their loved ones.

Other Common Hawaii Forms

Business Handbook - Make sure to update your information if any changes occur.

When engaging in a vehicle transaction in Florida, completing a Florida Motor Vehicle Bill of Sale is crucial to ensure all legal aspects are covered. This form not only documents the sale but also provides essential information that can help mitigate misunderstandings between the seller and the buyer. For those looking for a reliable source for this document and other necessary paperwork, visiting Florida Forms can be beneficial.

Hawaii Power of Attorney - With this form, you can maintain your dignity and preferences even when you are unable to voice them.

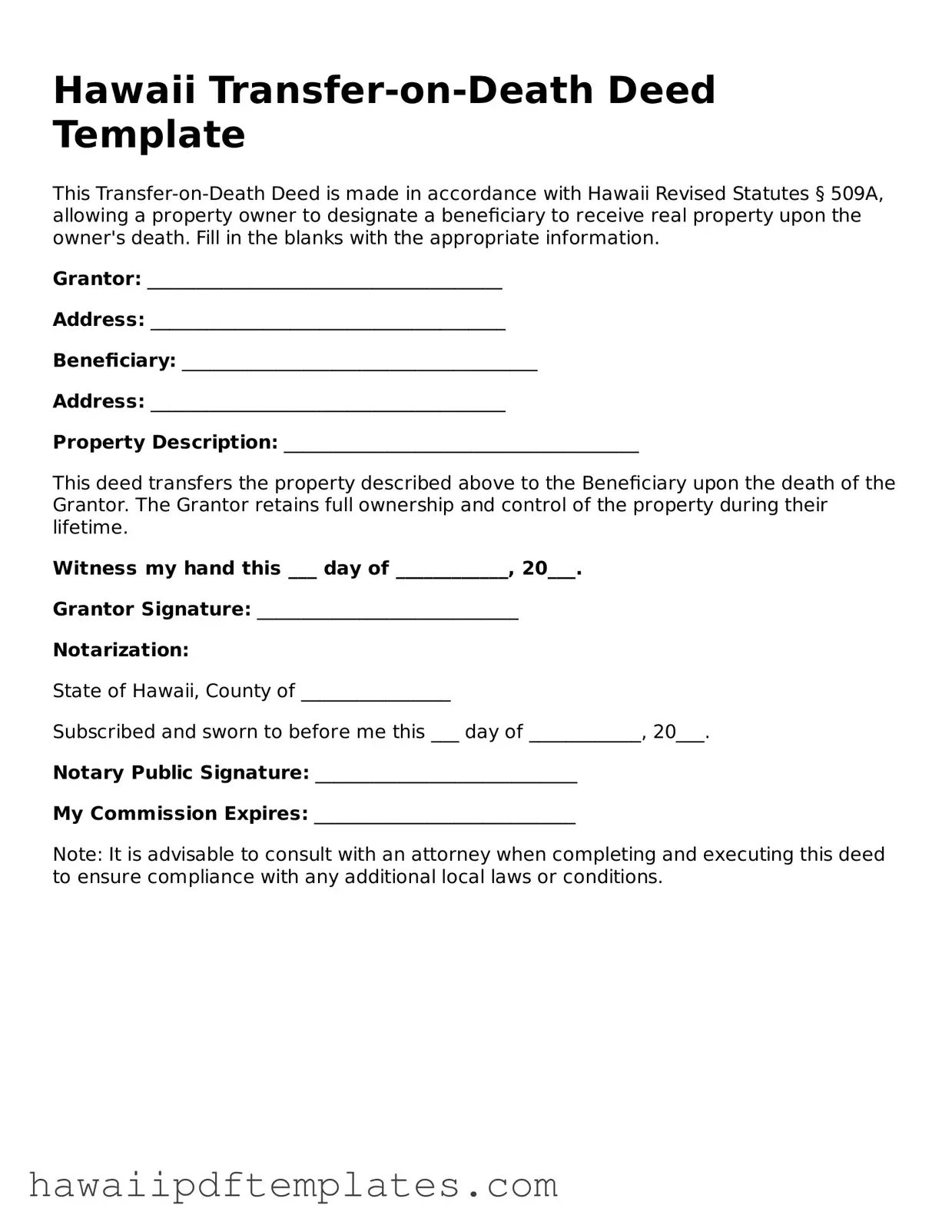

Steps to Writing Hawaii Transfer-on-Death Deed

Once you have the Hawaii Transfer-on-Death Deed form in hand, you will need to carefully fill it out to ensure that your wishes regarding property transfer are clearly documented. This process involves providing specific information about the property and the intended beneficiaries. Follow these steps to complete the form accurately.

- Begin by entering your name as the current owner of the property at the top of the form.

- Provide your address, including the city, state, and zip code, directly below your name.

- Next, describe the property you wish to transfer. This includes the legal description, which can typically be found on your property deed.

- List the names of the beneficiaries who will receive the property upon your passing. Make sure to include their full names.

- Include the beneficiaries' addresses next to their names for clarity.

- Sign and date the form at the bottom. Your signature should be done in the presence of a notary public.

- Finally, have the form notarized. This step is crucial for the deed to be legally valid.

After completing the form, you will need to file it with the appropriate county office in Hawaii. This ensures that the transfer-on-death deed is officially recorded and recognized. Make sure to keep a copy for your records as well.

Misconceptions

Understanding the Hawaii Transfer-on-Death Deed can be challenging. Here are nine common misconceptions about this form, along with clarifications to help you navigate the process.

- It automatically transfers property upon death. Many believe that the deed transfers property immediately upon death. In reality, it only takes effect after the death of the owner and requires proper recording.

- All types of property can be transferred. Some think that any property can be included. However, only real estate can be transferred using this deed; personal property is excluded.

- It eliminates the need for a will. Some assume that using a Transfer-on-Death Deed negates the necessity for a will. This is incorrect; the deed only addresses the transfer of specific real estate and does not cover other assets or estate matters.

- It is irrevocable once signed. There is a belief that the deed cannot be changed once executed. In fact, the owner can revoke or modify the deed at any time before their death.

- It avoids probate entirely. Many think that using this deed completely avoids probate. While it does simplify the process for the property listed, other assets may still require probate.

- It requires the consent of heirs. Some believe that all heirs must agree to the deed. This is not true; the owner can designate beneficiaries without needing approval from others.

- It is only for residents of Hawaii. A misconception exists that only Hawaii residents can use this deed. However, non-residents can also utilize it for property located in Hawaii.

- It has no tax implications. Some think that transferring property via this deed does not affect taxes. In reality, there may be tax consequences, such as capital gains tax, that should be considered.

- It is a complicated legal document. Many perceive the Transfer-on-Death Deed as overly complex. While it is important to complete it correctly, the form is designed to be user-friendly and accessible.

By addressing these misconceptions, individuals can make informed decisions regarding the Transfer-on-Death Deed in Hawaii.